Gaming Startups Market Trends: Funding, AI, and Cross-Platform Growth in 2025

After two uneven years, gaming startups are finding fresh momentum in 2025 as AI tooling, creator platforms, and cloud distribution reshape product roadmaps and revenue models. Investors are selectively backing teams that can thrive across mobile, PC, console, and web3—while navigating shifting platform policies in the US, Europe, and Asia.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Market Overview and Funding Climate

The global games market is stabilizing after a turbulent funding cycle, with revenue expected to edge higher as players spend more time in live-service ecosystems. Analysts point to cautious optimism for 2025, with the sector’s recovery tied to stronger engagement on platforms like Epic Games and Roblox, where user-generated content and regular content drops keep retention high. The macro picture shows growth resuming from 2024 levels, according to Newzoo’s latest market report.

Investment flows are returning to quality, with dealmaking concentrated in teams demonstrating durable monetization and cross-platform distribution. The rebound is visible in late-stage rounds and strategic investments, as tracked in the Drake Star Gaming Deals series, which notes steadier activity through 2024 and into early 2025 in its industry insights. Founders are calibrating to investor demands for capital efficiency, live-ops proficiency, and predictable user acquisition dynamics.

Startups including Sky Mavis, Immutable, and Animoca Brands are leaning into infrastructure and ecosystem plays—prioritizing interoperability, asset portability, and creator economics over speculative token cycles. Meanwhile, companies such as Unity and Niantic continue to shape the toolchain and platform layers that many new studios rely on for real-time 3D, multiplayer services, and AR capabilities.

AI-Driven Creation and the Rise of UGC Economies

Generative AI and intelligent tooling are compressing production timelines and expanding what small teams can ship. Companies like Unity and Niantic have rolled out creation tools and SDK improvements that streamline asset generation, environment building, and multiplayer services, allowing lean studios to iterate faster. This acceleration is underpinning a broader shift toward persistent worlds where content frequency matters as much as content quality.

Startups such as Inworld AI and Scenario are enabling dynamic NPCs and AI-assisted art pipelines that slot neatly into existing engines and live-ops workflows. The collision of AI agents, realtime networking, and physics-based gameplay is beginning to yield new interaction models—something industry watchers say will influence retention and session length over the next two years. Partnerships and pilots are expanding across engine vendors and platform holders, with creator monetization aligned to engagement metrics observed across top ecosystems.

Platforms are doubling down on user-generated content (UGC), which lowers the cost of content production and opens up new monetization doorways for small teams. Companies including Roblox and Epic Games have broadened creator payout programs, while modding-focused startup Overwolf continues to professionalize UGC through curated app stores and revenue share frameworks. This builds on broader Gaming trends where creators become co-developers, and live economies deepen with cosmetics, seasonal passes, and community events. The trend also benefits pipeline efficiency and extends product lifecycles by distributing creative workload across communities.

Mobile Monetization, Cloud, and Geographic Expansion

Mobile remains the backbone of near-term growth for many studios, with consumer spend resilient across key genres. Data on downloads, ARPDAU, and top-grossing titles shows continued strength in puzzle, RPG, and strategy, according to Data.ai’s State of Mobile 2024. Companies such as Supercell and HoYoverse keep refining live operations and event cadence, while startups including Dream Games and Moon Active have demonstrated the power of polished onboarding, segmented offers, and social loops to drive long-term retention.

Cloud distribution is broadening the addressable audience for PC and console-grade experiences, with startups like Boosteroid complementing services from NVIDIA and Microsoft’s Xbox. For founders, cloud’s promise lies in reducing hardware friction and enabling instant trials that can lower acquisition costs and boost conversion. In parallel, store intelligence on regional performance indicates that localized content, payment options, and community management remain decisive, as tracked by Sensor Tower.

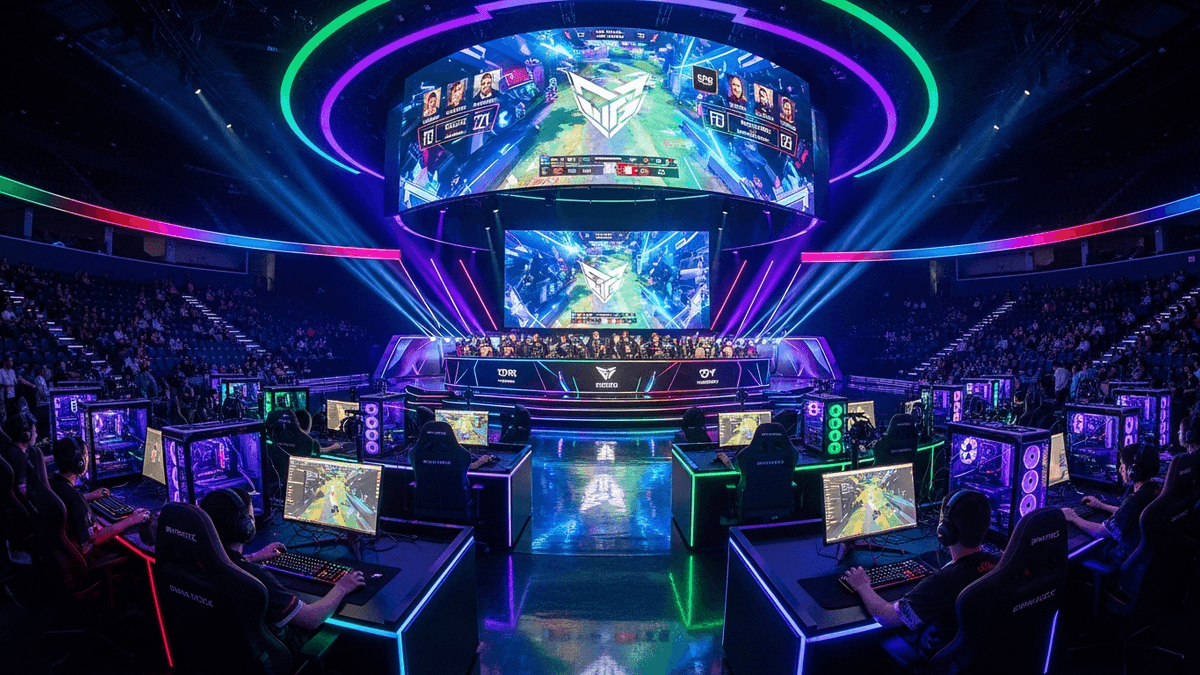

Geographically, expansion strategies are adapting to regulatory and distribution realities—from Europe’s platform rules to India’s fast-evolving mobile market. South Korea’s Krafton continues to back regional studios and esports initiatives, while cross-border publishing partnerships help startups navigate compliance and cultural nuances. For more on related Gaming developments, founders should watch language support, localized pricing, and regional influencer ecosystems.

Regulation and Platform Policies: Navigating the Rules

Policy shifts across app stores and digital platforms are reorganizing margins and go-to-market playbooks. Europe’s Digital Markets Act is catalyzing changes in distribution and payment choice, with implications for discovery, fees, and customer data portability as outlined by the European Commission. Companies like Epic Games have been at the center of debates over platform policies, with outcomes that influence how startups design storefronts, subscriptions, and off-platform monetization.

Founders are stress-testing multiple distribution channels—native app stores, web distribution, PC launchers, and cloud—to mitigate single-platform risk. Companies including Roblox, Unity, and Niantic are also updating guidelines and tooling to help teams comply with regional rules while optimizing performance and safety. The winners will be those who plan for policy-driven volatility, instrument for lifetime value across channels, and maintain flexibility in pricing, payments, and community management.

While the regulatory environment can be complex, the upside for agile teams is greater choice in routes to market and data visibility that supports smarter live-ops. Startups such as Immutable and Sky Mavis are building with interoperability and ownership in mind—models that could benefit from a more open distribution landscape. With platform policies in flux, disciplined experimentation and scenario planning are becoming core competencies for modern game businesses.

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

How is funding for gaming startups changing in 2025?

After a pullback in 2023, deal activity is stabilizing with investors prioritizing cross-platform distribution, live-ops proficiency, and efficient UA. Industry trackers, including Drake Star’s gaming deal insights, indicate healthier pipelines for late-stage rounds and strategic investments as studios demonstrate durable monetization.

What role is AI playing in new game development?

AI is compressing production cycles and enabling more dynamic content through tools from companies like Unity and startups such as Inworld AI and Scenario. Teams are using AI for asset generation, NPC behavior, and live-ops analytics to boost retention and reduce production overhead.

Which platforms matter most for creator-led growth?

UGC ecosystems like Roblox and Epic’s creator programs are central to discovery, content velocity, and monetization for small teams. Modding platforms such as Overwolf further professionalize creator workflows, expanding the supply of content while formalizing revenue share mechanisms.

Where are the strongest monetization channels today?

Mobile remains a powerhouse, with Data.ai and Sensor Tower tracking solid consumer spend across puzzle, RPG, and strategy. Cloud services from Boosteroid, NVIDIA, and Microsoft’s Xbox broaden access and trialability, while regional localization and community operations drive conversion and LTV.

How do evolving platform policies affect gaming startups?

Europe’s DMA and ongoing policy shifts across app stores are reshaping fees, payment choice, and data portability, requiring flexible go-to-market strategies. Founders are diversifying distribution, optimizing compliance, and instrumenting for LTV to manage volatility and capitalize on a more open ecosystem.