AI Market Size Surges; Spending Seen Above $300B by 2027

The artificial intelligence market is expanding at a breakneck pace, but estimates vary widely depending on what’s measured—spending, revenue, or economic impact. Fresh data from IDC, Bloomberg Intelligence, and Statista show AI investment accelerating across chips, cloud, and enterprise software, even as monetization models evolve.

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

AI’s scale and the definition problem

In the AI sector, The artificial intelligence market has entered a hyper-growth phase, yet pinning down its true size depends on definitions. Some trackers focus on enterprise and government spending on AI systems, others on vendor revenue, and some on broader economic impact. That’s why estimates diverge: Bloomberg Intelligence projects the generative AI economy to reach roughly $1.3 trillion by 2032, while Statista’s model forecasts the overall AI market approaching the high hundreds of billions by 2030. McKinsey, taking a macro lens, estimates generative AI could add $2.6 trillion to $4.4 trillion in annual economic value across use cases. For business leaders, the takeaway is less about a single headline number and more about a secular shift in budgets. Different methodologies slice the market by hardware, software, and services or by end-user spending versus supplier revenue. Those distinctions matter: the capital flowing into AI infrastructure—particularly GPUs and data centers—has outpaced near-term software sales, setting up a lag where monetization catches up to investment.

Spending momentum: IDC’s trajectory to $300B+

On the narrower question of enterprise and government outlays, IDC’s Artificial Intelligence Spending Guide shows the most consistent acceleration. The firm expects worldwide spending on AI to reach roughly $184 billion in 2024 and exceed $300 billion by 2027, implying a mid-to-high twenties compound annual growth rate. That spend spans software (from MLOps to copilots), services (integration, consulting, managed AI), and hardware (accelerators, networking, and storage tuned for AI workloads). This surge is not confined to tech-first firms. Financial services, retail, manufacturing, healthcare, and the public sector are scaling pilots into production systems—fraud detection and risk modeling, demand forecasting, predictive maintenance, clinical decision support, and citizen services. The pattern is consistent: initial proof-of-concept investments in 2023–2024 give way to repeat purchases and platform standardization, prompting larger multi-year contracts and cloud consumption commitments.

Where the money lands: chips, clouds, and model providers

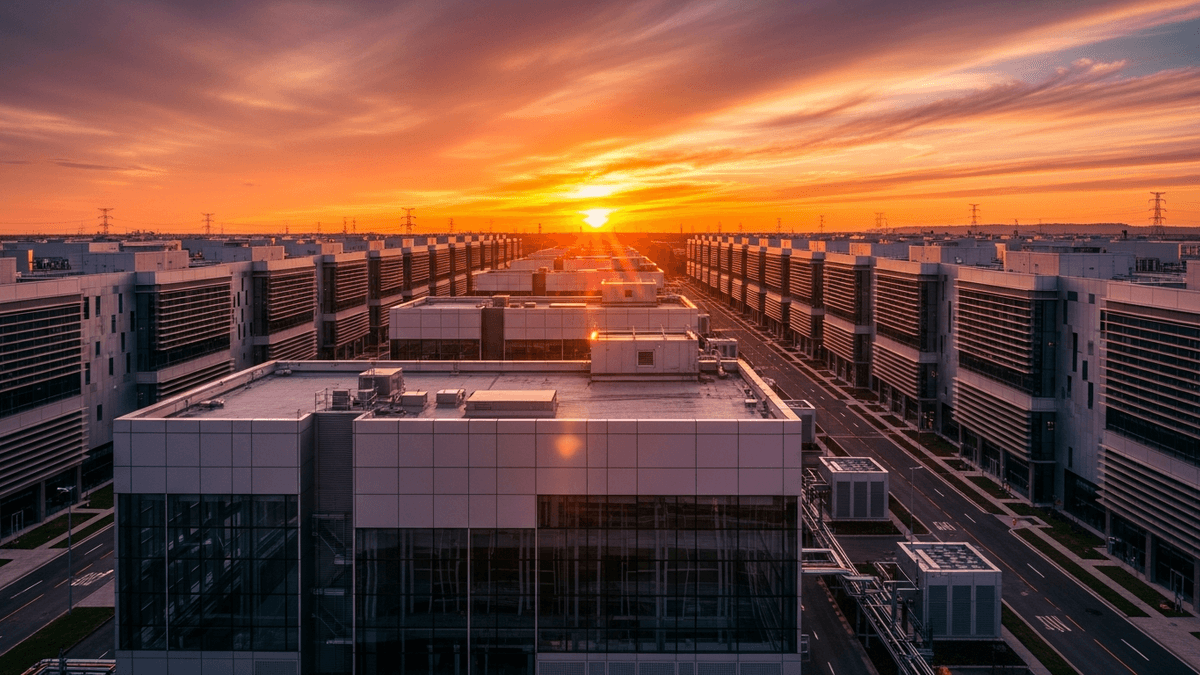

In the current cycle, the most visible revenue growth has accrued to the compute layer. GPU suppliers and their ecosystems are seeing unprecedented demand as training and inference workloads multiply. Semiconductors feed into hyperscaler buildouts—Microsoft, Amazon, Google, and Meta have all guided to elevated capital expenditure, much of it dedicated to data centers, network fabrics, and AI accelerators. That infrastructure spending underpins platform services and capacity reservations enterprises must buy before they deploy AI at scale. At the model and platform tier, partnerships between foundation-model providers and clouds are shaping go-to-market channels. OpenAI, Anthropic, Cohere, Mistral and others are distributing through Azure, AWS, and Google Cloud, often with consumption-based pricing that ties revenue to usage rather than seats. For enterprises, that translates into new budget lines for tokens and context windows, observability tools, guardrails, and retrieval infrastructure—spend categories that were marginal three years ago and now show up in CIO dashboards.

Software monetization: from copilots to vertical AI

The revenue story in software is maturing beyond pilots. Productivity suites are bundling AI copilots, with seat-based surcharges emerging as a primary monetization path. Early adopters report time savings in coding, document drafting, customer service, and sales enablement, but procurement teams are increasingly asking for measurable ROI—ticket deflection rates, code quality metrics, reduced cycle times—to justify renewals and wider rollouts. Industry-specific AI is the next leg. In manufacturing, predictive maintenance and quality inspection are creating multi-year software and services revenue streams tied to operational KPIs. In healthcare, ambient clinical documentation and decision support are moving from trials to contracts, subject to compliance requirements. Financial institutions are deploying AI for credit underwriting, anti-money laundering, and client advisory—areas where explainability and audit trails influence vendor selection and pricing.

Constraints, competition, and what’s next

Several factors could modulate near-term market size trajectories. Power and land constraints affect data center expansion, and supply chains for advanced packaging, memory, and networking remain tight. Regulatory developments—from data protection to algorithmic accountability—are shaping deployment pace and cost structures. And as more vendors release capable open-source models, price competition for inference could compress margins, shifting value toward differentiated data, integration, and workflow automation. Even with those caveats, the direction is clear: AI has transitioned from experimentation to scaled investment. As infrastructure bottlenecks ease and software ROI is validated, spending and revenue are likely to converge more closely. For executives, the practical implication is to align AI initiatives with specific business outcomes—and to track costs at the workload level—so that the next wave of budget growth translates into durable productivity gains rather than transient hype.

About the Author

James Park

AI & Emerging Tech Reporter

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.