Boeing, Airbus and Lockheed Martin Modernize Flight Systems With AI in 2026

Aerospace leaders are aligning AI and ML with certified avionics, digital twins, and autonomous defense systems. Competitive positioning is evolving as commercial, defense, and space segments converge on software-defined platforms and reusable launch economics.

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

Executive Summary

- Commercial and defense leaders including Boeing, Airbus, and Lockheed Martin are embedding AI/ML into avionics, MRO, and mission software to improve safety, cost, and throughput, supported by initiatives like Airbus Skywise.

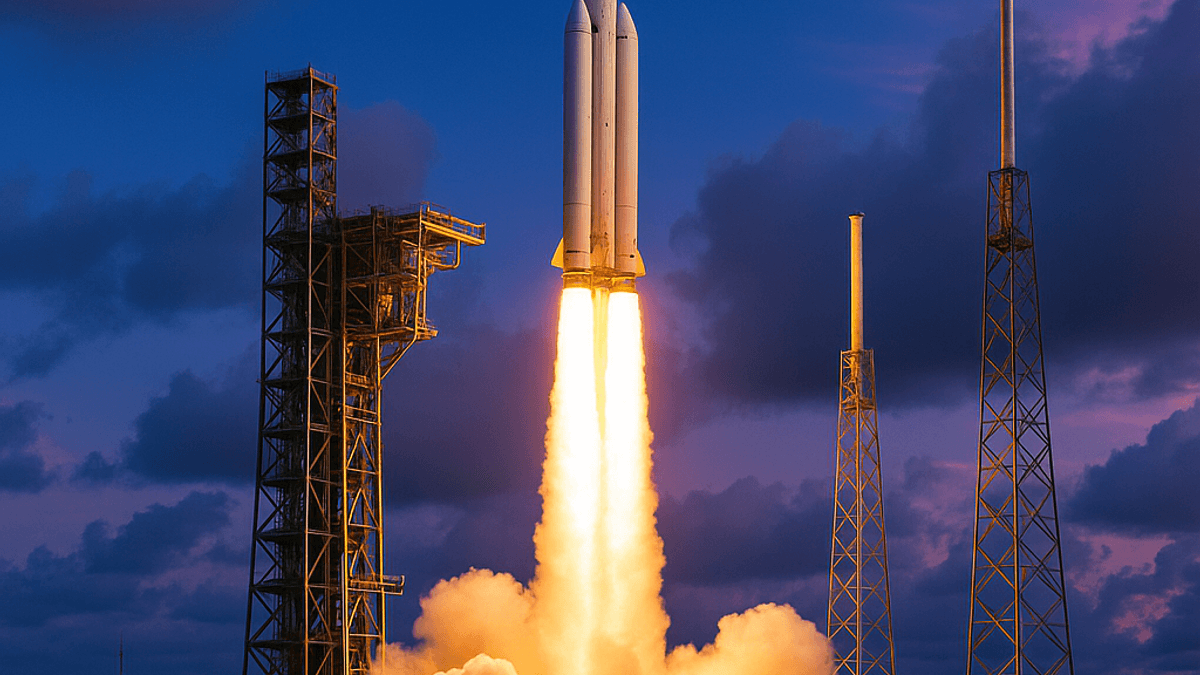

- Space launch economics led by SpaceX’s reusability and satellite connectivity influence budget decisions across flight operations and defense ISR, as documented by The Space Report.

- Avionics software certification and data governance mature under frameworks such as RTCA DO-178C, ISO 27001, and FedRAMP, shaping enterprise adoption roadmaps for aerospace software.

- Analyst coverage from McKinsey and Deloitte highlights digital thread, supply-chain visibility, and predictive maintenance as near-term ROI levers in aircraft manufacturing and in-service fleets.

Key Takeaways

- AI and ML are moving from proofs-of-concept to certified, operational use in avionics and MRO, with platforms from Airbus and Boeing Digital Aviation anchoring data strategy.

- Reusable launch and satellite constellations from SpaceX set cost and cadence expectations felt across both commercial and defense segments, per industry reporting.

- Defense primes such as Lockheed Martin and Northrop Grumman compete on autonomy, ISR software, and secure mission networks.

- Certification and governance standards (DO-178C, ISO 27001, FedRAMP) drive architecture decisions and vendor selection across enterprise deployments.

| Company | Recent Move | Focus Area | Source |

|---|---|---|---|

| Airbus | Expands Skywise analytics and digital thread for fleet MRO | Predictive maintenance, data platforms | Airbus Skywise |

| Boeing | Builds AI-driven performance tools via Digital Aviation Solutions | Flight ops optimization, analytics | Boeing Digital Aviation |

| Lockheed Martin | Integrates AI autonomy and ISR decision support | Mission systems, secure networks | Lockheed AI Capabilities |

| SpaceX | Scales reusable launch and satellite connectivity | Launch cadence, broadband | The Space Report |

| Northrop Grumman | Develops AI-enabled mission planning and ISR | Defense autonomy, sensors | NG Digital Transformation |

| Honeywell | Extends connected avionics and certifiable software stacks | Avionics, flight management | Honeywell Aerospace |

| Trend | 2026 Status | Key Players | Source |

|---|---|---|---|

| AI in Avionics and MRO | Scaling under certifiable processes | Airbus, Boeing, Honeywell | RTCA DO-178C |

| Digital Twin in Manufacturing | Widely adopted for quality and throughput | Airbus, Boeing | Dassault Systèmes |

| Reusable Launch Economics | Operational and influencing procurement | SpaceX | The Space Report |

| Satellite Connectivity Expansion | Constellations scaling coverage | SpaceX Starlink | Space Economy Analysis |

| Defense Autonomy and ISR | Integrated into mission software | Lockheed Martin, Northrop Grumman | IEEE A&E Systems |

Disclosure: BUSINESS 2.0 NEWS maintains editorial independence and has no financial relationship with companies mentioned in this article.

Sources include company disclosures, regulatory filings, analyst reports, and industry briefings.

Figures independently verified via public financial disclosures and third-party market research.

Related Coverage

About the Author

Aisha Mohammed

Technology & Telecom Correspondent

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

Frequently Asked Questions

How are Boeing and Airbus using AI/ML in commercial aviation operations?

Boeing and Airbus are embedding AI/ML into fleet analytics, predictive maintenance, and flight operations planning to reduce downtime and optimize fuel use. Airbus’s Skywise platform centralizes aircraft and operational data for models that improve reliability and MRO scheduling, while Boeing’s Digital Aviation Solutions deliver performance analytics and route optimization tools that interface with airline ops centers. These efforts emphasize traceability, testing, and certification compliance under frameworks like DO-178C, aligning analytics pipelines with safety-critical workflows.

What competitive impact does SpaceX have on aerospace budgets and strategy?

SpaceX’s reusable launch model lowers cost per mission and increases cadence, shaping procurement strategies for satellite operators, defense ISR programs, and adjacent aerospace services. The Space Report documents how launch economics and constellation growth influence connectivity markets and downstream data services. This dynamic pressures incumbents to evaluate reusable technologies, payload integration cycles, and satellite platforms, while enterprises reassess budgets for weather, navigation, and communications data that inform airline and defense operations.

Which standards and certifications are most relevant for aerospace AI deployment?

For avionics software, DO-178C governs development and verification, ensuring models and code are traceable to safety requirements. Security and governance frameworks such as ISO 27001 and SOC 2 establish controls for data handling, while FedRAMP authorizations are crucial for government cloud workloads. Enterprises align AI deployment with these standards to pass audits and sustain airworthiness, embedding model lifecycle management, dataset versioning, and test coverage into engineering processes to meet regulatory expectations across commercial and defense settings.

Where do defense primes like Lockheed Martin and Northrop Grumman focus AI efforts?

Defense primes invest in autonomy, ISR analytics, mission planning, and secure communications, integrating AI into software-defined systems to enhance decision speed and reliability. Lockheed Martin outlines autonomy and AI capabilities that support multi-domain operations, and Northrop Grumman emphasizes digital transformation across sensors and command networks. These programs prioritize interoperability, certification, and cybersecurity baselines, enabling modular upgrades and mission adaptability while meeting governmental oversight and compliance requirements for classified and secured environments.

What near-term outcomes should enterprise buyers expect from aerospace AI initiatives?

In the next quarter, buyers should expect measurable improvements in fleet turnaround times, component reliability, and mission readiness, with models integrated into certified workflows. Commercial platforms from Airbus and Boeing will likely continue to expand partnerships with suppliers like Honeywell and RTX for connected avionics and data services. Defense programs will push autonomy and ISR applications, while space segments prioritize launch cadence and coverage. Success depends on data quality, integration with legacy systems, and adherence to certification standards.