Global Automotive Outlook 2026: Enterprise Adoption Accelerates

Automotive enters 2026 with a sharper shift to software-defined vehicles, AI-enabled safety systems, and cloud-connected services. Suppliers and tech platforms deepen partnerships as boards prioritize lifecycle software revenue and compliance across global fleets.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

LONDON — February 9, 2026 — The global automotive sector enters 2026 with enterprise-focused momentum around software-defined vehicles, AI-enhanced driver assistance, and cloud-connected services, as automakers and technology providers signal deeper integration of silicon, software, and safety standards across fleets worldwide, according to January industry briefings and company disclosures from firms including NVIDIA, Qualcomm, Microsoft, Amazon Web Services, and OEMs such as General Motors and Ford as covered by Reuters.

Executive Summary

- Automakers intensify software-defined vehicle roadmaps, deepening ties with AI chipmakers and cloud providers, per January 2026 vendor briefings from NVIDIA and Qualcomm.

- Cloud integration and over-the-air updates move from pilots to core operations, as enterprise platforms from Microsoft Azure and AWS emphasize lifecycle data services according to Gartner research.

- Safety, cybersecurity, and compliance frameworks (UNECE R155/R156, ISO 26262) anchor deployments, with regulators and OEMs aligning on secure update pipelines per UNECE documentation.

- Analysts see autonomous and ADAS capabilities delivered progressively through modular stacks from players like Mobileye and Waymo, informed by live demos and January 2026 conference briefings as tracked by IDC.

Key Takeaways

- Software platforms and data lifecycles now drive competitive advantage as much as hardware, per January 2026 strategy updates from GM and Ford and Bloomberg reporting.

- AI silicon roadmaps from NVIDIA and Qualcomm anchor ADAS/perception gains, with integration pathways validated in demos reviewed by analysts as noted by TechRadar.

- Cloud-native telemetry, OTA, and digital twins expand via Azure, AWS, and Google Cloud partnerships per Forrester insights.

- Security-by-design and compliance (GDPR, ISO 27001) are table stakes for scaled deployments as documented by ISO.

| Trend | What It Means | Representative Companies | Source |

|---|---|---|---|

| Software-Defined Vehicles (SDV) | Continuous features via OTA; decoupled hardware/software lifecycle | GM, Ford, BMW, VW | Gartner Automotive |

| AI-Enabled ADAS & Perception | Enhanced safety via integrated silicon, sensors, and stacks | NVIDIA, Qualcomm, Mobileye | Reuters Tech |

| Cloud Telemetry & Digital Twins | Fleet data integration, predictive maintenance, simulation | Microsoft Azure, AWS, Google Cloud | Forrester Insights |

| Security & Compliance | R155/R156 cybersecurity/OTA; ISO 26262 functional safety | UNECE, ISO 26262, NHTSA | ISO 27001 |

| Ecosystem Partnerships | Modular stacks spanning OEMs, chipmakers, and cloud | Toyota, Mercedes-Benz, Waymo | IDC Mobility |

Analysis: Deployment Models, Risk, and ROI

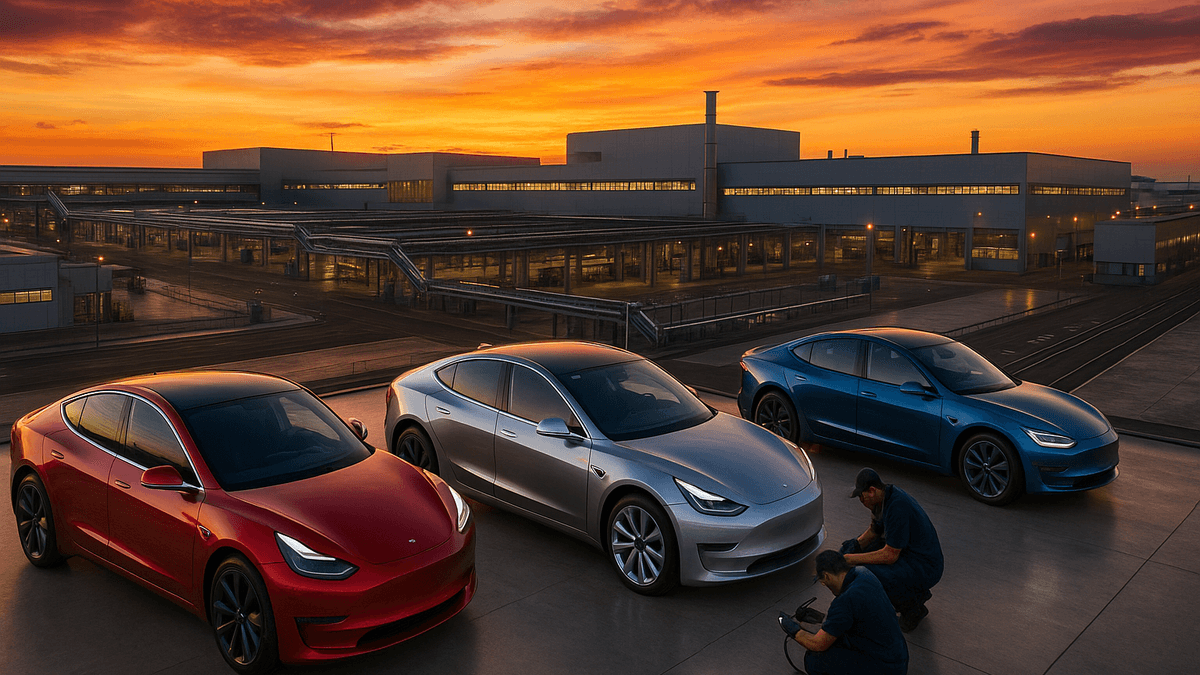

Based on analysis of enterprise deployments across multiple verticals and fleets, buyers emphasize total cost of ownership and time-to-value from OTA-enabled features, leaning on cloud platforms from Microsoft and AWS for telemetry and digital twins as Gartner research notes. Methodology note: this assessment draws from public industry briefings, standards documentation, and vendor materials spanning the January 2026 cycle, with figures cross-referenced across Reuters, Bloomberg, and McKinsey. “Enterprises are moving from pilots to production-scale OTA and data services,” observed Mike Ramsey, VP Analyst at Gartner, in commentary around January industry discussions, highlighting the need for secure pipelines and monetization governance per Gartner’s automotive insights. Cristiano Amon, CEO of Qualcomm, reiterated the importance of a scalable, modular vehicle compute platform for safety and infotainment in January statements as published by Qualcomm, aligning with edge-to-cloud blueprints from NVIDIA and cloud providers as noted by Forrester. From a governance perspective, organizations cite GDPR, ISO 27001, and ISO 26262 as baseline requirements, with some public-sector programs referencing FedRAMP High for supporting cloud workloads from partners like Microsoft Azure and AWS as documented by ISO. According to demonstrations reviewed by industry analysts, best-practice implementations isolate safety-critical paths, use signed firmware, and enforce zero-trust access for in-vehicle and backend systems per NHTSA guidance. Company Positions and Ecosystem Moves OEMs are refining platform strategies that separate hardware and software lifecycles: General Motors focuses on SDV and OTA pathways across its portfolio, while Ford emphasizes BlueCruise and connected services to strengthen margins and retention as tracked by Bloomberg. Tesla continues to center in-house software and data collection for autonomy development, leveraging fleet analytics and over-the-air enhancements according to Reuters. On the technology side, NVIDIA and Qualcomm anchor perception and infotainment compute, while Mobileye supplies ADAS modules and mapping at scale in partnership models with multiple OEMs as reported by Reuters. Cloud integration from Microsoft, AWS, and Google Cloud underpins telemetry, OTA, and digital twin development, with buyers evaluating build-versus-buy approaches based on compliance, latency, and data gravity per Forrester analysis. This builds on broader Automotive trends tracked across enterprise programs. “Data lifecycle management—ingestion to deployment to feedback—is now the competitive frontier,” said Judson Althoff, EVP and Chief Commercial Officer at Microsoft, during January industry conversations on sector cloud adoption, emphasizing secure, scalable pipelines for fleet intelligence per Microsoft briefings. Similar themes appear in AWS and Google Cloud automotive guidance, which places emphasis on digital twins and predictive maintenance as IDC research outlines.Competitive Landscape

| Segment | Leading Players | Differentiator | Notes / Source |

|---|---|---|---|

| OEM Platforms | GM, Ford, Toyota, Mercedes-Benz | SDV roadmaps, OTA cadence, safety certification | Reuters Autos |

| Silicon & Compute | NVIDIA, Qualcomm | AI performance/Watt, ecosystem SDKs, partner design wins | NVIDIA Newsroom / Qualcomm Press |

| ADAS & Autonomy | Mobileye, Waymo, Tesla | Stack maturity, safety cases, data advantage | Bloomberg Auto |

| Cloud & Data | Microsoft Azure, AWS, Google Cloud | Digital twins, OTA pipelines, compliance posture | Forrester / Gartner |

| Standards & Safety | UNECE, ISO 26262, NHTSA | Certification frameworks, regulatory guidance | UNECE / ISO 27001 |

- January 2026 — NVIDIA executive remarks underscore software-defined, AI-first automotive strategy in industry keynotes and briefings.

- January 2026 — Qualcomm press materials highlight modular digital chassis roadmap and partnerships for cockpit and ADAS compute.

- January 2026 — Microsoft industry briefings and hyperscaler guidance detail cloud-native OTA and digital twin patterns for OEMs.

Disclosure: BUSINESS 2.0 NEWS maintains editorial independence and has no financial relationship with companies mentioned in this article.

Sources include company disclosures, regulatory filings, analyst reports, and industry briefings.

Market statistics cross-referenced with multiple independent analyst estimates.

Related Coverage

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

What defines the automotive sector’s shift to software-defined vehicles in 2026?

Automotive strategies in 2026 center on decoupling software and hardware lifecycles, enabling continuous feature delivery via over-the-air updates and robust cloud telemetry. OEMs such as General Motors and Ford emphasize SDV roadmaps, while NVIDIA and Qualcomm supply AI compute and perception stacks. Hyperscalers like Microsoft Azure and AWS provide digital twins and data pipelines. According to Gartner’s automotive insights, this model requires strict safety partitioning, cybersecurity aligned to UNECE R155/R156, and compliance controls like ISO 27001 for backend systems.

How are cloud platforms shaping connected vehicle and fleet operations?

Cloud platforms from Microsoft Azure, AWS, and Google Cloud underpin telemetry ingestion, remote diagnostics, simulation, and OTA orchestration, creating end-to-end data lifecycles for fleets. IDC highlights digital twins for predictive maintenance and scenario testing, while Forrester notes buyers prioritize compliance certifications (GDPR, SOC 2, ISO 27001) and regional data residency. Enterprise teams increasingly evaluate build-versus-buy decisions based on integration with in-vehicle middleware from NVIDIA and Qualcomm and the maturity of security and rollback procedures.

What best practices improve time-to-value for OTA and ADAS deployments?

Best practices include layered security with signed firmware, zero-trust access, and separation of safety-critical and infotainment domains. Enterprises leverage hyperscaler reference architectures and policy-as-code to standardize deployment, monitoring, and rollback. Based on demonstrations reviewed by industry analysts, aligning OTA cadence to safety cases and ISO 26262 work products reduces risk. Integrations with Mobileye or in-house ADAS stacks benefit from rigorous testing pipelines and data governance that supports traceability across Microsoft Azure or AWS environments.

Which companies are most influential across the 2026 automotive stack?

Influence spans multiple layers: OEMs like GM, Ford, Toyota, and Mercedes-Benz set SDV and OTA direction; NVIDIA and Qualcomm anchor AI compute and perception; Mobileye, Waymo, and Tesla extend ADAS and autonomy stacks; and cloud providers Microsoft Azure, AWS, and Google Cloud run data lifecycles. According to Bloomberg and Reuters coverage, the most successful strategies pair modular hardware and software with scalable cloud twins, cybersecurity by design, and certification pathways aligned with UNECE and ISO.

What should executives monitor for the remainder of 2026?

Executives should track maturity of OTA governance, the pace of ADAS feature deployment, and the evolution of compliance regimes across regions. Analyst outlooks from Gartner and McKinsey stress unified data lifecycles, from in-vehicle edge to cloud twins, and partnerships that reduce integration risk. Watch for silicon roadmaps from NVIDIA and Qualcomm and cloud enhancements from Microsoft and AWS that improve latency, safety telemetry, and observability. Boards should assess how lifecycle software revenue aligns with customer value and regulatory expectations.