AI Startup Market Trends: Funding, Infrastructure, and Regulation in 2025

Venture capital is refocusing on full‑stack AI leaders while cloud alliances and new rules reshape the path to revenue. From Mistral AI’s mega round to enterprise rollouts by Microsoft and OpenAI, here’s how the next phase of AI commercialization is unfolding.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

A New Cohort of AI Startup Leaders

The generative AI surge has crystallized around a handful of high‑velocity players. Startups including OpenAI, Anthropic, Cohere, and Mistral AI are setting the technical and commercial tempo as enterprise buyers move from pilots to deployment. Adoption is broadening across industries, with the share of organizations using AI climbing again in 2024, according to McKinsey’s latest research.

The go‑to‑market muscle behind these models increasingly comes from hyperscale partnerships. Strategic alignments with Microsoft, Amazon, and Google are pulling AI capabilities deeper into productivity suites, cloud platforms, and data networks. Long‑term demand signals are strong: the broader generative AI economy could expand to $1.3 trillion by 2032, Bloomberg Intelligence estimates, underscoring why distribution and infrastructure access now matter as much as raw model performance.

Funding Flows, Valuations, and the Flight to Quality

Capital has gravitated toward platforms with proprietary research, robust safety practices, and privileged compute access. In Europe, Mistral AI raised roughly €600 million in 2024 to scale its model roadmap and distribution footprint, Reuters reported. In North America, OpenAI and Anthropic have continued to attract multi‑billion‑dollar strategic support from cloud partners like Microsoft and Amazon, reinforcing a flywheel of compute, data, and enterprise demand.

The ecosystem is simultaneously consolidating around data and application layers. Data‑cloud leaders Snowflake and lakehouse provider Databricks are embedding vector search, retrieval‑augmented generation, and model hosting to meet buyers where their data already lives. Open‑source momentum remains a counterweight: the developer community around Hugging Face continues to lower the cost of experimentation and fine‑tuning for product teams. For more on related AI developments.

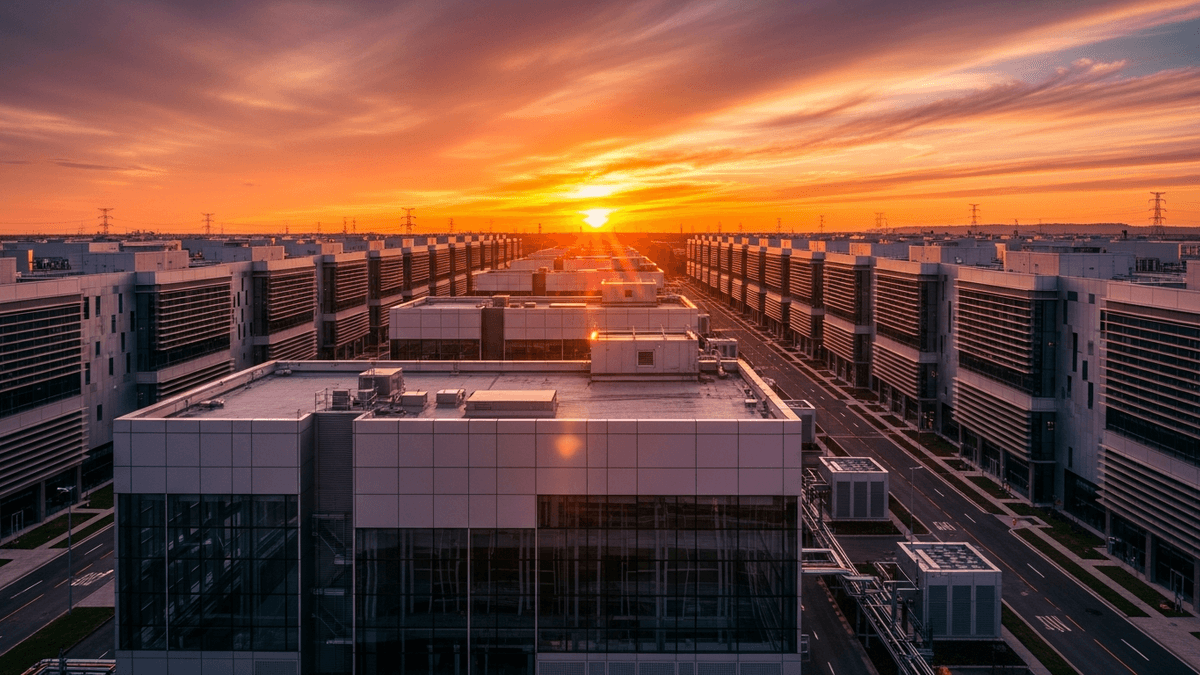

The Infrastructure Race: GPUs, Clouds, and the Data Stack

On the supply side, access to high‑end accelerators from NVIDIA dictates the pace of model training and inference economics. Cloud providers—Microsoft, Google, and Amazon—are bundling model endpoints, orchestration, security, and credits to streamline adoption, while funneling workloads into their compute fabrics. This alignment is creating de facto distribution rails for startups like Cohere and Anthropic to land enterprise deals without rebuilding massive field organizations.

Data gravity is equally determinative. Databricks and Snowflake are racing to make AI "native"—pushing serverless vector indexes, feature stores, and governance so regulated industries can ship AI features without re‑architecting pipelines. Open‑weight models accessible through Hugging Face and image/audio systems from Stability AI are giving product teams a menu of options to balance cost, control, and performance. These insights align with latest AI innovations.

Policy, Risk, and the Path to Revenue

Rules are catching up to reality. The EU’s AI Act—approved by Parliament in 2024—sets risk‑tier obligations for transparency, data governance, and oversight, with staggered compliance timelines, according to the European Parliament. In the U.S., the federal government has directed safety testing, watermarking, and reporting for advanced systems under the White House’s 2023 executive order, the administration’s document shows.

Commercialization is shifting from demos to durable contracts. Enterprise suites from Microsoft and model subscriptions from OpenAI, Cohere, and Anthropic are being procured alongside data‑stack upgrades from Snowflake and Databricks. Buyers are prioritizing cost predictability, provenance controls, and model evaluation benchmarks—criteria that will favor vendors with strong governance postures and ready‑made integrations across identity, security, and observability.

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

Which AI vendors are leading the current wave of enterprise adoption?

Model providers like OpenAI, Anthropic, Cohere, and Mistral AI are anchoring many new deployments, often through cloud marketplaces and productivity suites offered by Microsoft, Google, and Amazon. Their momentum reflects a blend of cutting‑edge research, safety practices, and distribution through hyperscale infrastructure.

How is funding evolving for AI ventures in 2024–2025?

Capital is concentrating in platform leaders with strong compute access and commercialization paths, exemplified by Mistral AI’s large 2024 round and continued strategic backing for OpenAI and Anthropic. At the same time, consolidation and data‑layer investments by Snowflake and Databricks are shaping where value accrues.

What infrastructure choices are shaping AI deployment costs?

Access to NVIDIA accelerators and integrations with cloud providers like Microsoft, Google, and Amazon are key determinants of training and inference economics. Data‑platform capabilities from Databricks and Snowflake—such as vector search and governance—further influence performance, security, and total cost of ownership.

What regulatory changes matter most for enterprise rollouts?

The EU AI Act introduces risk‑tier obligations for transparency, governance, and oversight, while the U.S. executive order emphasizes safety testing and reporting for advanced systems. These frameworks push vendors and buyers to formalize evaluation, provenance, and incident response before scaling deployments.

What is the outlook for AI revenue over the next decade?

Analysts project durable growth as AI moves deeper into software suites, data platforms, and industry workflows, with Bloomberg Intelligence estimating the generative AI economy could reach $1.3 trillion by 2032. Expect continued convergence between model providers and cloud/data platforms to unlock larger, multi‑year contracts.