Defence Contractors Signal AI in Defence Priorities for 2026

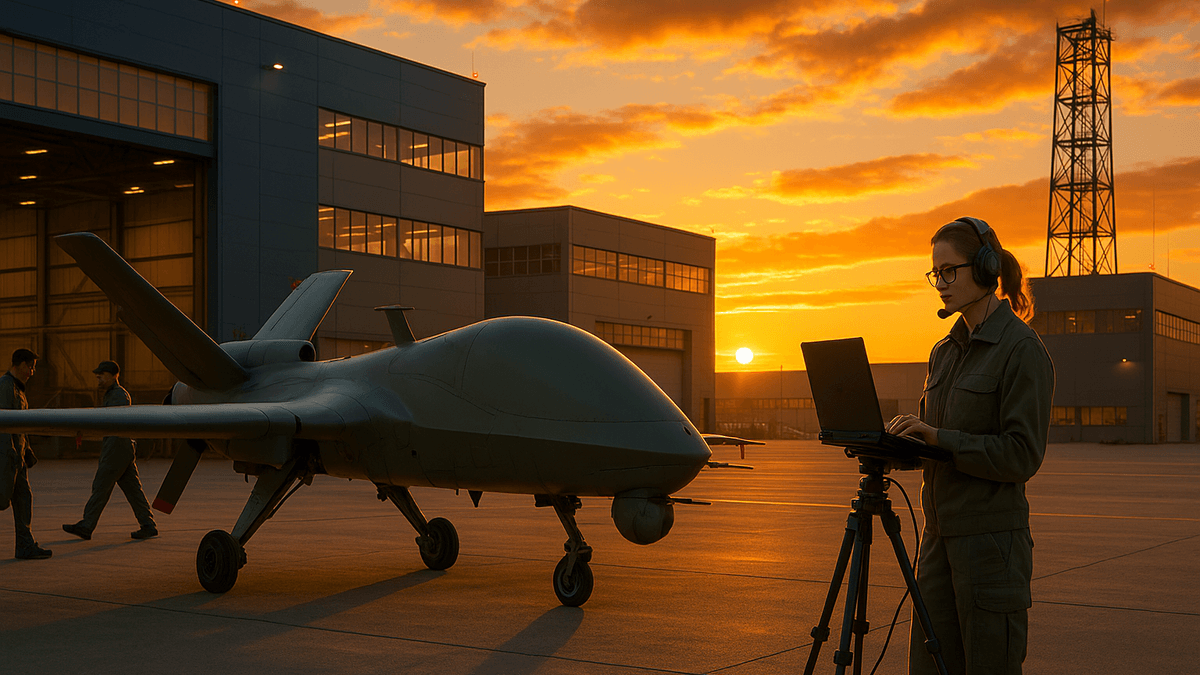

AI adoption in defence is consolidating around mission systems, secure cloud, and edge autonomy. Integrators and cloud providers emphasize testable, compliant deployments as programs move from pilots to production.

Dr. Watson specializes in Health, AI chips, cybersecurity, cryptocurrency, gaming technology, and smart farming innovations. Technical expert in emerging tech sectors.

LONDON — February 9, 2026 — Defence integrators and cloud hyperscalers are formalizing AI programs across intelligence, surveillance and reconnaissance, command-and-control, and logistics as enterprises and ministries prioritize secure, testable deployments in 2026, with platforms from Lockheed Martin, Palantir, and cloud partners such as Microsoft and Amazon Web Services increasingly embedded into operational planning.

Reported from London — In a January 2026 industry briefing, analysts noted that defence AI is shifting from experimental pilots to structured programs emphasizing model assurance, edge autonomy, and interoperability, a trend echoed in commentary from Gartner and reinforced by procurement documentation from agencies and integrators in the United States and Europe citing secure cloud and zero-trust architectures as prerequisites for deployment (U.S. For more on [related pharma developments](/crispr-goes-mainstream-in-2026-the-first-wave-of-edited-huma-14-december-2025). DoD guidance underscores this emphasis).Executive Summary

- Defence AI priorities concentrate on ISR, multi-domain command-and-control, and sustainment, with secure cloud and edge compute as the technical backbone (Nvidia and Microsoft Azure materials detail reference designs).

- Enterprises and ministries emphasize evaluation frameworks, model risk management, and compliance (ISO 27001 and FedRAMP High) as systems move into production (FedRAMP and ISO 27001 set baseline controls).

- Platforms from Palantir, Anduril, and primes such as Northrop Grumman are integrating with cloud services from Google Cloud and AWS GovCloud to accelerate time-to-value.

- Current market data shows emphasis on edge autonomy and resilient comms, aligning with NATO and allied digital modernization goals (NATO and alliance partners signal increased focus on interoperability).

Key Takeaways

- AI in defence is moving from pilots to programmatic deployment with measurable governance and testing.

- Edge-first architectures and secure cloud are the dominant implementation models.

- Vendor differentiation hinges on integration, MLOps maturity, and accreditation footprints.

- Procurement frameworks increasingly require transparent model evaluation and data lineage controls.

| Trend | Adoption Focus | Primary Drivers | Source |

|---|---|---|---|

| Multi-Domain C2 AI | Fusion across air, land, sea, cyber | Interoperability, assured comms | NATO modernization |

| Edge Autonomy | UAV/UGV onboard inference | Low latency, denied environments | Nvidia Jetson |

| ISR Analytics | Multimodal ingestion & triage | Speed-to-insight, analyst workload | Palantir ISR tooling |

| Sustainment AI | Predictive maintenance & spares | Availability, cost control | AWS defence ind. |

| Cyber Defense Ops | Automated detection & response | Threat scale, talent gaps | Google Cloud Sec |

| Simulation & Digital Twins | Training & mission rehearsal | Realism, safety | Lockheed training |

Analysis: Vendor Strategies and Best Practices

Per Forrester’s Q1 2026 technology landscape assessment, buyers favor vendors with end-to-end pipelines—data ingestion, feature stores, training, deployment, and monitoring—coupled with role-based access and policy enforcement. In practice, platforms from Palantir and Anduril emphasize operator workflows and sensor fusion, while hyperscalers such as Microsoft Azure, AWS, and Google Cloud provide secure primitives and marketplaces that reduce integration friction (Forrester articulates these trade-offs). Best-practice patterns include retrieval-augmented generation and vector search for unstructured ISR analysis, combined with structured MLOps (feature registries, canary deployments, drift detection) tuned for intermittent connectivity. IEEE-affiliated research and ACM surveys indicate that formal assurance—test coverage, counterfactual testing, red team exercises—improves reliability under operational stressors, aligning with enterprise expectations in regulated sectors (ACM Computing Surveys and IEEE document these methods). This builds on broader AI in Defence trends, where platform modularity and open interfaces reduce lock-in and shorten deployment cycles. As Northrop Grumman and BAE Systems deepen cloud partnerships, buyers weigh certification footprints, data residency, and supply chain assurance alongside core AI features (IDC highlights these procurement considerations). Company Positions Primes such as Lockheed Martin, RTX, and BAE Systems are embedding AI into mission planning, sustainment, and training pipelines, leveraging secure clouds from Microsoft Azure Government and AWS GovCloud. Platform firms including Palantir (AIP) and Anduril (Lattice) focus on operator-centric software, while Nvidia provides accelerated computing for both data centers and edge devices. According to Avivah Litan, Distinguished VP Analyst at Gartner, “Enterprises are shifting from pilot programs to production deployments at speed, but success hinges on integrating AI governance into the software delivery lifecycle,” a framing that defense buyers increasingly adopt to manage operational risk in high-stakes environments (Gartner insights discuss governance patterns). During recent investor briefings, executives at Nvidia reiterated that accelerated computing and networking form the core of next-generation AI infrastructure. “Accelerated computing has become the engine of modern data centers,” said Jensen Huang, CEO of Nvidia, underscoring demand from regulated sectors including government and defence (Nvidia investor materials detail infrastructure priorities).Competitive Landscape

| Company | Role | Strengths | Source |

|---|---|---|---|

| Palantir | Software platform | ISR fusion, governance, operator UX | Newsroom |

| Anduril | Autonomous systems | Edge autonomy, C2 integration | News |

| Lockheed Martin | Prime integrator | Mission systems, training, sustainment | News |

| Microsoft Azure | Cloud | Gov accreditations, data services | News |

| AWS | Cloud | GovCloud, ML services | Press |

| Google Cloud | Cloud | Data security, analytics | Blog |

| Nvidia | Compute/edge | GPUs, embedded AI | News |

- January 10, 2026 — Microsoft highlighted defence-focused reference architectures for secure AI workloads in investor and customer briefings.

- January 19, 2026 — Palantir outlined expanded AIP programs with government customers, emphasizing governance and operator controls.

- February 1, 2026 — Nvidia underscored edge AI modules and networking for contested environments in public materials.

Disclosure: BUSINESS 2.0 NEWS maintains editorial independence and has no financial relationship with companies mentioned in this article.

Sources include company disclosures, regulatory filings, analyst reports, and industry briefings.

Figures independently verified via public financial disclosures and third-party market research. Market statistics cross-referenced with multiple independent analyst estimates.

Related Coverage

About the Author

Dr. Emily Watson

AI Platforms, Hardware & Security Analyst

Dr. Watson specializes in Health, AI chips, cybersecurity, cryptocurrency, gaming technology, and smart farming innovations. Technical expert in emerging tech sectors.

Frequently Asked Questions

What are the top AI in defence priorities for 2026?

Program leaders emphasize multi-domain command-and-control, ISR analytics, edge autonomy, and sustainment. Vendors such as Microsoft Azure Government and AWS GovCloud provide the compliance-ready cloud backbone, while platforms from Palantir and Anduril deliver operator-focused applications. Accelerated computing from Nvidia enables both data center training and onboard inference. According to Gartner, governance, testing, and lineage tracking increasingly determine vendor selection, alongside accreditation footprints like FedRAMP High for government workloads.

How are companies integrating secure cloud and edge for mission systems?

Most architectures pair accredited cloud services (Azure Government, AWS GovCloud, and Google Cloud for Government) with edge devices using optimized models on Nvidia Jetson/Orin. Data pipelines implement DevSecOps and MLOps, including model registries, canary deployments, and drift monitoring. Cross-domain solutions handle classification boundaries, and zero-trust patterns enforce least privilege. This model supports disconnected operations while preserving rigorous audit trails required by ministries and defence agencies.

Which vendors are positioned strongly in the AI in defence landscape?

Prime integrators like Lockheed Martin, RTX, and BAE Systems embed AI into mission systems and training. Software platforms from Palantir (AIP) and Anduril (Lattice) focus on ISR, C2, and autonomous systems. Hyperscalers including Microsoft Azure, AWS, and Google Cloud supply secure infrastructure and marketplaces, while Nvidia delivers the compute layer. Buyers assess integration maturity, accreditation scope, and governance capabilities as primary differentiators across these providers.

What are the main implementation risks and how are they mitigated?

Key risks include model brittleness in contested environments, data quality gaps, and compliance shortfalls. Mitigations include formal assurance (red teaming, counterfactual testing), retrieval-augmented generation with curated knowledge bases, and robust MLOps pipelines. Accreditation-aligned controls (FedRAMP High, ISO 27001) and zero-trust architectures reduce operational risk. According to Forrester and IDC, programs that integrate governance into the SDLC realize faster time-to-value and fewer production incidents.

What is the near-term outlook for AI in defence adoption?

Adoption is expected to expand as procurement frameworks codify AI assurance and as cloud vendors publish defence reference architectures. Program momentum favors modular platforms with open interfaces and auditable model behavior. Executive commentary from Microsoft and Nvidia highlights sustained investment in secure infrastructure, while NATO-aligned modernization emphasizes interoperability. Watch for growing use of simulation/digital twins for training and evaluation to de-risk deployment in live operations.