Gaming Market Trends: Country-Level Statistics and Growth Drivers

Global gaming is consolidating around a handful of powerhouse countries, with the U.S., China, and Japan driving most consumer spend. New data highlights how platform preferences and policy shifts are reshaping national trajectories—and where companies are placing their bets.

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

Global Snapshot: Where Gaming Spend Is Concentrated

The geography of gaming is remarkably concentrated: a small group of markets command the majority of global revenue, with the United States, China, and Japan consistently ranked at the top. Global games revenue is expected to remain above $180 billion in 2024 and grow modestly through the mid-decade, according to the latest analyses from Newzoo’s Global Games Market Report. While growth is steady, its distribution is uneven—some countries are expanding on the back of mobile and free-to-play monetization, while others depend heavily on console cycles and premium titles.

Consumer behavior differs sharply by country. In the U.S., player demographics skew older than many assume, with 61% of Americans playing games weekly and an average player age of 32, per the Entertainment Software Association’s 2024 Essential Facts. In China, the market rebounded after regulatory turbulence, with industry reports showing a 13% rise in 2023 to roughly $46 billion as approvals resumed and mobile hits regained momentum, according to Reuters.

Country Leaders: U.S., China, and Asia’s Powerhouses

Hardware ecosystems and content pipelines shape national rankings. The United States benefits from strong console cycles led by Sony and Microsoft, alongside Nintendo’s resilient hybrid model via Nintendo. On PC, distribution strength from Valve and aggressive live-service updates from publishers like Activision Blizzard, Electronic Arts, and Take-Two Interactive help sustain recurring spend.

China’s scale is anchored in mobile and PC, with domestic giants Tencent and NetEase Games operating leading franchises and platforms alongside licensing dynamics that influence release cadence. Japan’s market remains a top-three heavyweight with a unique blend of console and mobile monetization steered by global platforms and homegrown IP; South Korea’s mix is defined by PC cafés and high-engagement online genres powered by KRAFTON and NCSOFT. Across Europe, Germany continues to punch above its weight in premium PC and console catalogs, while the U.K. thrives on a steady pipeline of multiplatform releases.

Platform Mix by Country: Mobile, Console, and PC

The platform split is the biggest driver of country-by-country differences. Mobile remains the largest slice of global consumer spend—hovering around the majority share—thanks to app store monetization via Apple and Google Play. Mobile gaming spend and downloads saw renewed momentum in 2024, as highlighted in data.ai’s State of Mobile Gaming, underscoring why Southeast Asian markets such as Indonesia and the Philippines skew heavily toward mobile titles published by regional platforms like Sea (Garena).

Console-first countries—especially the U.S. and Japan—are influenced by hardware cycles and exclusive content. Flagship launches and subscription services from Sony and Microsoft continue to reshape attach rates, while PC-centric markets favor storefronts and ecosystems from Valve and cross-platform hits from Epic Games. This builds on broader Gaming trends, where service models and cross-play are narrowing gaps between regional preferences.

Esports and Policy Shifts Reshape National Markets

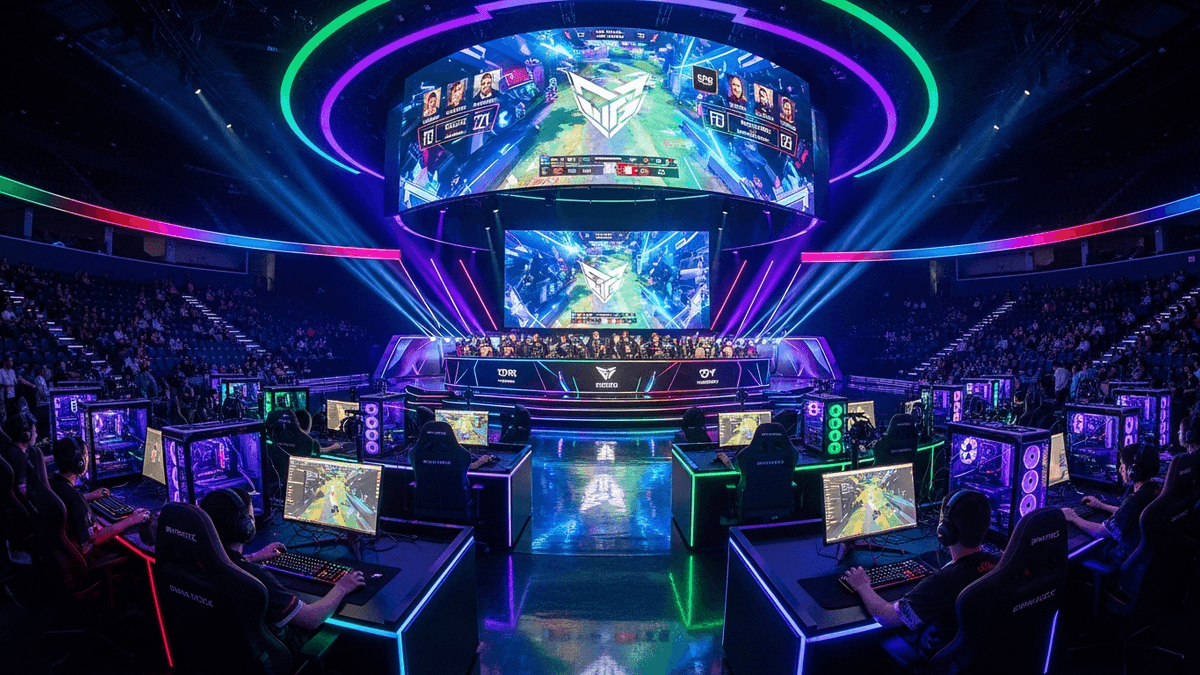

Policy continues to be a decisive force. China’s licensing framework, age restrictions, and playtime rules can dampen release velocity, yet the market has shown resilience as approvals normalize following 2023’s disruptions. India’s tax regime—imposing a higher levy on online gaming since 2023—has recalibrated some monetization models while leaving ample runway for growth in non-real-money categories. Esports investments and franchised leagues add localized gravity: Activision Blizzard and Epic Games keep flagship tournaments global, but national ecosystems vary widely in publisher support and sponsorship depth.

The Middle East has emerged as a strategic investor bloc, with Savvy Games Group deploying capital to build regional infrastructure and acquire global assets, enhancing the long-term visibility of MENA markets. Subscription and cloud services from Microsoft, NVIDIA (GeForce NOW), and Amazon are also beginning to soften hardware constraints in bandwidth-rich countries, potentially broadening access without immediate console purchases. For more on related Gaming developments, national rollouts of cloud gaming and localized pricing models bear watching through 2025.

Outlook: 2026–2028 Scenarios for Regional Growth

Most analysts forecast steady, single-digit growth through 2027, with mobile and live-service revenue offsetting hardware cycle variability. The longer-range view from PwC’s Global Entertainment & Media Outlook suggests interactive entertainment will remain a growth engine across media, with geography and platform mix determining outperformance in specific markets, according to industry reports. Countries with favorable regulatory environments and strong payments infrastructure are likely to capture a disproportionate share of incremental spend.

Key variables to monitor include console refresh cadence from Sony and Microsoft, mobile privacy and UA policy shifts from Apple and Google Play, and continued investment in esports and cloud access by NVIDIA and Amazon. With cross-play and subscriptions normalizing price sensitivity across borders, the next expansion phase will hinge less on blockbuster hardware and more on content pipelines, localized monetization, and stable regulatory frameworks.

About the Author

James Park

AI & Emerging Tech Reporter

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

Frequently Asked Questions

Which countries lead global gaming revenue today?

The United States, China, and Japan consistently top the global rankings, with the U.S. buoyed by console cycles and live-service spending, China anchored by mobile and PC, and Japan balanced across console and mobile. These positions align with findings from Newzoo’s global market tracking and regional industry reports.

How do platform preferences differ by country?

Mobile dominates in many markets, especially across Asia and emerging economies, due to frictionless distribution via Apple’s App Store and Google Play. The U.S. and Japan remain more console-centric, while South Korea and parts of Europe show strong PC engagement supported by ecosystems like Valve’s Steam.

What role do major companies play in shaping national trends?

Publishers and platform operators—such as Sony, Microsoft, Nintendo, Tencent, and NetEase—drive content pipelines and monetization models that influence local consumption. Live-service strategies from Activision Blizzard, EA, and Take-Two, alongside storefronts from Valve and Epic Games, help sustain recurring spend across countries.

How are regulations affecting gaming growth in key markets?

Regulatory frameworks impact release cadence and monetization, most visibly in China’s licensing cycles and India’s higher tax regime for online gaming. These policies can slow near-term growth or shift spending mix but rarely derail long-term demand when content pipelines and payment infrastructure remain strong.

What is the outlook for country-level growth through 2028?

Analysts expect low- to mid-single-digit growth, with mobile and subscriptions offsetting hardware variability. Cloud distribution by Microsoft, NVIDIA, and Amazon may expand access in bandwidth-rich markets, while stable regulations and localized pricing will differentiate outperformers.