Aerospace Investment Heats Up: From Jet Backlogs to the Space Economy

Capital is returning to aerospace at scale as airlines re-fleet, suppliers retool, and space companies tap both public budgets and private equity. But the investment cycle is more disciplined than the last boom, with sustainability, supply-chain resilience, and government demand shaping where the money goes.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Capital is flowing back into flight

In the Aerospace sector, After a turbulent reset, investors are redeploying capital across aerospace, balancing long-cycle bets in commercial aviation with faster-moving space and defense plays. Airline profitability has recovered in most regions and passenger demand remains resilient, supporting large order books and improving cash generation at OEMs and lessors. That, in turn, is reopening financing channels for Tier-1 and Tier-2 suppliers that must fund capacity expansions, digitalization, and inventory buffers.

The macro picture anchors the thesis: demand for new aircraft is robust across the next two decades. Boeing’s latest outlook sees demand for more than 42,000 new jets through 2043, underpinned by fleet renewal, traffic growth, and rising cargo needs, according to Boeing’s Commercial Market Outlook. Investors are calibrating exposure accordingly—overweighting narrowbody programs with clearer rate ramps while selectively backing widebody and freighter niches tied to long-haul recovery and e-commerce logistics.

Commercial aviation: backlog-rich, capacity-constrained

Record backlogs—exceeding 8,000 aircraft at Airbus and over 5,000 at Boeing—are translating into multi‑year revenue visibility for OEMs and their supply chains. The bottleneck is execution. Engine availability, castings, forgings, and avionics lead times continue to dictate the pace, pushing suppliers to invest in automation, workforce, and dual sourcing. Airbus is targeting a higher narrowbody production tempo mid‑decade, consistent with long‑term fleet growth projected in the Airbus Global Market Forecast, while Boeing’s stabilization efforts are steering a more measured rate profile.

The investment theme is clear: capex and working capital today for operating leverage tomorrow. Tiered suppliers with proprietary processes (e.g., hot‑section components, advanced materials) are drawing premium valuations as airlines prioritize fuel efficiency. Engine consortia and airframers are also sustaining elevated R&D on next‑gen propulsion and aerodynamics, aiming for double‑digit efficiency gains. Lessors, buoyed by lease rate factors and residual values, continue to finance new‑tech single‑aisles, though higher interest rates keep a lid on marginal projects and drive consolidation among smaller leasing platforms.

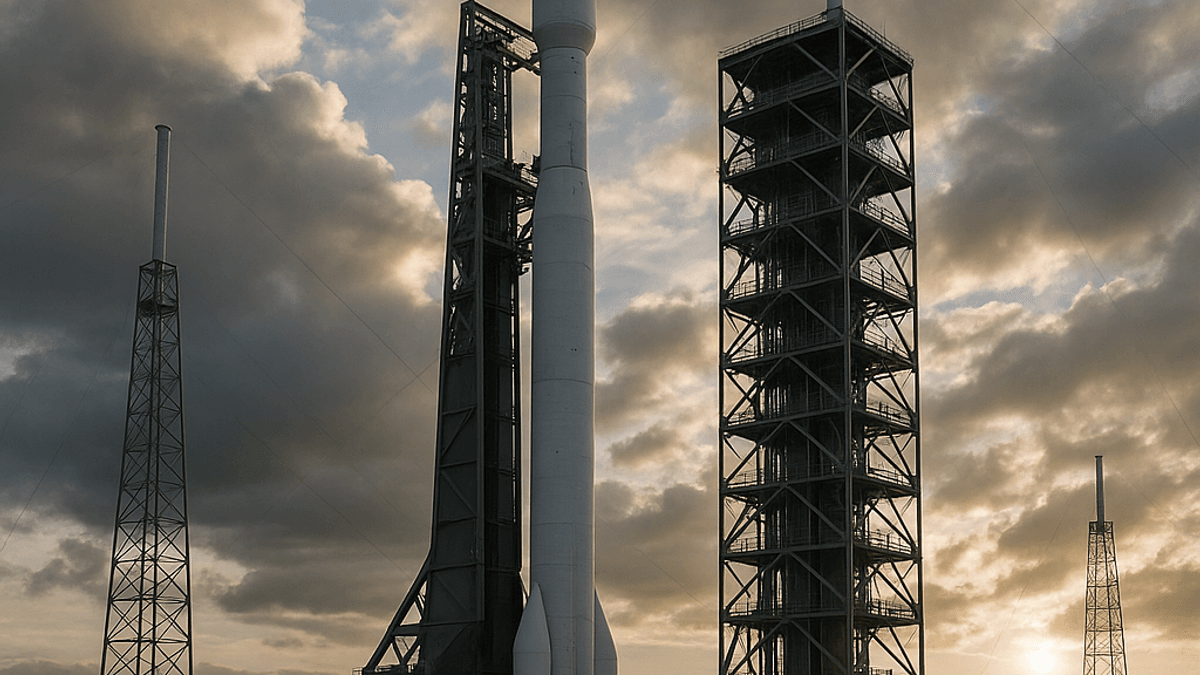

Space economy: private capital stabilizes, public budgets surge

In space, the funding mix is shifting toward government-backed programs and revenue‑generating constellations, while early‑stage venture moderates from 2021 peaks. The global space economy reached roughly $630 billion in 2023—up mid‑single digits year over year—according to Space Foundation’s Space Report. That growth is anchored by launch cadence, satellite manufacturing, national security space, and downstream services such as Earth observation analytics and satcom.

Private investment remains selective but active. Late‑stage rounds for companies with proven revenue (launch services, in‑orbit services, and RF/sensing constellations) are clearing, while pre‑revenue hardware faces longer diligence cycles and milestone‑based tranching. Importantly, private financing in 2023 still topped $12 billion for space startups—well below the 2021 surge but showing resiliency—per BryceTech’s Start-up Space analysis. Governments are filling gaps through multi‑year procurement and mission funding, with national security space, weather, PNT resilience, and cislunar exploration attracting sustained appropriations that de‑risk capex for primes and select new entrants.

Sustainability and new frontiers: where capital is concentrating

Net‑zero pathways are now a central capital allocation filter. Sustainable aviation fuel (SAF) is the near‑term lever, but supply is the constraint. Global SAF output is set to roughly triple in 2024 to around 1.5 million tonnes—still a fraction of jet fuel demand—according to IATA’s latest outlook. Investors are backing producers with advantaged feedstocks, power-to‑liquid pilots near low‑cost renewable power, and offtake-backed projects; airlines are using forward purchase agreements to catalyze buildouts, while engine OEMs validate higher SAF blend compatibility.

Beyond fuels, capital is flowing into efficiency technologies—advanced aerostructures, digital twins, predictive maintenance—as well as moonshot propulsion bets that target 20%+ fuel burn reductions over the next decade. Advanced air mobility (AAM) remains a long‑dated option: certification is progressing, partnerships with airlines and infrastructure players are deepening, and defense use cases offer interim revenue, but timelines and infrastructure complexity temper valuations. The investable takeaway is to prioritize platforms with regulatory momentum, credible unit economics, and clear integration into existing airspace and ground operations.

The investor’s playbook for the next cycle

Aerospace is entering a capital‑productive phase, but dispersion will be wide. In commercial aviation, investors should expect multi‑year operating leverage as rates rise and delivery mix improves—tempered by supplier bottlenecks that reward patient capital and balance‑sheet strength. In space, anchor on government‑aligned revenue and late‑stage assets that can convert backlog to cash, while reserving risk capital for upstream technologies with differentiated IP and clear paths to recurring services.

Across segments, sustainability and resilience are no longer side themes; they are underwriting criteria. Portfolios that blend long‑duration OEM/supplier exposure with selective space infrastructure and downstream data services can capture secular growth while smoothing cyclicality. With durable demand signals from airline fleets and sovereign space priorities, and improved capital discipline across the ecosystem, aerospace investment is poised to compound—so long as execution keeps pace with ambition.

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation