Airlines Meet EU SAF Mandate as ESA’s Zero-Debris Pact Grows and Hydrogen Engine Trials Advance

In a late-year surge, European carriers report compliance with the EU’s 2% sustainable aviation fuel (SAF) requirement, ESA adds new signatories to its Zero Debris Charter, and hydrogen/next-gen engine trials progress across Airbus–CFM, Rolls-Royce, and NASA’s X-66A program. Investors and policymakers watch closely as supply contracts and airport infrastructure initiatives lock in 2026 momentum.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

- European airlines report year-end compliance with the EU’s 2% SAF blend requirement under ReFuelEU Aviation, with the mandate set to ramp through 2030-2050, according to the European Commission.

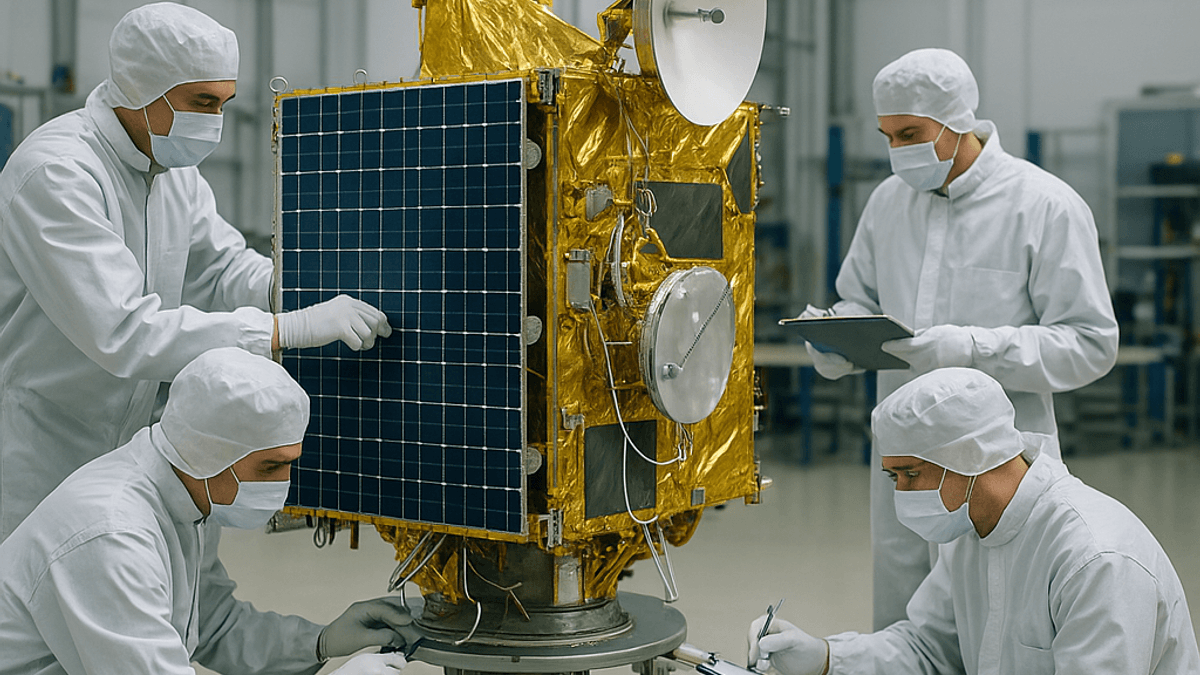

- ESA’s Zero Debris Charter expands with new signatories in December, accelerating space sustainability commitments for post-mission disposal and collision risk mitigation, ESA reports.

- Hydrogen and next-generation engine programs move forward: Airbus–CFM’s H2 combustion demonstration, CFM RISE open fan, Rolls-Royce UltraFan SAF testing, and NASA’s X-66A progress, Airbus, CFM, Rolls-Royce, and NASA indicate.

- SAF supply upticks and contracting activity continue into year-end with producers such as Neste and LanzaJet, bolstered by corporate and airline demand signals, Neste and LanzaJet note.

| Entity | Initiative | Key Detail | Source |

|---|---|---|---|

| European Commission | ReFuelEU Aviation | 2% SAF blend requirement in 2025; rising trajectory | Policy page |

| NASA X-66A | Sustainable Flight Demonstrator | Year-end assembly/integration update | Program update |

| CFM RISE | Open Fan Engine | Targeting ~20% efficiency improvement | CFM materials |

| Airbus–CFM | Hydrogen Combustion Demo | Integration progress for A380 testbed | Airbus update |

| Rolls-Royce | UltraFan & SAF | Ongoing validation with 100% SAF | Company releases |

| ESA | Zero Debris Charter | New signatories in December | ESA Clean Space |

- ReFuelEU Aviation: Reducing emissions in aviation - European Commission, December 2025

- X-66A Sustainable Flight Demonstrator - NASA, December 2025

- CFM RISE Program Overview - CFM International, November–December 2025

- ZeroE Hydrogen Demonstrator - Airbus, December 2025

- Press Releases: UltraFan and SAF Testing - Rolls-Royce, November–December 2025

- Zero Debris Charter - European Space Agency (ESA), December 2025

- Releases and News - Neste, November–December 2025

- Company News - LanzaJet, November–December 2025

- Sustainable Aviation Fuels Policy and Insights - IATA, December 2025

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

What does the EU’s 2% SAF requirement mean for airlines at the end of 2025?

ReFuelEU Aviation requires suppliers at EU airports to deliver jet fuel with a 2% SAF blend starting in 2025, increasing over time. Airlines, airports, and producers have coordinated procurement, blending, and logistics to meet compliance at year-end. Producers such as Neste and LanzaJet reported late-year deliveries aligned with multi-year offtakes. The policy aims to anchor demand signals and catalyze investment in new capacity, with costs expected to ease as alcohol-to-jet and e-fuels projects scale.

How are engine programs contributing to near-term emissions reductions?

Manufacturers are targeting efficiency and fuel flexibility. CFM’s RISE open fan program aims for about a 20% fuel-burn improvement versus today’s engines and compatibility with 100% SAF. Rolls-Royce continues validating 100% SAF on large turbofans, supporting immediate decarbonization of widebodies. NASA’s X-66A focuses on an airframe configuration that can deliver double-digit burn reductions, complementing drop-in SAF and setting up hydrogen demos for longer-term gains.

What’s the significance of ESA’s Zero Debris Charter for aerospace?

The Zero Debris Charter formalizes commitments to avoid debris creation, ensure timely post-mission disposal, and reduce collision risks. December’s expansion of signatories strengthens industry norms on orbital stewardship and transparency. This complements aviation decarbonization to create an end-to-end sustainability agenda for aerospace, spanning ground operations, flight emissions, and space. It anticipates tighter expectations on space traffic management and lifecycle accountability across satellite programs.

Where is SAF supply coming from, and can it meet 2026 demand?

SAF supply is growing from HEFA, alcohol-to-jet, and emerging power-to-liquids projects. Producers like Neste and LanzaJet reported year-end shipments to European hubs and multi-year sales contracts. While SAF still carries a premium, policy support and corporate demand are unlocking financing for new facilities. Airports are readying blending and storage infrastructure, and airlines are leveraging customer programs to fund SAF procurement, improving prospects for 2026 compliance and volume growth.

What’s the outlook for hydrogen in commercial aviation?

Hydrogen is advancing through demonstrators and infrastructure planning. The Airbus–CFM A380 hydrogen combustion project is progressing integration milestones, while airports and OEMs explore hydrogen hubs to plan future fueling. Widespread adoption depends on aircraft design, certification, fuel production, and airport investments, implying a mid- to long-term timeline. In the interim, sustainable aviation fuel and advanced engines provide practical emissions reductions for the existing fleet and near-term deliveries.