Climate Tech Market Trends: Investment, Deployment, and Corporate Demand in 2025

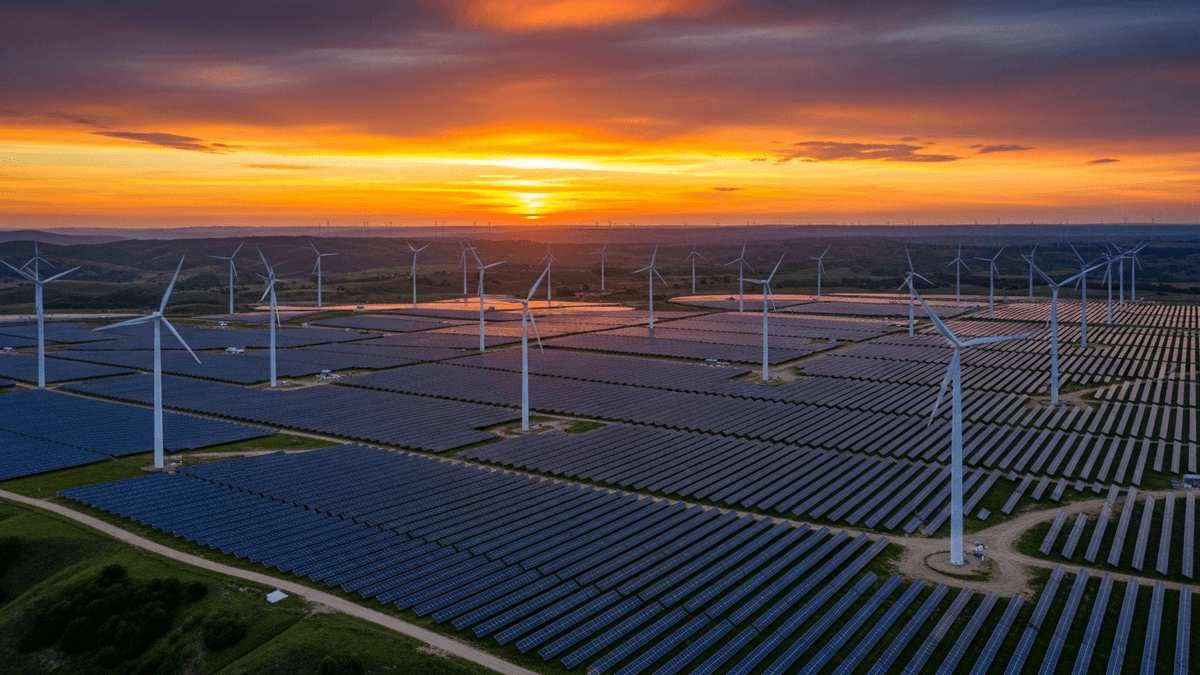

Clean energy and climate tech investment is accelerating even as venture markets recalibrate. From record energy-transition capital in 2023 to surging EV sales and corporate power deals, fresh statistics reveal where growth is strongest—and where challenges remain.

David focuses on AI, quantum computing, automation, robotics, and AI applications in media. Expert in next-generation computing technologies.

Global Investment Snapshot

Global capital flowing into climate tech remains robust. Investment in the energy transition hit $1.8 trillion in 2023, up 17% year over year, according to BloombergNEF’s latest tally global investment data. The International Energy Agency projects clean energy investment to reach roughly $2 trillion in 2024, outpacing fossil fuel spending and underscoring the sector’s structural momentum IEA World Energy Investment 2024. These figures span renewables, electrified transport, grid modernization, storage, low-carbon fuels, and efficiency technologies.

Electrified transport and power systems continue to capture outsized shares of capital. Leaders like Tesla, BYD, and battery suppliers such as CATL benefit from rising EV demand and stationary storage deployments, while large-scale developers including NextEra Energy and Ørsted expand renewable generation portfolios. Grid hardware and distributed energy providers—among them Siemens, GE Vernova, and residential solar-storage specialists like Enphase Energy—are positioned to capture upgrades that integrate intermittent generation and flexible demand.

Regional dynamics are shifting as policy support and manufacturing advantages diverge. Europe’s offshore wind leaders, including Vestas and Ørsted, face inflation, permitting, and supply-chain constraints even as long-term targets expand. In North America, utility-scale renewables and storage are benefiting from tax incentives, while Asia’s EV and battery ecosystems—anchored by BYD and CATL—are accelerating export and domestic market penetration.

Venture Funding and Startup Dynamics

Venture and growth equity for climate tech cooled alongside broader private markets. PwC’s State of Climate Tech 2023 report found sector funding declined roughly 40% year over year in the first half of 2023, though climate tech continued to outperform many venture categories on a relative basis industry report. Deal pacing and valuations normalized as investors prioritized capital efficiency and commercialization milestones over moonshot R&D without near-term unit economics.

Startups such as Climeworks and Heirloom in direct air capture, Form Energy in multi-day storage, and Northvolt in battery manufacturing illustrate the pivot from prototypes to bankable projects with booked offtake. Their pipelines increasingly involve industrial partners and utilities, rather than purely laboratory deployments. PitchBook’s climate tech analyses emphasize that categories tied to infrastructure-scale assets—storage, industrial decarbonization, and carbon removal—are attracting more project finance and strategic participation analyst data.

Corporate participation remains crucial as demand signals shift from pilots to long-term contracts. Tech leaders like Microsoft and Google are pairing power-purchase agreements with carbon removal and clean-firm power procurement, while large buyers such as Amazon continue to anchor utility-scale renewable projects across multiple regions. This blend of venture, offtake, and project finance is increasingly the defining capital stack for scaling climate solutions.

Deployment Metrics: EVs, Renewables, Storage, and Efficiency

Deployment statistics show climate tech shifting from promise to production. Electric car sales exceeded 14 million in 2023, an estimated 18% of total car sales worldwide, with growth concentrated in China, Europe, and the United States IEA Global EV Outlook 2024. Model lineups from Tesla and BYD have catalyzed mainstream adoption, while supply-chain leaders like CATL translate battery scale into cost reductions that reinforce both vehicle and stationary storage economics.

Renewables are expanding at record pace. The IEA reports that global renewable capacity additions reached a historic high in 2023, with solar PV accounting for most new installs IEA Renewables 2023. Utility-scale developers such as NextEra Energy and Ørsted are executing large solar and wind pipelines, turbine makers like Vestas are shipping hardware to increasingly complex projects, and storage providers including Tesla and Form Energy are scaling capacity to firm variable generation. These insights align with latest Climate Tech innovations.

Efficiency technologies and electrified heating remain pivotal to meeting demand. While heat pump sales slowed in parts of Europe in 2023, the technology’s global trajectory remains positive as policy and consumer economics improve IEA Heat Pumps. Manufacturers like Daikin and Carrier are broadening portfolios that serve both residential and commercial markets, where total cost of ownership increasingly favors electrification in many geographies.

Policy, Corporate Procurement, and Outlook

Corporate clean energy purchasing hit a record in 2023, reinforcing demand for long-duration offtakes that underpin new project financing. Large buyers including Google, Microsoft, and Amazon continued signing multi-gigawatt PPAs across wind, solar, and storage, according to analysts and industry trackers Reuters coverage. Carbon-pricing mechanisms now cover a growing share of global emissions, with the World Bank indicating wider adoption and rising price floors that are shaping industrial strategies World Bank report.

Public funding is also scaling first-of-a-kind projects. The U.S. announced up to $1.2 billion to support two commercial-scale direct air capture hubs, led by 1PointFive, which uses technology from Carbon Engineering, and the Project Cypress consortium including Climeworks DOE announcement. These moves aim to derisk early deployments and crowd in private capital for engineered carbon removal and storage. For more on related Climate Tech developments.

Looking ahead, the 2025 outlook hinges on grid buildouts, permitting reforms, and supply-chain resilience. The IEA’s latest investment projections show clean energy spending widening its lead versus fossil fuels IEA World Energy Investment 2024, while developers and manufacturers—such as Ørsted, Vestas, Northvolt, and GE Vernova—focus on cost discipline and execution. The data points to continued growth, but success will depend on translating policy support and corporate demand into on-time, on-budget commissioning across markets.

About the Author

David Kim

AI & Quantum Computing Editor

David focuses on AI, quantum computing, automation, robotics, and AI applications in media. Expert in next-generation computing technologies.

Frequently Asked Questions

How much capital is flowing into climate tech and clean energy in 2024?

The International Energy Agency projects clean energy investment to reach about $2 trillion in 2024, extending strong momentum from the $1.8 trillion deployed in 2023 across the energy transition. This includes renewable power, electrified transport, grids, storage, and efficiency technologies.

Which sectors are leading deployment growth within Climate Tech?

EVs, solar PV, and grid-scale storage are expanding fastest, with over 14 million electric cars sold in 2023 and record renewable capacity additions. Companies like Tesla, BYD, NextEra Energy, and Ørsted are scaling assets as battery suppliers such as CATL enable cost and capacity improvements.

Are climate tech startups still attracting venture capital?

Yes, though funding has normalized alongside broader venture markets. PwC data shows a year-over-year decline in 2023, but startups such as Climeworks, Heirloom, Form Energy, and Northvolt continue to secure strategic backing, offtake agreements, and project finance as they move from pilots to commercial deployments.

What role do corporate buyers and public policy play in growth?

Corporate clean energy purchasing hit records in 2023, providing long-term demand signals for developers and manufacturers. Public programs—such as the U.S. DOE’s support for direct air capture hubs—help derisk first-of-a-kind projects and crowd in private capital for scaling emerging technologies.

What are the key challenges for Climate Tech in 2025?

The sector must navigate grid interconnection backlogs, permitting timelines, and supply-chain volatility while maintaining cost discipline. Continued policy clarity, robust corporate offtakes, and execution excellence from equipment makers and developers will be critical to sustaining growth.