Climate Tech Market Trends: Startup Ecosystem Accelerates in 2024–2025

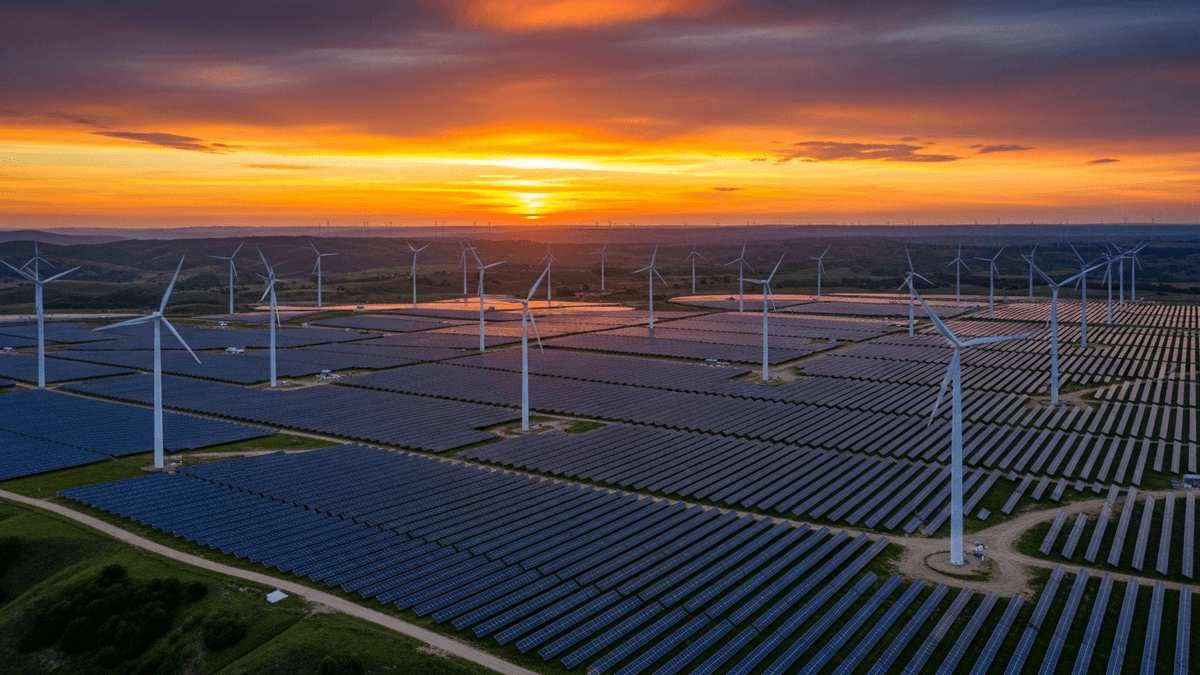

Climate tech is shifting from experimentation to large-scale deployment as capital, policy, and corporate demand converge. Despite a choppy venture market, the sector’s share of investment is rising and a new cohort of scale-ups is moving from pilots to gigafactories and commercial offtakes.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Momentum Builds: Funding Stabilizes as Deployment Surges

Global energy transition financing set a new record at $1.77 trillion in 2023, according to BloombergNEF’s latest analysis. Clean energy investment is poised to reach roughly $2 trillion in 2024 as it outpaces fossil fuels by nearly two-to-one, IEA data shows. That capital is increasingly reaching infrastructure-scale projects that underpin climate startups’ growth trajectories, from battery plants to carbon removal hubs.

Venture activity has cooled from 2021 highs, but climate tech continues to outperform broader VC as a share of deal flow, according to PwC’s State of Climate Tech 2023. The shift in focus—from rapid seed rounds to growth equity and project finance—reflects a maturing pipeline. Startups such as Climeworks in carbon removal and Fervo Energy in next‑gen geothermal are now executing multi-year buildouts anchored by long-term customer contracts.

The breadth of climate solutions is widening across hardware, software, and services. Companies such as Northvolt (batteries) and H2 Green Steel (low‑carbon steel) embody the industrial scale of the opportunity, while buyers like Microsoft and Amazon are catalyzing demand via clean power PPAs and carbon removal procurement that de‑risk early markets.

Capital, Policy, and the New Geography of Scale

A new financing stack is taking hold as venture blends with infrastructure capital. Early backers including Breakthrough Energy Ventures and Lowercarbon Capital are increasingly pairing with project lenders to fund first‑of‑a‑kind assets. Startups such as Fervo Energy and H2 Green Steel exemplify this progression from lab to commercial scale, supported by policy incentives and corporate offtakes.

In the U.S., the Inflation Reduction Act has catalyzed a manufacturing and deployment surge across batteries, hydrogen, and grid tech—spurring hundreds of billions in announced projects, the White House reports. Europe is answering with the Green Deal Industrial Plan to accelerate permitting and subsidies for clean industries, backed by the EU’s broader decarbonization framework, European Commission guidance shows. Companies such as Northvolt and H2 Green Steel have become regional anchors, drawing supply chains and talent into new industrial hubs. This builds on broader Climate Tech trends.

Corporate purchasing is now a decisive growth driver. Buyers including Microsoft, Amazon, and Shopify have signed multi‑year agreements for clean power and carbon removal, creating bankable demand signals for startups such as Climeworks. In mobility and logistics, electrification strategies at Rivian are stimulating adjacent ecosystems in charging and battery recycling.

Technology Pillars Gaining Traction

Long‑duration energy storage, industrial heat, and advanced geothermal are moving from prototypes toward commercial fleets. Startups such as Form Energy (iron‑air batteries) and Rondo Energy (thermal batteries) are targeting hard‑to‑abate segments where round‑the‑clock clean energy is critical. For more on related Climate Tech developments.

Carbon management and circular materials are also scaling. Startups such as Climeworks and Carbon Clean are deploying capture and removal systems while offtakers lock in multi‑year volumes; in parallel, Redwood Materials is building a domestic supply of battery‑grade materials from recycled content. In fuels and chemicals, Twelve converts captured CO2 into aviation and chemical feedstocks, hinting at a broader power‑to‑X wave as renewable electrons get cheaper, according to industry reports.

Electrified transport remains a cornerstone of climate tech scale‑up. Startups such as Rivian are pushing into fleet and consumer segments, while charging networks like ChargePoint expand interoperability and uptime to serve a growing vehicle base. These insights align with latest Climate Tech innovations.

Path to Scale: Customers, Cash Flows, and Exits

Commercialization is increasingly defined by bankability—creditworthy counterparties, standardized contracts, and repeatable assets. Partnerships with industrial incumbents are becoming pivotal: integrators such as Schneider Electric and offtakers including Shell are enabling pilots to evolve into multi‑site rollouts. As more projects pencil out under stable policy regimes, developers can recycle equity faster and lean more on non‑recourse debt.

Public markets remain selective for pre‑profit climate ventures, but strategic M&A and growth equity are filling the gap while first‑project risks are retired. In the U.S., transferable tax credits and production incentives from the IRA have lowered the weighted average cost of capital for eligible assets, according to recent research. The medium‑term outlook remains constructive: IEA projections and BloombergNEF’s investment trends suggest that companies such as Northvolt and Climeworks will be graduating from first‑of‑a‑kind facilities to multi‑gigawatt and megatonne‑scale deployment by the end of the decade.

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

How large is the Climate Tech investment landscape today?

Global energy transition investment reached about $1.77 trillion in 2023, and clean energy investment is on track to approach $2 trillion in 2024. This pool spans venture, growth equity, and infrastructure capital, increasingly directed at build‑out of large‑scale assets.

What’s driving the recent momentum in Climate Tech startups?

Policy tailwinds like the U.S. Inflation Reduction Act and the EU’s Green Deal Industrial Plan have improved project economics and accelerated siting and manufacturing. Corporate demand from buyers such as Microsoft, Amazon, and Shopify is creating bankable offtake for early markets like carbon removal and 24/7 clean power.

Which technologies are emerging as near‑term winners?

Long‑duration storage (e.g., Form Energy), industrial heat batteries (e.g., Rondo Energy), and enhanced geothermal (e.g., Fervo Energy) are moving toward multi‑site deployments. Carbon management players like Climeworks and Carbon Clean, alongside circular materials leaders such as Redwood Materials, are also scaling rapidly.

What are the biggest hurdles to scaling Climate Tech?

First‑of‑a‑kind projects face capital intensity, permitting complexity, and supply‑chain risks. Bankable customer contracts, partnerships with incumbents like Schneider Electric and Shell, and policy certainty help convert one‑off pilots into repeatable, financeable asset classes.

What is the outlook for Climate Tech exits and growth through 2030?

Public markets remain selective, but strategic M&A and growth equity are active as projects de‑risk and cash flows stabilize. With continued policy support and corporate procurement, leaders such as Northvolt and Climeworks are positioned to expand from initial facilities to gigascale deployments by decade’s end.