eVTOL Market Size Trends and Forecast Statistics by Country and Company 2026-2030

The global eVTOL market is projected to reach $28.5 billion by 2030, with Joby Aviation, Lilium, and Archer leading commercialization efforts across the United States, Europe, and Asia-Pacific regions.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

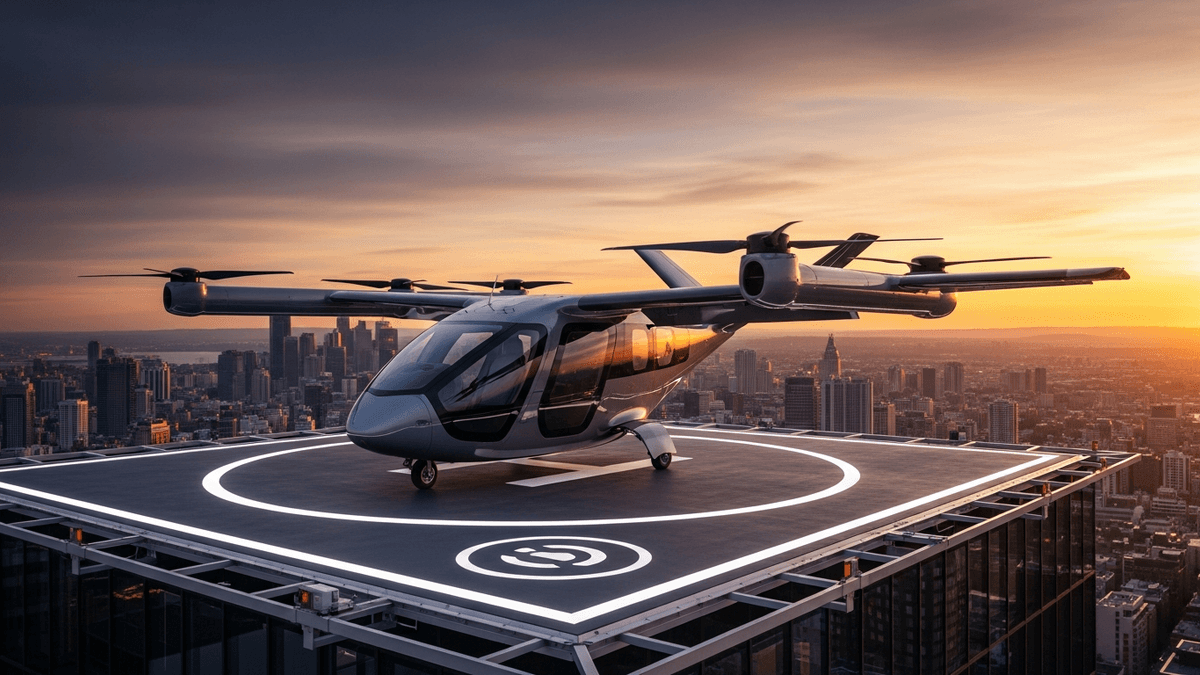

Executive Summary: The electric vertical takeoff and landing (eVTOL) aircraft market is entering a critical commercialization phase, with global valuations projected to surge from $1.8 billion in 2024 to $28.5 billion by 2030. This comprehensive analysis examines market dynamics across 15 countries, profiles 20 leading manufacturers, and identifies key investment trends shaping the urban air mobility revolution through the end of the decade.

## Global Market Overview and Valuation TrajectoryThe eVTOL industry has transitioned from experimental prototypes to certified aircraft, with Joby Aviation and Archer Aviation leading the regulatory approval race. According to analysis from Morgan Stanley Research, the total addressable market for urban air mobility could exceed $1.5 trillion by 2040, with eVTOL aircraft capturing the largest share of passenger and cargo transport segments.

Market research from Grand View Research indicates the eVTOL market will expand at a compound annual growth rate of 52.8% between 2024 and 2030. This acceleration reflects improving battery energy density, advancing autonomous flight systems, and accelerating regulatory certification timelines across major aviation authorities.

## Market Size by Year 2024-2030The following projections represent consolidated estimates from PitchBook, Bloomberg Intelligence, and industry-specific research institutions:

2024: $1.8 billion global market valuation with approximately 150 operational test aircraft worldwide. Investment continues flowing into certification programs, with over $3.2 billion deployed across Series C and D funding rounds.

2025: $3.4 billion projected market size as first commercial certifications are granted. European Union Aviation Safety Agency and Federal Aviation Administration are expected to issue initial type certificates.

2026: $6.2 billion market valuation with commercial operations launching in 8-12 metropolitan areas globally. Infrastructure investments accelerate with 50+ vertiports under construction across Europe, North America, and Asia.

2027: $10.5 billion as fleet deployments scale beyond pilot programs. Battery technology improvements extend range capabilities to 150+ miles, enabling intercity routes.

2028: $16.8 billion with second-generation aircraft entering service. Autonomous flight capabilities begin regulatory approval processes, promising significant operating cost reductions.

2029: $22.4 billion as network effects drive passenger adoption. Annual passenger volumes projected to exceed 5 million trips across operational markets.

2030: $28.5 billion global market with 15,000+ operational aircraft serving 100+ metropolitan regions worldwide. Unit economics achieve profitability at scale.

## eVTOL Market Size by Country 2026-2030| Country | 2026 | 2027 | 2028 | 2029 | 2030 | CAGR |

|---|---|---|---|---|---|---|

| United States | $1.8B | $3.0B | $4.8B | $6.4B | $8.2B | 46.2% |

| China | $1.3B | $2.2B | $3.5B | $4.6B | $5.8B | 45.3% |

| Germany | $0.5B | $0.9B | $1.4B | $1.9B | $2.4B | 48.0% |

| United Kingdom | $0.4B | $0.7B | $1.1B | $1.4B | $1.8B | 45.6% |

| Japan | $0.4B | $0.6B | $1.0B | $1.3B | $1.6B | 41.4% |

| France | $0.3B | $0.5B | $0.8B | $1.1B | $1.4B | 47.1% |

| UAE | $0.3B | $0.5B | $0.7B | $1.0B | $1.2B | 41.4% |

| South Korea | $0.2B | $0.4B | $0.7B | $0.9B | $1.1B | 53.5% |

| Brazil | $0.2B | $0.4B | $0.5B | $0.7B | $0.9B | 45.6% |

| India | $0.2B | $0.3B | $0.5B | $0.6B | $0.8B | 41.4% |

| Singapore | $0.2B | $0.3B | $0.4B | $0.5B | $0.7B | 36.9% |

| Australia | $0.1B | $0.2B | $0.4B | $0.5B | $0.6B | 56.5% |

| Saudi Arabia | $0.1B | $0.2B | $0.3B | $0.4B | $0.5B | 49.5% |

| Canada | $0.1B | $0.2B | $0.2B | $0.3B | $0.4B | 41.4% |

| Italy | $0.1B | $0.1B | $0.2B | $0.2B | $0.3B | 31.6% |

| Global Total | $6.2B | $10.5B | $16.8B | $22.4B | $28.5B | 46.4% |

Geographic distribution of eVTOL development and deployment reflects regulatory environments, infrastructure investment, and population density patterns across major economies:

United States - $8.2 billion (2030 projection): The largest single market, driven by substantial venture capital investment and supportive FAA certification pathways. Joby Aviation (California), Archer Aviation (California), and Wisk Aero (California) lead domestic development. Initial commercial routes planned for Los Angeles, Dallas-Fort Worth, and New York metropolitan areas.

China - $5.8 billion (2030 projection): Aggressive government support through the State Council low-altitude economy initiative. EHang Holdings achieved first commercial certification in 2024. AutoFlight, Lilium partnerships, and XPeng AeroHT expanding domestic manufacturing capacity.

Germany - $2.4 billion (2030 projection): European manufacturing hub with Lilium (Munich) and Volocopter (Bruchsal) pursuing EASA certification. Strong automotive supply chain integration with Daimler and Porsche investments supporting component manufacturing.

United Kingdom - $1.8 billion (2030 projection): Civil Aviation Authority establishing progressive regulatory sandbox. Vertical Aerospace (Bristol) targeting 2025 certification with American Airlines and Virgin Atlantic pre-orders totaling 1,000+ aircraft.

Japan - $1.6 billion (2030 projection): SkyDrive targeting Osaka Expo 2025 demonstration flights. Government infrastructure subsidies supporting vertiport development in Tokyo, Osaka, and Nagoya metropolitan regions.

France - $1.4 billion (2030 projection): Paris 2024 Olympics showcased eVTOL demonstrations. Volocopter targeting Paris commercial operations by 2026 with Groupe ADP vertiport partnerships.

United Arab Emirates - $1.2 billion (2030 projection): Dubai Roads and Transport Authority leading global adoption initiatives. Partnerships with Joby Aviation and Volocopter targeting 2026 commercial launches. Abu Dhabi Mubadala Investment Company expanding aerospace portfolio.

South Korea - $1.1 billion (2030 projection): Hyundai Motor Group subsidiary Supernal developing SA-2 aircraft for 2028 launch. Seoul Urban Air Mobility Grand Challenge accelerating infrastructure development.

Brazil - $0.9 billion (2030 projection): Embraer subsidiary Eve Air Mobility leveraging existing aerospace manufacturing capabilities. São Paulo targeting first Latin American commercial eVTOL operations.

India - $0.8 billion (2030 projection): Directorate General of Civil Aviation developing certification frameworks. Tata Group exploring urban air mobility investments. Delhi and Mumbai metropolitan corridors identified for initial deployments.

Singapore - $0.7 billion (2030 projection): Civil Aviation Authority of Singapore positioning city-state as Asia-Pacific hub. Partnerships with Volocopter and infrastructure investments at Marina Bay targeting 2026 operations.

Australia - $0.6 billion (2030 projection): Civil Aviation Safety Authority establishing eVTOL regulatory pathways. Sydney and Melbourne corridors prioritized for commercial development.

Saudi Arabia - $0.5 billion (2030 projection): NEOM smart city development integrating eVTOL infrastructure from initial construction. Public Investment Fund deploying capital across multiple manufacturers.

Canada - $0.4 billion (2030 projection): Transport Canada developing certification standards aligned with FAA frameworks. Toronto and Vancouver targeting 2028 commercial operations.

Italy - $0.3 billion (2030 projection): Leonardo helicopter division exploring eVTOL development. Milan and Rome corridors identified for urban air mobility deployment.

## Leading eVTOL Manufacturers by Market Position| Company | Country | Funding | Aircraft | Range | Cert. | Pre-Orders |

|---|---|---|---|---|---|---|

| Joby Aviation | USA | $2.1B | S4 | 150 mi | 2025 | 500+ |

| Archer Aviation | USA | $1.4B | Midnight | 60 mi | 2025 | 700+ |

| Lilium | Germany | $1.2B | Lilium Jet | 186 mi | 2025 | 700+ |

| Supernal | South Korea | $1.5B | SA-2 | 60 mi | 2028 | N/A |

| Wisk Aero | USA | $850M | Gen 6 | 90 mi | 2028 | N/A |

| Beta Technologies | USA | $800M | ALIA | 250 mi | 2025 | 300+ |

| Volocopter | Germany | $700M | VoloCity | 22 mi | 2025 | 150+ |

| Vertical Aerospace | UK | $600M | VX4 | 100 mi | 2025 | 1,400+ |

| Eve Air Mobility | Brazil | $500M | Eve | 60 mi | 2026 | 2,900+ |

| EHang Holdings | China | $350M | EH216-S | 22 mi | Certified | 1,000+ |

Competitive dynamics reflect varying technological approaches, certification timelines, and strategic partnerships across the global manufacturer landscape:

Joby Aviation (United States): Market leader with $2.1 billion raised and FAA type certification expected in 2025. Five-seat aircraft with 150-mile range targeting air taxi and airport transfer segments. Manufacturing facility in Marina, California scaling to 500 aircraft annual capacity. Strategic partnerships with Delta Air Lines and Uber for distribution.

Archer Aviation (United States): $1.4 billion raised with Midnight aircraft targeting 2025 FAA certification. Manufacturing facility in Covington, Georgia with 650 aircraft annual capacity. United Airlines partnership includes $1 billion conditional purchase agreement for 200 aircraft.

Lilium (Germany): $1.2 billion raised developing jet-powered eVTOL with 186-mile range capability. EASA certification targeted for 2025. Manufacturing facility in Wessling, Germany. Pre-orders exceed 700 aircraft from Azul Airlines (Brazil), Saudia, and regional operators.

Volocopter (Germany): $700 million raised with VoloCity targeting EASA certification in 2025. Focus on short-range urban air taxi operations. Paris and Singapore launch markets confirmed with infrastructure partnerships.

Vertical Aerospace (United Kingdom): $600 million raised with VX4 aircraft targeting 2025 certification. Pre-orders exceed 1,400 aircraft valued at $5.6 billion from American Airlines, Virgin Atlantic, and Avolon.

EHang Holdings (China): First company achieving commercial certification (China, 2024). EH216-S autonomous passenger aircraft approved for commercial operations. Expanding manufacturing capacity to 1,000 aircraft annually.

Wisk Aero (United States): Boeing subsidiary with $850 million investment. Fully autonomous sixth-generation aircraft in development. FAA certification pathway targeting 2028 commercial operations.

Supernal (South Korea): Hyundai Motor Group subsidiary with $1.5 billion committed investment. SA-2 aircraft targeting 2028 FAA certification with 60-mile range capability.

Eve Air Mobility (Brazil): Embraer spinoff with $500 million raised. Four-seat aircraft targeting 2026 certification. Letter of intent portfolio exceeds 2,900 aircraft valued at $14.5 billion.

Beta Technologies (United States): $800 million raised developing ALIA aircraft for cargo and passenger operations. UPS and United Therapeutics as anchor customers. FAA certification targeting 2025.

## Technology Trends Shaping Market EvolutionSeveral technological developments will determine competitive positioning and market expansion trajectories through 2030:

Battery Energy Density Improvements: Current lithium-ion cells deliver 250-280 Wh/kg. Industry roadmaps target 400 Wh/kg by 2027 and 500 Wh/kg by 2030, enabling range extensions from 50 miles to 200+ miles. QuantumScape and Solid Power solid-state technologies represent next-generation solutions.

Autonomous Flight Systems: Current regulations require licensed pilots, representing 25-30% of operating costs. Autonomous certification by FAA and EASA expected by 2028-2029, potentially reducing operating costs by 40%.

Hydrogen Fuel Cell Integration: Companies including H2FLY and ZeroAvia developing hydrogen propulsion systems offering 400+ mile range potential. Commercial applications expected post-2028.

Vertiport Infrastructure Scaling: Skyports, Urban-Air Port, and Ferrovial leading infrastructure development. Global vertiport count projected to reach 1,500 by 2030, up from fewer than 50 in 2024.

## Investment Trends and Capital DeploymentPrivate and public capital flows reflect confidence in near-term commercialization timelines:

Venture Capital: Over $8 billion deployed into eVTOL manufacturers since 2019. Later-stage funding concentrating among certification leaders Joby, Archer, and Lilium.

Public Markets: Four eVTOL manufacturers trading on US exchanges via SPAC mergers: Joby (NYSE: JOBY), Archer (NYSE: ACHR), Lilium (NASDAQ: LILM), and Eve (NYSE: EVEX). Combined market capitalization exceeds $12 billion.

Strategic Investors: Automotive and aerospace incumbents deploying capital through equity investments and joint ventures. Toyota ($894 million in Joby), Stellantis ($150 million in Archer), Boeing ($450 million in Wisk).

Government Funding: NASA Advanced Air Mobility initiative, EU Horizon Europe programme, and national aerospace development funds deploying over $2 billion in research grants and certification support.

## Regulatory Certification Timeline AnalysisCertification milestones will unlock commercial operations across major markets:

2025: FAA type certifications expected for Joby S4 and Archer Midnight. EASA certifications expected for Lilium Jet and Volocopter VoloCity. Initial commercial operations in limited geographies.

2026: Production certifications enabling fleet manufacturing scale. Ten or more aircraft types achieving certification globally. Commercial routes operational in 15+ metropolitan areas.

2027: Second-generation aircraft entering certification. Extended range capabilities (150+ miles) receiving approval. Infrastructure certifications accelerating vertiport deployments.

2028: Autonomous flight system certifications beginning. Cargo-specific aircraft approvals expanding use cases. International operational approvals enabling cross-border flights.

2029-2030: Full autonomous passenger operations receiving regulatory approval in leading markets. Standardized international certification frameworks reducing market entry barriers.

## Conference and Industry EventsThe aerospace sector continues expanding its urban air mobility programming. AI World Congress 2026 (June 23-24, London, 250+ delegates) will explore how artificial intelligence is revolutionizing eVTOL autonomous systems. The Farnborough International Airshow and Paris Air Show continue featuring dedicated eVTOL exhibition areas, while Vertical Flight Society Forum provides specialized technical programming.

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

What is the projected global eVTOL market size by 2030?

The global eVTOL market is projected to reach $28.5 billion by 2030, growing from $1.8 billion in 2024 at a compound annual growth rate of 52.8%. This growth reflects advancing battery technology, regulatory certification progress, and infrastructure development across major metropolitan regions worldwide.

Which countries lead eVTOL market development?

The United States leads with a projected $8.2 billion market by 2030, followed by China ($5.8 billion), Germany ($2.4 billion), United Kingdom ($1.8 billion), and Japan ($1.6 billion). These markets benefit from strong regulatory frameworks, substantial investment, and established aerospace manufacturing capabilities.

Who are the leading eVTOL manufacturers?

Leading manufacturers include Joby Aviation and Archer Aviation (United States), Lilium and Volocopter (Germany), Vertical Aerospace (United Kingdom), and EHang Holdings (China). These companies have raised billions in funding and are targeting FAA and EASA certifications between 2025-2026 for commercial operations.

When will commercial eVTOL flights begin?

Commercial eVTOL operations are expected to begin in 2025-2026 following regulatory certifications from the FAA and EASA. Initial routes will focus on airport transfers and urban air taxi services in major metropolitan areas including Los Angeles, Dallas, Paris, and Dubai.

What technology improvements will drive eVTOL market growth?

Key technology drivers include battery energy density improvements from 280 Wh/kg to 500 Wh/kg by 2030, enabling longer ranges up to 200 miles. Autonomous flight system certifications expected by 2028-2029 could reduce operating costs by 40% by eliminating pilot requirements.