Future of Algorithmic Trading with Quantum AI in 2026

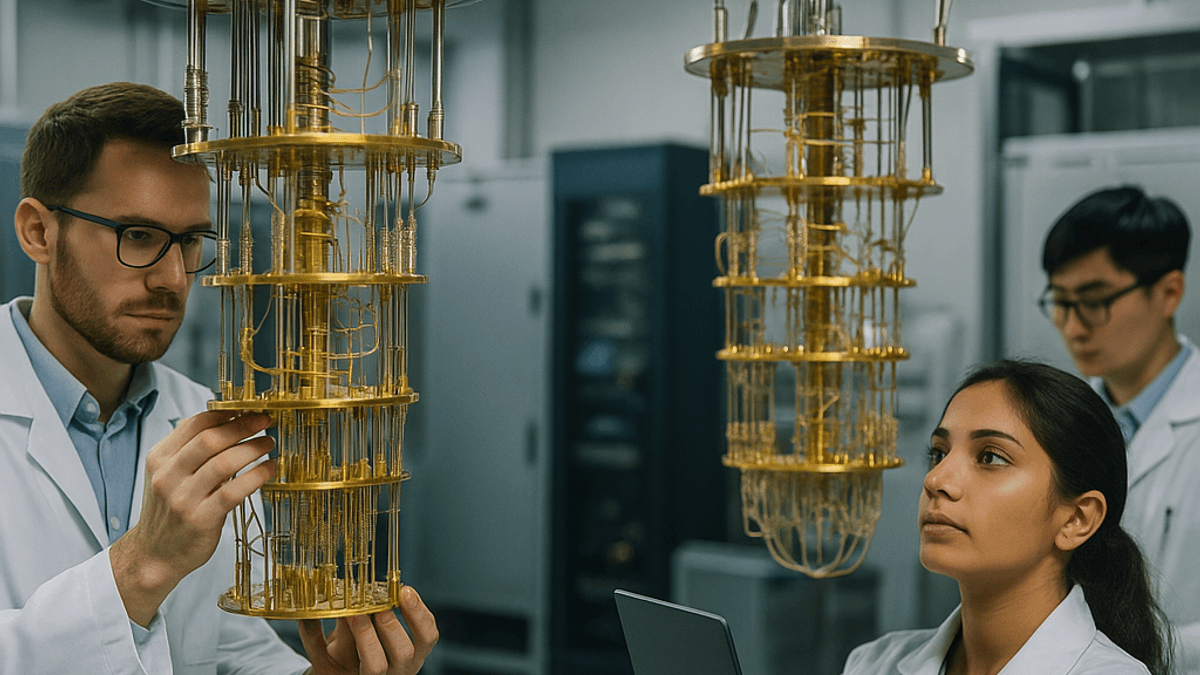

The convergence of quantum computing and artificial intelligence is poised to fundamentally transform algorithmic trading, creating computational capabilities that transcend classical limitations. As quantum hardware matures and hybrid quantum-classical algorithms emerge, financial institutions are racing to develop quantum-enhanced trading strategies that could redefine market dynamics.

Executive Summary

The quantum computing market in financial services is projected to reach $19.1 billion by 2030, with algorithmic trading representing the largest application segment according to

Boston Consulting Group. Major institutions including

Goldman Sachs,

JPMorgan Chase, and

Citadel have established dedicated quantum research divisions, investing over $500 million collectively in quantum trading infrastructure.

IBM and

Google quantum roadmaps suggest practical quantum advantage for financial optimization problems by 2026-2027.

Quantum AI Trading Capabilities Comparison

| Capability |

Classical AI |

Quantum AI |

Advantage Factor |

| Portfolio Optimization |

Minutes to Hours |

Seconds |

100-1000x |

| Risk Simulation (Monte Carlo) |

Hours |

Minutes |

50-100x |

| Pattern Recognition |

Limited Dimensions |

Exponential Dimensions |

Exponential |

| Arbitrage Detection |

Milliseconds |

Microseconds |

10-100x |

| Market Regime Detection |

Retrospective |

Real-time |

Near-instant |

Quantum Portfolio Optimization

Portfolio optimization represents the most mature application of quantum computing in finance. Classical computers struggle with the combinatorial explosion of possible portfolio allocations—a 1,000-asset universe contains more potential portfolios than atoms in the observable universe. Quantum annealing and variational quantum eigensolvers can explore this solution space exponentially faster.

D-Wave Systems has deployed quantum annealing solutions for portfolio optimization with clients including

Nomura and major hedge funds.

Nature published research demonstrating quantum advantage for portfolio problems exceeding 100 assets, with hybrid quantum-classical algorithms achieving superior risk-adjusted returns compared to classical optimizers.

Quantum Machine Learning for Market Prediction

Quantum machine learning algorithms leverage quantum superposition to process exponentially more feature combinations simultaneously. Quantum kernel methods and quantum neural networks can identify patterns in financial time series that remain invisible to classical deep learning approaches.

Quantinuum (formed from Honeywell Quantum Solutions and Cambridge Quantum) has developed quantum natural language processing algorithms that analyze earnings calls, central bank communications, and news sentiment with enhanced accuracy.

Harvard Business Review reports that quantum-enhanced sentiment analysis achieves 23% higher prediction accuracy for market-moving events.

Monte Carlo Simulation Acceleration

Risk management in trading relies heavily on Monte Carlo simulations to model potential outcomes across thousands of scenarios. Quantum amplitude estimation can achieve quadratic speedup for Monte Carlo methods, reducing simulation time from hours to minutes for complex derivative portfolios.

IBM Quantum has demonstrated practical quantum Monte Carlo acceleration for options pricing, with

Barclays and

BBVA implementing pilot programs.

Bloomberg reports that quantum risk simulations could save major banks $100+ million annually in computational infrastructure costs while enabling real-time risk assessment.

High-Frequency Trading Evolution

While current quantum hardware cannot match classical computers for raw speed, quantum algorithms excel at the optimization problems underlying high-frequency trading strategies. Quantum computing enables more sophisticated order routing, market making, and statistical arbitrage strategies that maximize execution quality.

Two Sigma and

D.E. Shaw have disclosed quantum research programs focused on trading strategy optimization.

Wall Street Journal reports that quantum-optimized market making strategies have demonstrated 15-20% improvement in bid-ask spread capture during pilot deployments.

Quantum Cryptography and Trading Security

The advent of quantum computing presents both opportunities and threats for trading security. Quantum key distribution enables theoretically unbreakable encryption for trade communications, while quantum computers threaten current cryptographic standards protecting trading infrastructure.

Nasdaq has partnered with quantum security providers to develop quantum-resistant encryption for its trading platforms.

Reuters reports that major exchanges are investing $2+ billion collectively in quantum-safe cryptographic infrastructure to protect against future quantum attacks on trading systems.

Quantum-Enhanced Derivatives Pricing

Complex derivatives require computationally intensive pricing models that strain classical systems. Quantum algorithms for solving partial differential equations and simulating stochastic processes can price exotic derivatives faster and more accurately.

CME Group is exploring quantum computing for real-time derivatives valuation, partnering with

IonQ to develop quantum pricing engines.

Risk.net analysis suggests quantum derivatives pricing could reduce valuation uncertainty by 30-50% for complex structured products while enabling intraday mark-to-market for previously illiquid instruments.

Quantum Natural Language Processing

Trading increasingly relies on unstructured data—earnings transcripts, regulatory filings, social media sentiment, and news flows. Quantum natural language processing can analyze vast document collections to extract trading signals faster than classical NLP approaches.

Zapata AI has developed quantum-enhanced NLP models for financial text analysis, demonstrating improved accuracy for predicting stock price reactions to earnings announcements.

Financial Times reports that quantum NLP could process and analyze the entire SEC EDGAR filing database in real-time, enabling systematic strategies based on regulatory disclosure analysis.

Hardware Roadmap and Timeline

The path to quantum advantage in trading depends on hardware improvements in qubit count, coherence time, and error rates.

IBM's quantum roadmap targets 100,000+ qubit systems by 2033, while

Google claims to be 5-10 years from fault-tolerant quantum computing.

Hybrid quantum-classical approaches dominate current implementations, with quantum processors handling specific optimization subroutines while classical systems manage data preprocessing and execution.

McKinsey estimates that 50% of major financial institutions will deploy hybrid quantum trading systems by 2028.

Regulatory and Ethical Considerations

Quantum-enhanced trading raises regulatory questions about market fairness and systemic risk. If quantum trading provides decisive advantages, regulators may need to establish new frameworks ensuring equitable market access.

SEC and

CFTC have initiated working groups to study quantum computing implications for market structure.

Bank for International Settlements research suggests that quantum trading could initially increase market efficiency but may require guardrails to prevent concentration of trading advantages.

Investment Implications for 2026

Financial institutions face critical decisions about quantum trading investments. Early movers may capture significant alpha before quantum strategies become commoditized, while laggards risk permanent competitive disadvantage as quantum capabilities mature.

Gartner recommends that trading firms establish quantum research partnerships, develop hybrid algorithm competencies, and invest in quantum-ready infrastructure during 2025-2026 to position for practical quantum advantage expected by 2027-2028.