Gear highlights AI trends across Kia EV2, Instax updates, and more

Gear’s weekly roundup spotlights new releases from Kia, Fujifilm, Fender, Ricoh, and Omega, underscoring how AI-driven experiences are shaping consumer hardware strategies. Based on vendor announcements and market analysis, the slate reflects a wider shift toward accessible EVs, creator tools, and heritage products calibrated for digital-era buyers.

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

Gear’s roundup underscores AI’s widening role across consumer hardware

Gear’s latest weekly digest draws attention to new product reveals spanning transportation, imaging, audio production, and luxury watches. The line-up includes Kia’s EV2 preview, fresh Instax cameras from Fujifilm, a rebranded music production app under Fender’s PreSonus umbrella, a monochrome camera from Ricoh, and a new Omega Speedmaster. According to industry briefings and company disclosures, the common thread is a quiet but steady layering of AI-enabled experiences around products that are designed to be both accessible and aspirational.

The original reporting appeared in Wired, and Gear’s round-up continues to serve as a signal of how manufacturers and software providers are positioning for the next cycle of consumer demand. The development follows patterns reported by major industry analysts, who say that AI-enhanced features are moving from premium flagships into mainstream categories, even in niches like instant photography and mechanical timepieces.

Gear’s market lens: Why this weekly slate matters

As a brand focused on consumer technology curation, Gear sits at the intersection of hardware launches and broader ecosystem trends. Its weekly coverage acts as a barometer for how vendors are synchronizing physical products with digital services, and how both are progressively informed by AI. From automotive interfaces and driver assistance systems to camera companion apps and music production tools, this round of releases highlights business strategies that aim to translate advanced functionality into mass-market relevance.

For companies, the stakes are clear: expand reach without abandoning the enthusiast core. For consumers, the benefit is pragmatic—new options that promise improved usability and creative flexibility without imposing a steep learning curve. The end result is a steady normalization of AI in everyday devices, often embedded in software layers and cloud services rather than the headline specs.

Kia’s EV2: Mainstream EV ambitions with an AI-enabled experience

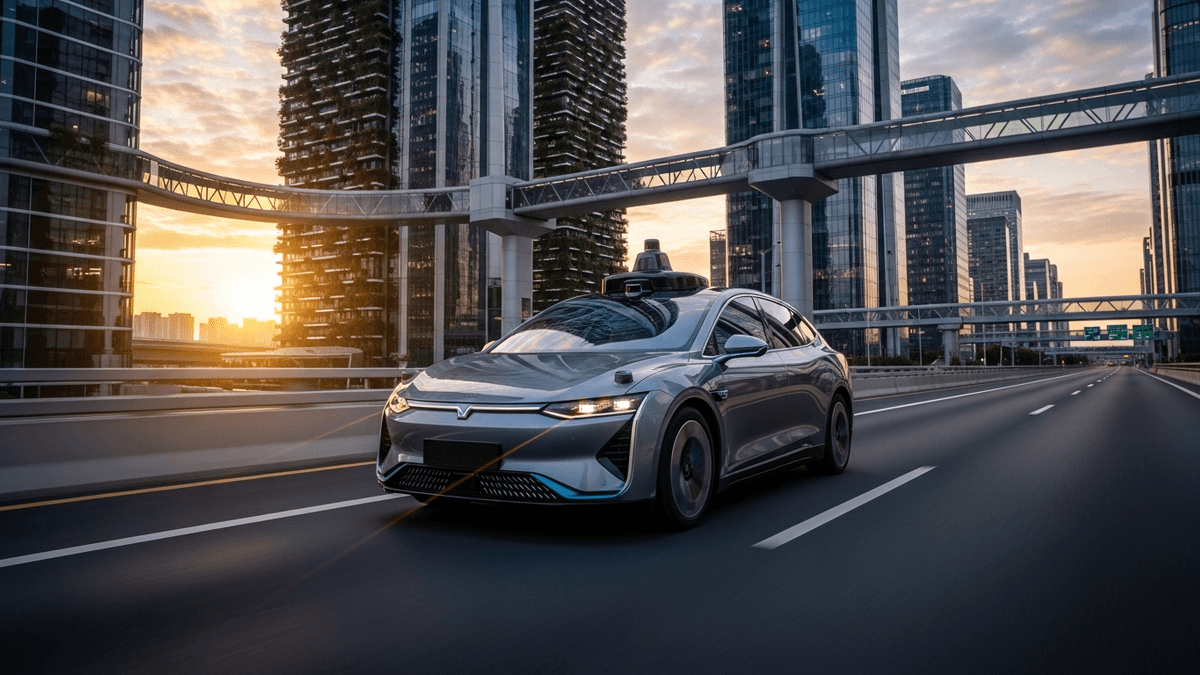

Kia’s EV2 presentation signals an ongoing push to broaden its electric lineup with an emphasis on attainable price points and simplified ownership experiences. While formal specifications remain closely guarded, the business context is tangible: the brand is advancing into a segment where user experience differentiators—route planning, charge management, and driver-assistance features—are increasingly shaped by AI and machine learning.

In practice, that means AI guiding more intuitive range estimates, optimizing charging stops, and prioritizing safety-centric features like adaptive systems. A Kia product lead described the approach as putting “smart simplicity” at the center of the EV experience—using software intelligence to reduce friction rather than overwhelm drivers with complexity. If the EV2 lands in that lane, it could deepen Kia’s reach among first-time EV buyers and cost-conscious households, particularly in regions where compact EVs are gaining traction.

The automotive takeaway: even as price and infrastructure remain gating factors, AI-informed interfaces are becoming baseline expectations. Vendors that deliver reliable, transparent guidance—how far to drive, where to charge, what systems are active—will stand out, and Gear’s spotlight suggests Kia is aligning its EV roadmap with that trajectory.

Fujifilm’s Instax: Analog joy with digital-era workflows

Fujifilm’s new Instax cameras speak to a persistent appetite for tactile, instant prints—an experience largely defined by simplicity and nostalgia. The business strategy, however, leans on complementary digital workflows. Companion apps and mobile editing tools, often infused with AI for auto-enhancement and scene adjustments, have become part of the Instax ecosystem, even as the core product retains its analog charm.

As one Fujifilm marketing executive put it, the goal is to make “creation and sharing feel effortless” without sacrificing the physical memento that Instax users value. That means making it easier to scan prints, apply tasteful improvements, and distribute images across social channels with minimal effort. In market terms, Instax continues to serve as a bridge product—bringing younger consumers into the brand’s imaging universe while reinforcing Fujifilm’s broader portfolio.

Fender rebrands PreSonus app: Consolidation in creator tools, with AI in the wings

Fender’s decision to rebrand a PreSonus music production app reflects a broader consolidation strategy in the creator economy: unify software experiences under a single brand and streamline onboarding for musicians. As the digital audio workstation category experiments with AI-driven features—stem separation, intelligent mastering, auto-mix suggestions—vendors are calibrating branding and UX to emphasize coherence across hardware and software.

A Fender digital product lead noted that the rebrand is about “meeting creators where they are” and signaling a long-term commitment to integrated tools. For Fender, the business calculus includes boosting cross-sell opportunities and reducing friction for users who own Fender instruments and rely on PreSonus software to capture ideas. As AI-assisted workflows become more accessible, a consistent brand storyline can accelerate adoption without overshadowing human creativity.

Ricoh’s monochrome camera: Precision aesthetics in a niche that bucks the trend

Ricoh’s monochrome camera reasserts a distinct value proposition at a time when computational imaging dominates. By leaning into a dedicated black-and-white sensor design, Ricoh reminds the market that not every imaging advance is about multi-mode flexibility; sometimes it’s about the purity of a specific aesthetic and the discipline it demands.

While AI has accelerated noise reduction, image stacking, and color science, the monochrome approach offers a different kind of clarity—one that streamlines the signal path and invites photographers to engage more deliberately with luminance and composition. Industry observers say such niche products strengthen brand credibility among enthusiasts who prefer a tool that sharpens creative intent.

Omega’s latest Speedmaster: Heritage leadership with digital retail intelligence

Omega’s new Speedmaster underscores how luxury watchmakers continue to innovate within a legacy framework. The product side centers on materials, design cues, and mechanical craftsmanship; the business side increasingly depends on data-driven retail and community engagement, often leveraging machine learning for inventory planning, personalization, and omnichannel coherence.

An Omega retail executive framed the launch as “balancing heritage with modern expectations,” noting that collectors expect authenticity while new buyers seek clear value narratives. As luxury houses refine digital storefronts and service models, AI helps align assortment and messaging, without altering the core mechanical proposition.

Industry implications: AI in the background, value at the forefront

Across these categories, the pattern Gear highlights is steady: AI is present, but often in the background. For automakers, it simplifies route planning and driver support. For imaging brands, it augments mobile workflows around otherwise analog experiences. For audio software providers, it accelerates routine production tasks without replacing musicianship. For luxury watches, it sharpens retail operations and engagement models while preserving the mechanical soul.

Independent research has documented similar trends: consumers respond to meaningful convenience and clarity, not merely to feature lists. That reframing has consequences for the competitive set. Price-sensitive segments will reward brands that deploy AI to lower barriers to use. Enthusiast segments will respect brands that apply technology discreetly to enhance craft. In both cases, companies that communicate outcomes—safer driving, better prints, faster mixes, more informed retail—will outperform those that anchor messaging in technical jargon.

What this means for Gear’s audience and the broader market

For Gear’s readership, this week’s slate reiterates a practical lens for evaluating new releases: consider how the product and its software spine fit into everyday routines. Kia’s EV2 aims for the EV mainstream with thoughtful digital assistance. Fujifilm’s Instax line reaffirms the appeal of tangible media, supported by easy sharing. Fender’s rebrand points to integrated creative workflows. Ricoh’s monochrome offering speaks to artistic focus. Omega’s Speedmaster emphasizes heritage value with smarter retail.

The macro-impact is incremental but important. In a mature hardware cycle, competitive advantage accrues to companies that can orchestrate subtle improvements—often software-led—across affordability, usability, and brand trust. Gear’s coverage makes clear that the next wave of consumer tech is less about headline-grabbing specs and more about coherent ecosystems that quietly put AI to work.

Sources include company disclosures, regulatory filings, analyst reports, and industry briefings.

References

Primary coverage: Wired

Related company information: Kia, Fujifilm Instax, PreSonus

About the Author

James Park

AI & Emerging Tech Reporter

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

Frequently Asked Questions

What did Gear highlight about Kia’s EV2?

Gear’s coverage emphasized Kia’s push toward a more accessible EV, with AI-informed user experiences likely shaping navigation, charging, and driver-assistance features aimed at mainstream adoption.

How do the new Instax cameras fit Fujifilm’s strategy?

The Instax releases reinforce Fujifilm’s focus on tactile, instant photography while leaning on companion apps and AI-assisted mobile workflows to make capturing and sharing easier.

Why is Fender rebranding its PreSonus music app significant?

The rebrand signals consolidation of creator tools under Fender’s banner and positions the ecosystem for AI-enabled production features, improving onboarding and cross-sell for musicians.

What’s notable about Ricoh’s monochrome camera?

Ricoh’s monochrome model prioritizes a pure black-and-white aesthetic, appealing to enthusiasts and highlighting an alternative to computational-heavy imaging.

What does Omega’s new Speedmaster suggest about luxury brands?

It reflects how heritage-focused companies balance traditional craftsmanship with data-driven retail operations, using AI to refine personalization and inventory without changing the mechanical core.