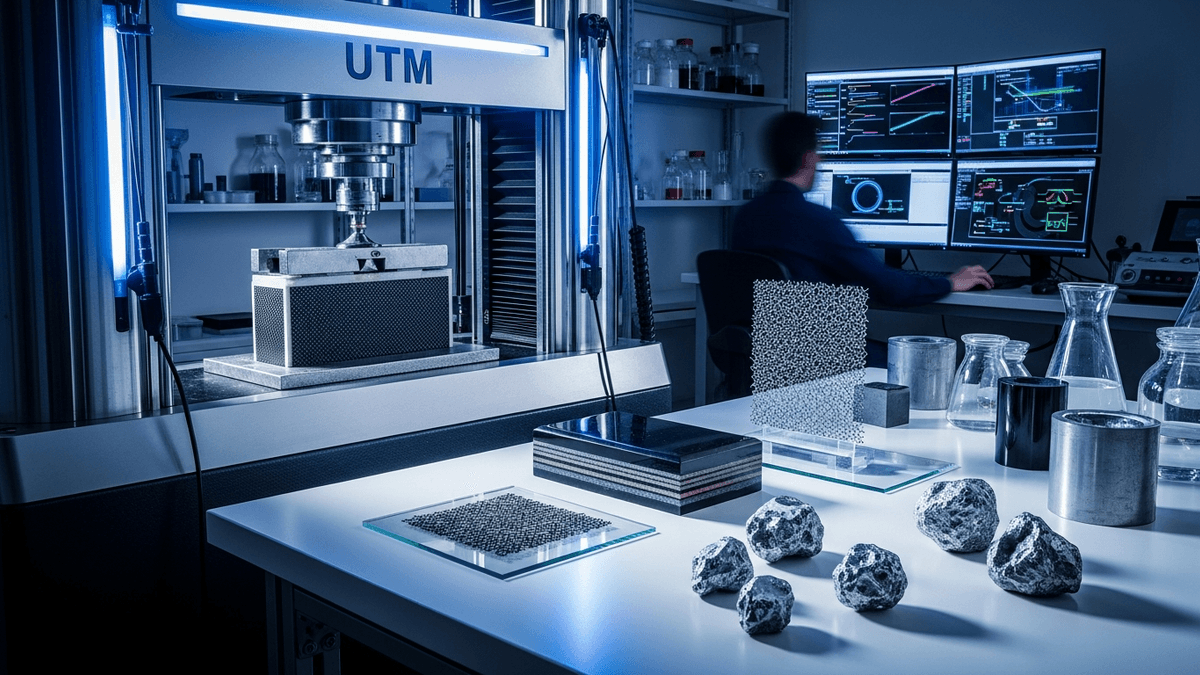

Advanced Materials Market Size, Trends and Forecast 2026-2030 in UK, Europe, US, Canada and Asia

New policies, Q4 disclosures, and late-2025 research updates point to stronger demand for advanced materials across electronics, energy, transportation, and construction. Major players including BASF, 3M, DuPont, and Solvay outline investments and product moves as regulators in the UK, EU, US, Canada, and Asia sharpen funding and standards for next-generation materials.

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

- Analysts estimate advanced materials demand will expand across electronics, batteries, aerospace, and construction through 2030, with Asia and North America driving volume growth and Europe leading regulatory standardization initiatives (industry analysis).

- Late-2025 disclosures from leaders such as BASF, 3M, DuPont, and Solvay signal ongoing portfolio shifts toward specialty composites, engineered polymers, battery materials, and sustainable chemistries (investor updates).

- Government actions in the UK, EU, US, Canada, and Asia emphasize critical materials, recycling, and low-carbon processing, setting the stage for advanced materials scale-up in 2026–2030 (EU Commission releases; US DOE announcements).

- Recent research highlights improvements in high-entropy alloys, solid-state battery electrolytes, and thermal management materials, indicating faster commercialization pathways in electronics and mobility (arXiv materials science updates).

| Region | Primary Growth Drivers (2026–2030) | Estimated Momentum | Source |

|---|---|---|---|

| United Kingdom | Translational materials R&D, aerospace composites, sustainable construction | Moderate-to-strong | UKRI news (Nov–Dec 2025) |

| European Union | Battery materials, circularity, low-carbon processing, regulatory standards | Strong | EU Commission releases (Q4 2025) |

| United States | Semiconductor materials, advanced composites, battery supply chain | Strong | US DOE announcements (late 2025) |

| Canada | Critical materials processing, recycling integration, clean-tech alignment | Moderate-to-strong | Natural Resources Canada news (Q4 2025) |

| Asia (Japan/Korea) | Electronic materials, carbon fiber composites, advanced battery chemistries | Strong | METI Japan; MOTIE Korea (late 2025) |

- European Commission Press Corner - European Commission, Nov–Dec 2025

- UK Research and Innovation News - UKRI, Nov–Dec 2025

- US Department of Energy Newsroom - US DOE, Nov–Dec 2025

- Natural Resources Canada News - Government of Canada, Nov–Dec 2025

- BASF Investor Relations Updates - BASF, Nov–Dec 2025

- DuPont Investor News Releases - DuPont, Nov–Dec 2025

- Solvay Investors - Solvay, Nov–Dec 2025

- 3M Investor Relations - 3M, Nov–Dec 2025

- Applied Materials Press Releases - Applied Materials, Nov–Dec 2025

- arXiv Condensed Matter New Submissions - arXiv, Nov–Dec 2025

About the Author

James Park

AI & Emerging Tech Reporter

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

Frequently Asked Questions

How is demand for advanced materials expected to evolve from 2026 to 2030 across major regions?

Industry sources indicate steady-to-strong demand growth across electronics, energy storage, aerospace, and construction, with Asia and North America leading volume gains and Europe driving regulatory standardization. Late-2025 government updates in the US, EU, UK, and Canada prioritize critical materials, recycling, and low-carbon production, which support scaling. Corporate disclosures from BASF, DuPont, Solvay, and 3M emphasize specialty chemistries and high-performance composites, pointing to diversified end-market pull.

Which material categories are seeing the most late-2025 momentum heading into 2026?

Battery materials (including cathode and solid-state electrolytes), engineered polymers, thermal interface materials, and aerospace-grade composites showed notable momentum in late 2025. Investor and product communications from BASF, Solvay, DuPont, and LG Chem highlighted capacity investments and portfolio alignment. Semiconductors and advanced packaging continue to sustain demand for deposition and patterning chemistries, as indicated by updates from Applied Materials and Merck KGaA.

What role do policy and regulation play in market readiness and forecasts?

Policy contributes by de-risking investment through funding programs, standards, and incentives. The European Commission’s late-2025 releases emphasize industrial competitiveness and circularity, while US DOE updates focus on battery and semiconductor ecosystems. UK and Canadian releases highlight translational research, processing, and critical mineral strategies. These frameworks are expected to accelerate commercialization and supply resilience in the 2026–2030 period.

What are the primary risks facing advanced materials supply chains in the next five years?

Key risks include feedstock availability, price volatility, qualification bottlenecks, and geopolitical exposures. Industry analyses recommend diversification, localized processing, and recycling integration to mitigate shocks. Late-2025 corporate and policy updates underscore metrology-led yield improvements, long-term contracting, and circular strategies as stabilizers for cost and quality. These measures help align production with OEM requirements in mobility and electronics.

Where are the most immediate business opportunities for materials producers and OEMs?

Near-term opportunities lie in electrification (battery materials and thermal management), aerospace lightweighting, semiconductor-grade chemistries, and sustainable construction materials. OEMs increasingly value validated performance, stable pricing, and end-of-life solutions. Late-2025 disclosures from DuPont, Solvay, LG Chem, and Applied Materials point to collaboration with equipment makers and system integrators, reducing qualification cycles and expediting market entry in 2026–2030.