AI Chip Market Size, Share and Forecast Statistics by Company and Country 2026-2030

Comprehensive analysis of the global AI chip market projected to reach $300 billion by 2030, with detailed breakdowns by leading companies NVIDIA, AMD, Intel, and regional market shares across US, China, Taiwan, and Europe.

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

Global AI Chip Market: A $300 Billion Opportunity by 2030

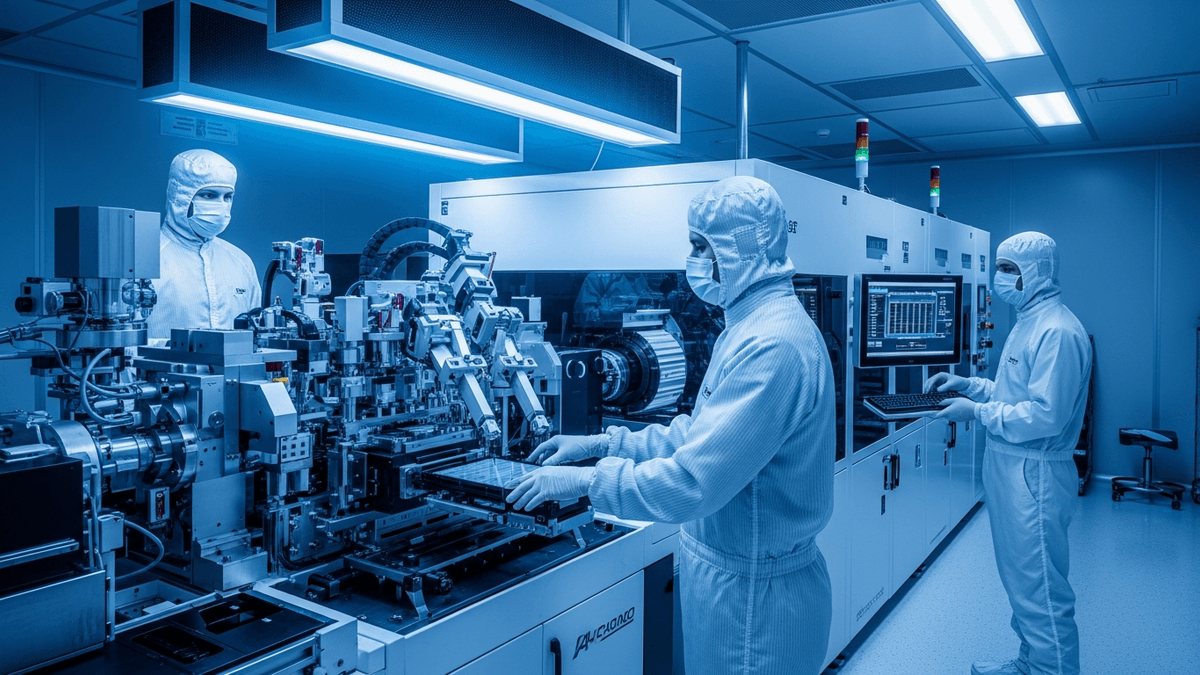

The artificial intelligence chip market is experiencing unprecedented growth, driven by explosive demand for generative AI, data center computing, and edge AI applications. According to latest industry analysis, the global AI chip market is projected to grow from $53.4 billion in 2024 to over $300 billion by 2030, representing a compound annual growth rate (CAGR) of 33.2%.

This rapid expansion reflects the fundamental shift in computing paradigms, as traditional CPU-centric architectures give way to specialized accelerators designed for parallel processing workloads. The convergence of large language models, autonomous systems, and intelligent edge devices has created insatiable demand for silicon specifically optimized for AI inference and training.

Market Size Forecast 2026-2030

| Year | Market Size (USD) | YoY Growth |

|---|---|---|

| 2026 | $91.2 billion | 28.5% |

| 2027 | $124.8 billion | 36.8% |

| 2028 | $172.3 billion | 38.1% |

| 2029 | $231.6 billion | 34.4% |

| 2030 | $304.2 billion | 31.3% |

Source: Industry analysis compiled from Gartner, IDC, and Statista research reports.

The acceleration through 2028 reflects enterprise AI adoption reaching critical mass, with growth moderating slightly toward 2030 as the market matures. However, even the moderated growth rates of 31-34% represent extraordinary expansion compared to broader semiconductor industry averages of 5-8% annually.

Market Share Analysis by Company

The AI chip market exhibits significant concentration, with NVIDIA commanding an estimated 70-80% market share in data center AI accelerators. This dominance stems from first-mover advantage in GPU computing, a mature software ecosystem (CUDA), and aggressive product iteration that has kept competitors perpetually catching up.

NVIDIA Corporation commands 70-80% of data center AI market share. The company H100 and B100 Blackwell GPUs power the majority of AI training infrastructure globally. Revenue from their data center segment exceeded $47 billion in fiscal 2024, representing a 217% year-over-year increase. The next-generation Rubin architecture is planned for 2026-2027, promising further performance gains. NVIDIA market position is reinforced by the CUDA software ecosystem, which represents over 15 years of developer investment and creates significant switching costs for enterprises.

AMD (Advanced Micro Devices) holds approximately 10-15% market share and is emerging as the primary challenger. Their MI300X accelerators are gaining traction with hyperscalers seeking supply diversification. AMD is targeting 20% AI accelerator market share by 2027 through strategic partnerships with Microsoft Azure and Meta. The company acquisition of Xilinx strengthens their position in adaptive AI computing. Website: amd.com

Intel Corporation maintains 5-8% market share, primarily through their Gaudi 3 accelerators positioned for inference workloads. Intel foundry services are expanding AI chip manufacturing capacity, with the company investing $100 billion in US manufacturing through 2030. While Intel has lost ground in cutting-edge AI training, their established enterprise relationships and manufacturing capabilities position them for recovery. Website: intel.com

Google (Alphabet) develops custom TPUs exclusively for internal use and Google Cloud customers. Their TPU v5p powers Google Cloud AI services, enabling competitive pricing against NVIDIA-based offerings. This custom silicon strategy reduces NVIDIA dependency and demonstrates the viability of purpose-built AI accelerators. Website: cloud.google.com/tpu

Amazon Web Services follows a similar strategy with custom Inferentia and Trainium chips. Trainium2 chips target cost-effective AI training at approximately 40% lower cost than comparable GPU instances. Inferentia2 is optimized for inference at scale, powering Amazon internal AI services and customer workloads. Website: aws.amazon.com

Several emerging players are challenging the established order with innovative architectures. Cerebras Systems produces wafer-scale AI processors that eliminate the memory bottleneck constraining traditional chips. Groq focuses on ultra-low latency inference chips achieving remarkable tokens-per-second performance. SambaNova Systems offers dataflow architecture optimized for enterprise AI deployment. Graphcore develops Intelligence Processing Units (IPUs) with unique approaches to sparse computation.

Regional Market Analysis 2026-2030

Geographic distribution of the AI chip market reflects both technological capability and government industrial policy. The concentration of advanced manufacturing in East Asia, combined with Western design leadership, creates a complex global supply chain with significant geopolitical implications.

The United States remains the market leader with projected 2026 market size of $38.2 billion, growing to $121.7 billion by 2030. Key players include NVIDIA, AMD, Intel, Qualcomm, and Apple. The CHIPS Act provides $52 billion in semiconductor subsidies, representing the largest US industrial policy investment in decades. American dominance in AI chip design stems from Silicon Valley ecosystem advantages, access to venture capital, and proximity to hyperscaler customers. However, manufacturing capability lags East Asian competitors, a vulnerability the CHIPS Act aims to address.

China represents the fastest-growing major market with 2026 projected size of $24.6 billion, reaching $78.4 billion by 2030. Key players include Huawei with their Ascend chips, Alibaba with Hanguang processors, Baidu with Kunlun chips, and Cambricon. US export restrictions on advanced chips and manufacturing equipment have paradoxically accelerated domestic Chinese chip development. While Chinese designs currently lag 2-3 generations behind leading-edge Western chips, the trajectory of improvement is steep. Government investment through the National Integrated Circuit Industry Investment Fund exceeds $50 billion.

Taiwan functions as the global manufacturing powerhouse, with TSMC fabricating over 90% of advanced AI chips worldwide. Their 3nm and emerging 2nm process technology leadership represents a critical chokepoint in the global AI supply chain. TSMC strategic importance has elevated Taiwan semiconductor industry to a matter of international security, with implications for cross-strait relations and global technology access.

The European Union is pursuing strategic autonomy with 2026 market size projected at $8.7 billion, growing to $31.2 billion by 2030. The EU Chips Act targets €43 billion in investment, focusing on automotive AI, industrial applications, and establishing leading-edge manufacturing capacity. Key initiatives center on reducing dependency on Asian manufacturing while leveraging European strengths in automotive and industrial sectors.

South Korea plays a critical role through memory and logic integration. Samsung and SK Hynix lead global HBM (High Bandwidth Memory) production, a critical component for AI accelerators. HBM shortage has constrained AI chip production, highlighting the importance of memory in the AI silicon stack. Samsung foundry operations are expanding AI chip manufacturing to compete with TSMC.

Japan focuses on specialized applications, particularly automotive AI chips and robotics. Sony image sensors enable edge AI for cameras and autonomous systems. Government subsidies have attracted TSMC investment in Japanese manufacturing facilities, marking a revival of the domestic semiconductor industry after decades of decline.

Market Segmentation by Application

Understanding demand drivers requires analyzing how AI chips are deployed across different use cases, each with distinct performance requirements and price sensitivities.

Data Center AI Training represents approximately 45% of the market. This segment is dominated by NVIDIA H100/B100 GPUs, with growing competition from AMD MI300X and custom hyperscaler chips. Average selling prices range from $25,000-$40,000 per chip, reflecting the extreme performance requirements for training large language models. A single GPT-4 class training run may consume tens of thousands of these chips over months of computation. Demand is concentrated among hyperscalers (Microsoft, Google, Amazon, Meta) and well-funded AI labs (OpenAI, Anthropic, xAI).

Data Center AI Inference accounts for roughly 25% of the market. This segment emphasizes cost-efficiency over raw training performance, as inference workloads scale with user traffic rather than model development. AWS Inferentia, Google TPU, and AMD MI300I target this segment with optimized performance-per-dollar metrics. As generative AI applications scale to billions of users, inference demand is growing faster than training demand, shifting market dynamics toward inference-optimized architectures.

Edge AI and IoT represents approximately 18% of the market. Qualcomm Snapdragon NPUs, Apple Neural Engine, and specialized automotive AI processors serve applications requiring local intelligence. Autonomous vehicle development drives significant investment, with each self-driving car requiring multiple AI accelerators for perception, planning, and control. Industrial IoT applications for predictive maintenance and quality control represent growing enterprise demand.

Consumer Devices comprise roughly 12% of the market. Smartphone AI accelerators enable on-device features like computational photography, voice assistants, and real-time translation. PC and laptop neural processing units support emerging AI-powered productivity features. Gaming consoles increasingly incorporate AI capabilities for graphics enhancement and player behavior modeling.

Technology Trends Shaping 2026-2030

Several technological developments will reshape the competitive landscape over the forecast period.

Advanced Packaging Technologies are enabling chiplet architectures that allow modular AI chip designs. Rather than manufacturing massive monolithic chips with low yields, designers can combine smaller optimized chiplets for different functions. TSMC CoWoS (Chip on Wafer on Substrate) and Intel EMIB (Embedded Multi-die Interconnect Bridge) represent leading packaging technologies. 3D stacking technologies place memory directly on logic chips, dramatically improving memory bandwidth—a critical bottleneck for AI workloads.

Process Node Advancement continues driving performance improvements. 3nm production is ramping through 2026, with 2nm expected in late 2026-2027. NVIDIA and AMD compete intensely for leading-edge TSMC capacity, creating allocation challenges during supply constraints. Each process generation delivers approximately 25-30% performance improvement or equivalent power reduction, maintaining the historical pace of Moore Law-adjacent progress.

Memory Integration represents perhaps the most important architectural trend. HBM4 is expected by 2028 with 2TB/s bandwidth, roughly doubling current HBM3 capabilities. On-chip memory integration reduces data movement bottlenecks that currently limit AI chip utilization. Processing-in-memory architectures that perform computation within memory arrays are emerging from research into commercial products, potentially eliminating the memory wall that constrains conventional designs.

Energy Efficiency Focus has intensified as data center power consumption raises environmental and practical concerns. AI training facilities now consume hundreds of megawatts, comparable to small cities. Liquid cooling is becoming standard for high-performance AI servers, enabling higher power densities and better thermal management. Carbon-neutral semiconductor manufacturing initiatives address growing ESG (Environmental, Social, Governance) requirements from enterprise customers.

Investment and M&A Activity

The AI chip sector continues attracting extraordinary investment, reflecting confidence in long-term growth trajectories.

NVIDIA market capitalization exceeded $3 trillion in 2024, briefly making it the world most valuable company. This valuation implies continued dominance and market expansion through the forecast period.

AMD acquisition of Xilinx for $50 billion strengthened their adaptive AI computing position, adding FPGA capabilities that enable flexible acceleration for evolving AI workloads.

Intel committed $100 billion to US fab expansion, betting that domestic manufacturing capability will command premium pricing from customers seeking supply chain security.

Arm Holdings IPO valued the company at $65 billion, reflecting the importance of their architecture for edge AI and mobile applications.

Venture funding for AI chip startups exceeded $8 billion in 2024, with investors betting on architectural innovations that could challenge NVIDIA dominance.

Challenges and Risk Factors

Several factors could alter the market trajectory from current projections.

Supply Chain Concentration presents systemic risk. TSMC manufacturing dominance creates single-point-of-failure exposure for the global AI industry. Geopolitical tensions between the US and China affecting Taiwan could disrupt chip supply for years. Equipment suppliers like ASML, the sole producer of EUV lithography machines, face export restrictions that could fragment the global technology ecosystem.

Talent Shortage constrains industry growth. Semiconductor engineering talent is in extreme demand, with experienced chip designers commanding compensation exceeding $1 million annually. Universities struggle to produce sufficient graduates with relevant expertise, creating a structural talent deficit. Immigration policy affects talent acquisition, particularly in the United States where visa restrictions limit access to international engineering talent.

Technology Competition from alternative computing paradigms could disrupt current market leaders. Quantum computing, while still nascent, could eventually solve certain AI problems more efficiently than classical accelerators. Neuromorphic computing inspired by biological neural networks offers dramatic power efficiency improvements for specific workloads. Open-source AI chip designs like those from the RISC-V ecosystem could commoditize hardware that currently commands premium pricing.

Outlook and Strategic Implications

The AI chip market is poised for continued explosive growth through 2030, driven by generative AI adoption across enterprises, autonomous vehicle deployment requiring edge AI, government investment in domestic chip manufacturing, and next-generation AI models demanding ever more compute.

NVIDIA is expected to maintain market leadership through architectural innovation and ecosystem lock-in. However, AMD and custom silicon from hyperscalers will capture increasing share as customers seek supply diversification and cost optimization. Regional diversification efforts, particularly in the US, Europe, and China, will reshape the global supply chain landscape, potentially reducing TSMC concentration while increasing manufacturing costs.

For investors, the AI chip sector offers growth exposure but requires careful attention to competitive dynamics, supply chain risks, and valuation levels that already reflect optimistic scenarios. For enterprise technology leaders, the message is clear: securing AI chip supply has become a strategic imperative, requiring direct relationships with vendors and long-term capacity commitments.

The companies and countries that secure leadership in AI chips will wield disproportionate influence over the next era of technological progress. The stakes extend far beyond financial returns to encompass economic competitiveness, national security, and the trajectory of artificial intelligence development itself.

About the Author

Aisha Mohammed

Technology & Telecom Correspondent

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

Frequently Asked Questions

What is the projected AI chip market size by 2030?

The global AI chip market is projected to reach approximately $300 billion by 2030, growing from $53.4 billion in 2024 at a CAGR of 33.2%.

Which company has the largest AI chip market share?

NVIDIA dominates the AI chip market with 70-80% market share in data center AI accelerators, driven by its H100 and B100 GPU product lines.

How is China responding to US chip export restrictions?

China is accelerating domestic AI chip development through companies like Huawei (Ascend chips), Alibaba, and Baidu, aiming to reduce dependency on American technology.

What role does Taiwan play in AI chip manufacturing?

Taiwan, primarily through TSMC, manufactures over 90% of the world most advanced AI chips. TSMC 3nm and upcoming 2nm processes are critical for next-generation AI accelerators.

Which regions are investing most in AI chip manufacturing?

The United States ($52B CHIPS Act), European Union (€43B EU Chips Act), and China are making massive investments in domestic semiconductor manufacturing capacity.