Deere, CNH And DJI Roll Out Edge-AI Field Systems As Smart Farming Enters An Autonomy Sprint

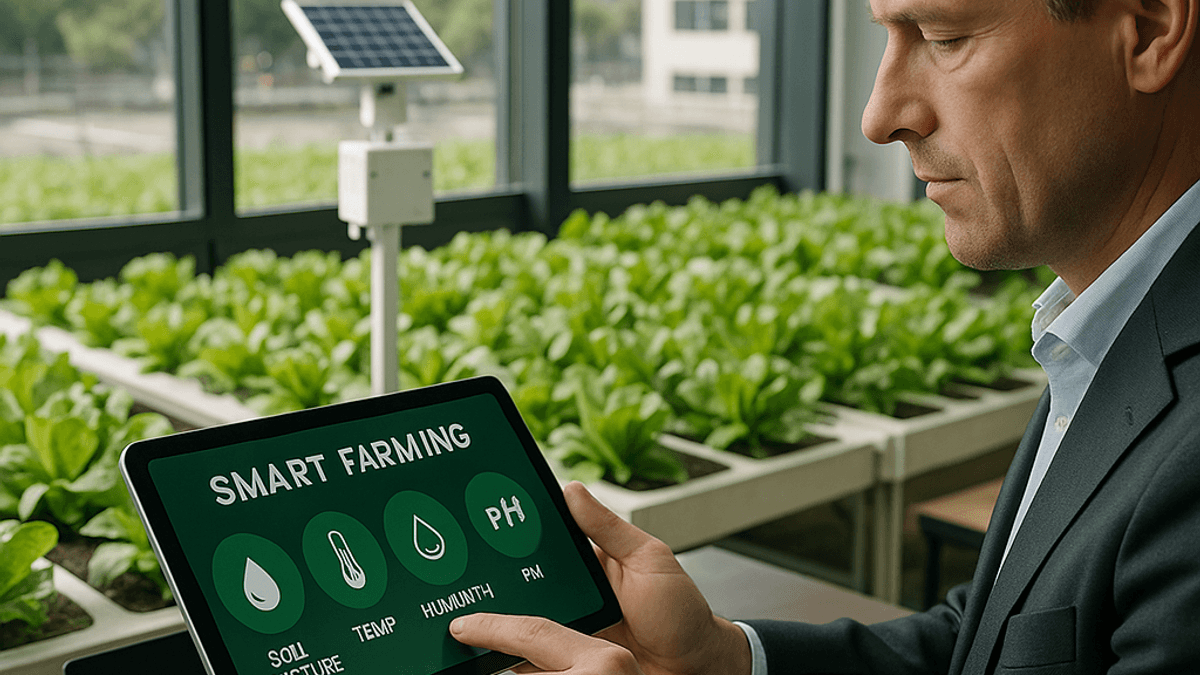

A wave of next-gen farm technology is debuting as 2026 opens, with Deere, CNH, and DJI showcasing autonomous and edge-AI platforms, satellite-to-field connectivity pilots, and climate intelligence tools. The push targets input savings, labor gaps, and resilient yields as agriculture digitization accelerates.

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

- Autonomous tractors, vision-guided implements, and spray drones headline new releases from John Deere, CNH Industrial, and DJI announced in recent weeks.

- Satellite-to-field connectivity pilots using Starlink and edge gateways from ag OEMs aim to reduce rural connectivity gaps that hinder real-time agronomy and autonomy.

- Remote sensing and MRV integrations from Planet Labs and Regrow push emissions quantification and input optimization into day-to-day agronomy workflows.

- Analysts and industry groups say AI-enabled precision tools could lift input-use efficiency by double-digit percentages over the next cycles, while tightening compliance and sustainability reporting (McKinsey agriculture insights).

| Company | Technology | Claimed Benefit/Focus | Source & Date |

|---|---|---|---|

| John Deere | Autonomy-ready vision stack for large tractors/sprayers | Precision weed targeting; software-first unlocks | Deere Newsroom, Dec 2025–Jan 2026 |

| CNH Industrial | Operator-in-the-loop implement automation via Raven | Reduced overlap, guided turns, RTK precision | CNH Press, Dec 2025 |

| DJI | Agras spray/spread drones with enhanced route planning | Higher throughput; terrain-following radar | DJI Agras, Dec 2025 |

| Starlink | Enterprise satellite connectivity for fleets/fields | Backhaul for autonomy and telematics | Starlink Enterprise, Dec 2025 |

| Planet Labs & Regrow | MRV-ready satellite analytics in agronomy UX | N-management, practice verification | Planet Pulse; Regrow Blog, Dec 2025 |

About the Author

Aisha Mohammed

Technology & Telecom Correspondent

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

Frequently Asked Questions

What new Smart Farming technologies were announced in the past 45 days?

Recent weeks brought autonomy and edge-AI updates from major OEMs and drone makers. John Deere highlighted autonomy-ready vision stacks for large tractors and sprayers, emphasizing software-first upgrades (company newsroom). CNH Industrial showcased operator-in-the-loop implement automation via Raven’s stack. DJI expanded its Agras line with higher-throughput spray and spread capabilities and improved route planning. Connectivity advances include enterprise-grade satellite services from Starlink for backhauling telemetry and autonomy data, plus ongoing LPWAN deployments for dense, low-cost sensor grids.

How do satellite connectivity and edge computing change on-farm operations?

Satellite backhaul and edge computing close persistent rural coverage gaps, enabling real-time autonomy, telematics, and agronomic decision-making. Enterprise-grade Starlink terminals provide bandwidth where cellular is unreliable, while OEM gateways dynamically route traffic across cellular, Wi‑Fi, and satellite. Edge inference on tractors, sprayers, and drones reduces latency and cloud dependence, improving resilience during peak operations. This architecture supports timely variable-rate prescriptions, over-the-air updates, and compliance reporting with fewer data dropouts.

What is the role of satellite imagery and MRV platforms in 2026 agronomy?

High-cadence satellite imagery from providers like Planet feeds biomass, soil exposure, and harvestable-area signals into agronomy tools. Platforms such as Regrow integrate these data with equipment logs to quantify nitrogen use and practice adoption, producing MRV-grade reports for sustainability programs. This reduces manual data entry and accelerates eligibility for incentives or premium contracts. The same pipelines guide in-season applications by field zone, contributing to input-use efficiency and consistent documentation.

Where are growers seeing the clearest ROI from next-gen tools?

Growers report faster paybacks in use cases like spot spraying, variable-rate topdress, and harvest logistics. Vision-based weed targeting can reduce herbicide overlap, while drone operations address patchy pressure and difficult terrain. Connectivity upgrades minimize downtime and enable predictive maintenance. As sustainability data becomes a procurement lever, MRV-integrated platforms can add revenue upside through premiums and incentives, tilting ROI beyond input savings alone, according to analyst commentary and recent OEM briefings.

What should farm operators prioritize when adopting these technologies in 2026?

Focus on modular deployments with clear seasonal outcomes—start with edge-AI retrofits for in-season tasks, pair drones with agronomy service support, and strengthen connectivity using a hybrid of cellular and satellite. Ensure data interoperability between machinery logs, imagery, and sustainability tools to streamline reporting. Lean on dealer and integrator expertise to validate coverage and latency for autonomy workflows. Finally, align pilots with procurement incentives that reward documented input reductions and practice adoption to improve payback profiles.