Gaming Market Size: Growth Engines, Segments, and 2028 Outlook

After a post-pandemic reset, the global gaming market is stabilizing near the $190 billion mark, with mobile leading growth and console content reaccelerating. As consolidation reshapes the competitive landscape, executives are watching monetization models and regional demand shifts to gauge the next leg up.

Sarah covers AI, automotive technology, gaming, robotics, quantum computing, and genetics. Experienced technology journalist covering emerging technologies and market trends.

Global market size enters a steadier phase

In the Gaming sector, After two years of normalization following the pandemic boom, the global gaming market is back on a steadier growth trajectory. Industry trackers estimate 2023 revenues at roughly the high-$180 billions, supported by a resilient player base and ongoing expansion in mobile and live-service franchises. The market’s breadth and recurring monetization have limited volatility relative to other consumer tech categories, even as hardware cycles and macro conditions ebb and flow.

While unit economics have tightened for some publishers, demand remains broad-based. Global player counts still number in the billions, and recurring content updates continue to drive engagement. The report pipeline suggests incremental growth through 2024–2025 as hardware availability normalizes and premium releases stack into the calendar. This backdrop aligns with Newzoo’s latest Global Games Market Report, which points to a durable revenue base and a player ecosystem that has expanded beyond core markets.

The sector’s consolidation and platform dynamics are also recasting revenue pools. Subscription models, cross-play, and cloud services have widened access, while in-game monetization keeps average revenue per user elevated. With advertising, virtual goods, and battle passes becoming standard, publishers and platforms are securing more predictable cash flows even as launch-day volatility persists.

Segment dynamics: mobile leads, console content reaccelerates

Mobile continues to be the industry’s largest revenue contributor, buoyed by reach, low friction, and a deep catalog of free-to-play titles. Consumer spend on mobile games topped the $100 billion threshold in 2023, underscoring the platform’s dominance and improving monetization efficiency, according to the State of Mobile 2024 report. The combination of live-ops, sophisticated UA, and privacy-aware targeting is helping leading titles sustain multi-year revenue arcs.

Console cycles, meanwhile, are entering a content-rich phase. With supply constraints largely resolved, the installed base for current-generation hardware is expanding, creating tailwinds for premium releases and microtransaction-driven live-service games. In the U.S., spending rose to about $57 billion in 2023, reflecting a rebound led by content and accessories as well as a healthier hardware pipeline, according to industry reporting. PC gaming remains robust, anchored by free-to-play ecosystems, mod communities, and strong engagement in multiplayer and creator-driven platforms.

Regionally, growth is diversified. North America and Western Europe are steady, Asia remains the largest single demand pool led by China and Southeast Asia, and Latin America shows continued momentum in mobile engagement despite macro headwinds. Payment innovation—from carrier billing to digital wallets—has lowered friction, while cloud distribution and cross-platform accounts are expanding addressable markets without the capex burden of hardware.

Consolidation, IP pipelines, and monetization strategy

Market size is increasingly shaped by the strategies of a handful of platform-scale players and IP-rich publishers. Microsoft’s acquisition of Activision Blizzard, Sony’s investment in live-service capabilities, and Tencent’s global publishing reach have amplified the role of multi-platform franchises and subscription distribution. For investors, the scale benefits include cross-marketing, unified entitlement, and improved lifetime value across console, PC, and mobile.

Content pipelines are poised for a heavy-hitting 2025, with blockbuster IP expected to catalyze premium spending and sustain live-service engagement. Publishers are balancing tentpole releases with ongoing content drops to smooth revenue curves, while free-to-play ecosystems and creator platforms (e.g., Roblox and Fortnite Creative) help seed new user segments and monetize via cosmetics, passes, and UGC-driven economies.

Monetization innovation remains a lever for expanding market size without relying solely on unit sales. Hybrid models—combining subscriptions, microtransactions, and ad-supported tiers—are gaining traction. Regional compliance and platform policies are reshaping loot-box mechanics and IAP disclosures, pushing publishers toward more transparent value propositions and season-based progression that can lift conversion rates and retention.

Outlook to 2028: growth, risks, and what to watch

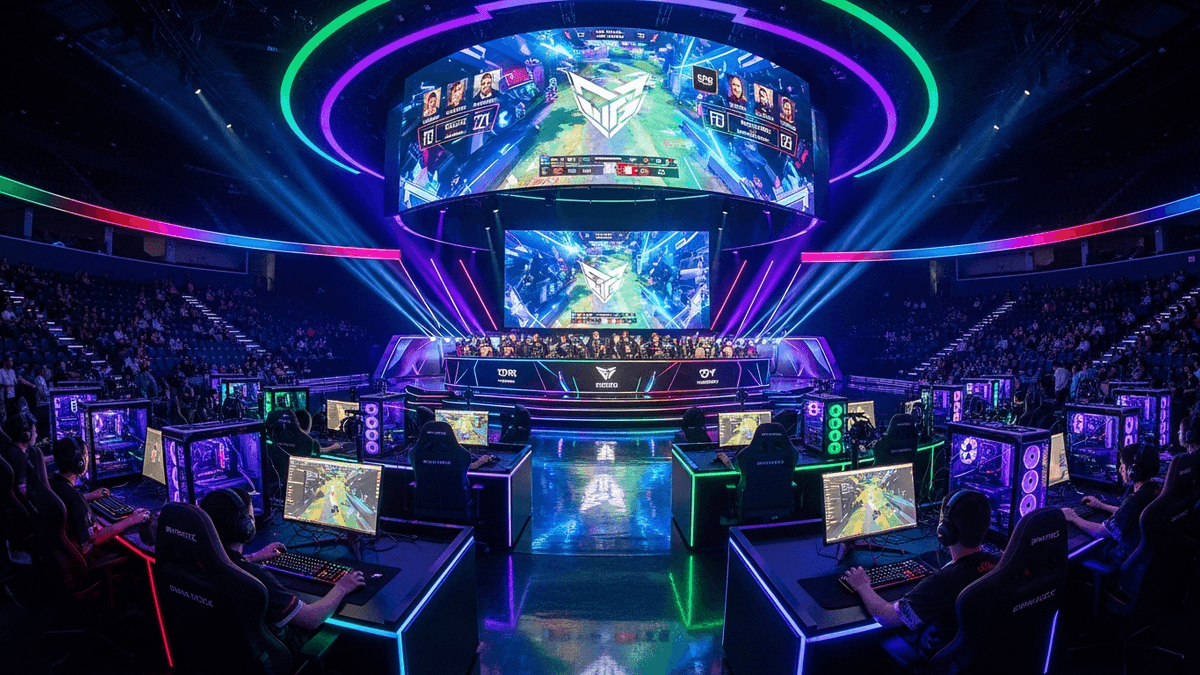

Most outlooks call for mid-single-digit growth through 2028, with mobile, live-service, and cross-platform franchises driving the next leg of expansion. Professional services and sector analysts expect steady gains for games and esports as distribution widens and monetization models mature, as outlined in PwC’s Global Entertainment & Media Outlook. While the market’s absolute size is already substantial, the addressable base could grow as cloud streaming reduces hardware barriers and on-device AI improves personalization.

Key risks include platform policy changes, regulatory scrutiny of monetization mechanics, and rising content costs. IDFA-style privacy shifts continue to pressure user acquisition efficiency on mobile, and subscription pricing must balance value perception with content amortization. On the upside, generative AI tools are helping reduce art, localization, and QA costs, potentially compressing development cycles and enabling more frequent live-ops updates without sacrificing quality.

For executives and investors, the playbook is clear: invest behind durable IP, optimize cross-platform distribution, and diversify monetization. With mobile anchoring the revenue mix and console/PC content cycles turning, the gaming market size appears set for incremental growth, backed by an expanding user base and maturing business models. If pipelines deliver and platform policies remain stable, the industry’s trajectory into 2028 should remain constructive—albeit with disciplined execution required to fully capture the opportunity.

About the Author

Sarah Chen

AI & Automotive Technology Editor

Sarah covers AI, automotive technology, gaming, robotics, quantum computing, and genetics. Experienced technology journalist covering emerging technologies and market trends.