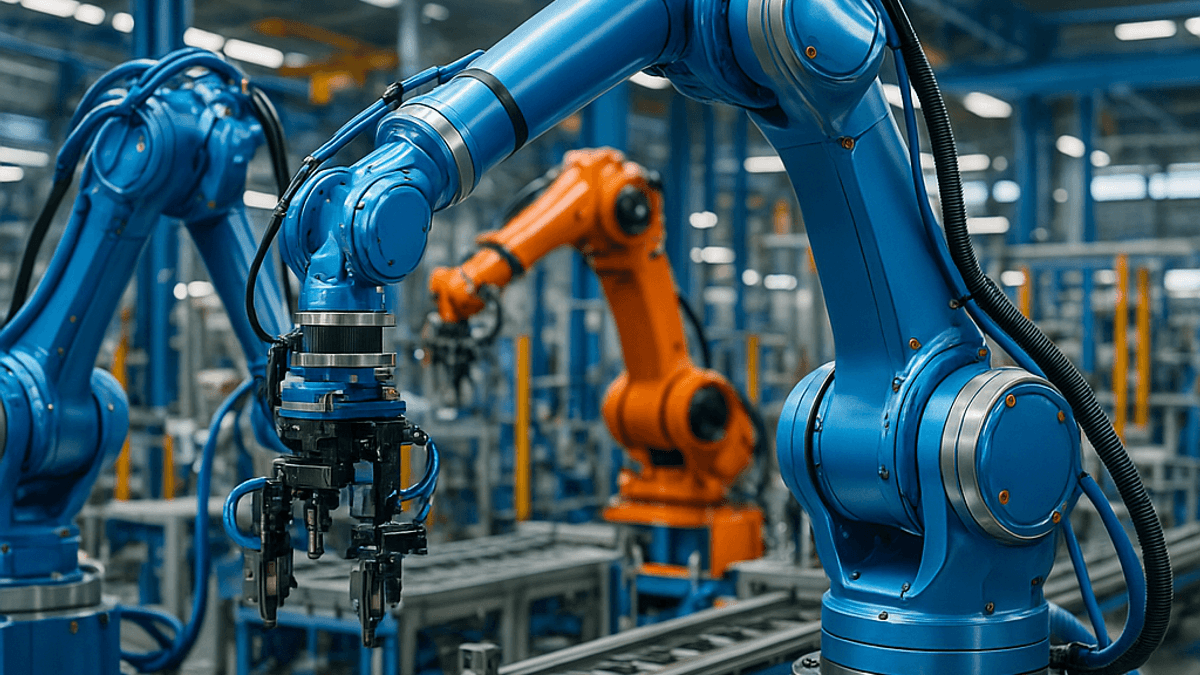

ABB, Fanuc and KUKA Advance ML Factory Automation in 2026

Industrial robotics leaders are consolidating around ML-first stacks and edge compute to boost throughput and flexibility in factories and warehouses. This analysis examines how ABB, Fanuc, KUKA, NVIDIA, and Boston Dynamics are repositioning platforms, and what it means for enterprise buyers.

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

Executive Summary

- Industrial leaders like ABB, Fanuc, and KUKA are embedding ML-driven perception, planning, and digital twins to raise uptime and adaptability across production lines, supported by platforms from NVIDIA and systems innovators such as Boston Dynamics.

- Forecasts point to sustained growth in industrial and logistics robotics spending, with stronger adoption in automotive, electronics, and e-commerce fulfillment, according to MarketsandMarkets and IDC.

- Enterprises prioritize modular cells, AI-enabled vision, safety compliance (ISO 10218), and integration with MES/ERP, as documented by A3/Robotics Standards and ISO.

- ML-first robotics stacks are converging on edge compute, digital twin simulation, and orchestration APIs, consistent with Gartner analyses and IEEE Transactions on Robotics findings.

Key Takeaways

- ML-enabled perception and planning are becoming table stakes for industrial and warehouse deployments, led by ABB, Fanuc, KUKA, and NVIDIA.

- Digital twins and simulation accelerate commissioning and reduce downtime, supported by platforms like NVIDIA Isaac Sim and vendor-specific tools from ABB.

- Safety and governance frameworks (ISO 10218, ANSI/RIA) drive deployment standards; guidance from A3 and OSHA informs global rollouts.

- Best-practice architectures combine edge inference, cloud orchestration, and secure data pipelines, consistent with McKinsey operations guidance.

| Company | Recent Move | Focus Area | Source |

|---|---|---|---|

| ABB | Expanded ML-driven vision and digital twin workflows | Factory automation, MES/ERP integration | ABB Process Automation |

| Fanuc | Enhanced reliability and lifecycle service offerings | High-throughput industrial cells | Fanuc Support & Training |

| KUKA | Integrated software stack with simulation and safety | Collaborative robots, logistics cells | KUKA Software |

| NVIDIA | Advanced simulation and edge inference tooling | Perception, planning, orchestration | Isaac Sim |

| Boston Dynamics | Agile mobility for inspection and handling | Dynamic environments, facility operations | Boston Dynamics Resources |

Disclosure: BUSINESS 2.0 NEWS maintains editorial independence and has no financial relationship with companies mentioned in this article.

Sources include company disclosures, regulatory filings, analyst reports, and industry briefings.

Related Coverage

About the Author

Aisha Mohammed

Technology & Telecom Correspondent

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

Frequently Asked Questions

How are ABB, Fanuc, and KUKA integrating ML into factory automation?

ABB, Fanuc, and KUKA are embedding ML across perception, path planning, and predictive maintenance layers to lift throughput and reduce error rates. ABB prioritizes digital twins and MES connectivity, Fanuc emphasizes reliability and lifecycle services, and KUKA integrates simulation and safety for collaborative robots. These align with standards from A3 and ISO 10218 and platform ecosystems such as NVIDIA Isaac Sim, which accelerates commissioning and scenario testing. Enterprises report improvements in flexibility and uptime when ML models run at the edge for real-time decisions.

What platforms and tools are central to modern robotics deployments?

Simulation-first tooling like NVIDIA Isaac Sim, vendor-specific digital twins, and orchestration APIs form the backbone of contemporary deployments. Industrial vendors integrate software suites with MES/ERP, while logistics operators incorporate AMR fleet management and autonomy modules. Research from IDC and IEEE shows that edge inference combined with ML-driven vision boosts accuracy in dynamic environments. Governance frameworks (ISO 10218, ANSI/RIA) and operator training round out the stack, ensuring safety and operational resilience at scale.

What are best practices for integrating robots with legacy manufacturing systems?

Best practices include layering robots behind well-defined APIs, using digital twins for validation, and synchronizing shop-floor data with MES/ERP. Enterprises should deploy edge compute for low-latency inference, and enforce role-based access control with SOC 2 and ISO 27001-aligned policies. Collaboration with vendors like ABB and KUKA helps tailor safety case documentation and commissioning workflows. According to McKinsey and Gartner analyses, early investments in data quality, operator training, and lifecycle services reduce downtime and accelerate time-to-value.

What challenges constrain ML-driven robotics, and how can enterprises mitigate them?

Key constraints include data drift, variable lighting and occlusions, safety certification complexity, and integration costs. Mitigation strategies involve robust data governance, synthetic data generation via simulation, adherence to ISO/ANSI standards, and phased rollout plans. Partnering with platform providers such as NVIDIA for simulation and edge inference, and industrial vendors like Fanuc for reliability and service, strengthens deployments. Organizations can also leverage A3 and OSHA guidance to formalize safety protocols and operator training.

What is the near-term outlook for robotics adoption in manufacturing and logistics?

In the next 90 days, expect more projects targeting ML-based quality inspection, bin picking, and autonomous materials handling, driven by edge inference and digital twins. Analysts at IDC and Gartner anticipate continued momentum in automotive, electronics, and e-commerce fulfillment, where throughput and flexibility are paramount. Buyers will prioritize open APIs, safety certifications, and training to operationalize systems responsibly. Platforms from ABB, KUKA, Fanuc, and NVIDIA are poised to underpin these deployments, with logistics leaders like Amazon and DHL showcasing scalable playbooks.