Global Logistics Market Size, Trends and Forecast Statistics by Country and Company 2026-2030

Fresh rate benchmarks, new corporate guidance, and late-December analyst notes are reshaping how shippers and carriers model logistics growth through 2030. Early-January indicators from ocean and air freight platforms, combined with recent company disclosures, point to mid-single-digit expansion, with regional divergences and technology-driven productivity gains.

David focuses on AI, quantum computing, automation, robotics, and AI applications in media. Expert in next-generation computing technologies.

- Industry sources suggest the global logistics sector is positioned for mid-single-digit annual growth through 2030, with near-term rate volatility as ocean lanes reset in early 2026, according to recent platform data and analyst commentary (Freightos FBX; Xeneta).

- Country-level momentum diverges: US demand stabilizes, Europe remains mixed, and India accelerates multimodal investment, based on late-December and early-January market signals (S&P Global; DHL Global Connectedness Index).

- Major companies, including FedEx, UPS, DHL, Maersk, and Amazon Logistics, outlined 2026 operational priorities across cost controls, network optimization, and automation in recent updates and pressroom posts (FedEx IR; UPS Newsroom).

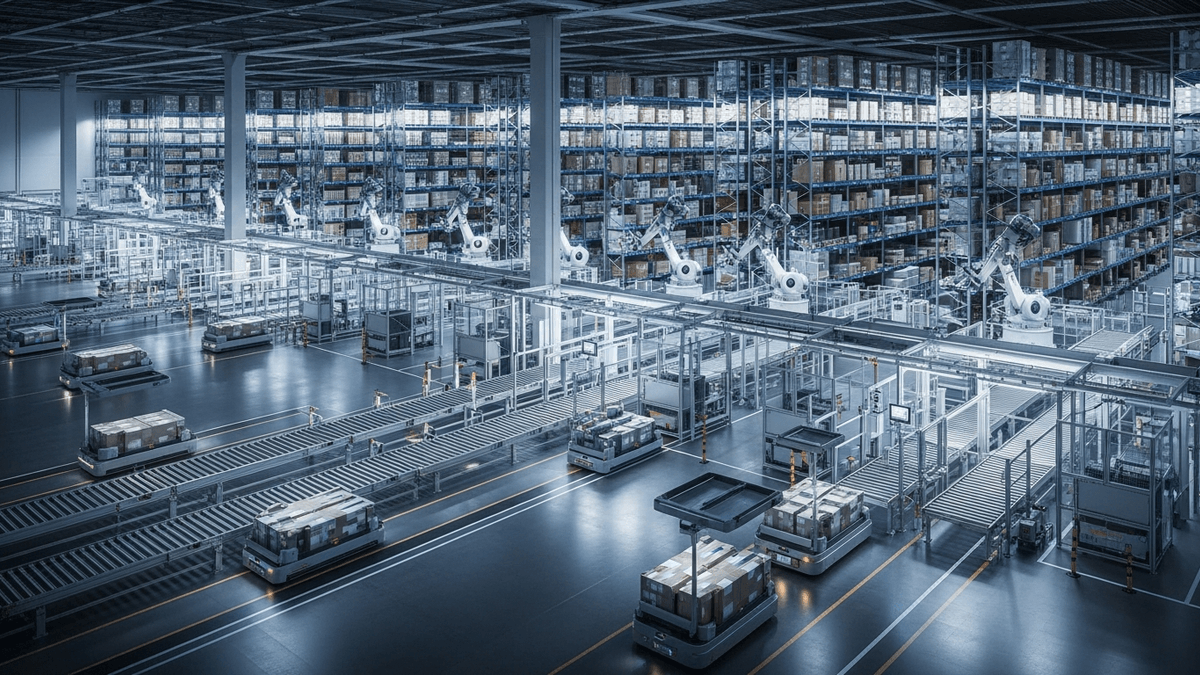

- Analysts project technology investments in AI routing, robotics, and visibility platforms to compound productivity 2026–2030, supported by new findings in late-2025 logistics research and platform reports (Gartner Supply Chain; McKinsey Operations Insights).

| Indicator (Early Jan 2026) | Status vs Nov–Dec 2025 | Main Source | Notes |

|---|---|---|---|

| Ocean spot rates (major east–west) | Elevated | Freightos FBX | Platforms report higher benchmarks entering 2026 |

| Air cargo yields | Resilient/Stable | Xeneta Air Freight | Post-peak season normalization with steady pricing |

| US logistics activity baseline | Stable | S&P Global PMI | Late-Dec PMIs indicate improving planning cycles |

| Europe demand signals | Mixed | DHL GCI | Connectivity index highlights uneven momentum |

| Carrier service advisories | Active | Maersk News | Network adjustments guide Q1 shipments |

| Fulfillment automation initiatives | Accelerating | Amazon Logistics | Robotics and machine vision scale-up into 2026 |

- Freightos Baltic Index (FBX) Weekly Spot Rate Benchmarks - Freightos, January 2026

- Xeneta Ocean & Air Freight Insights Blog - Xeneta, January 2026

- IATA Pressroom: Air Cargo Market Updates - IATA, December 2025–January 2026

- S&P Global Market Intelligence: PMI and Logistics Analyses - S&P Global, December 2025–January 2026

- FedEx Investor Relations Press Releases - FedEx, December 2025

- UPS Newsroom: Operational and Technology Updates - UPS, December 2025–January 2026

- Maersk News: Service Advisories and Network Updates - Maersk, January 2026

- CMA CGM News and Updates - CMA CGM, December 2025–January 2026

- DHL Global Connectedness Index (Latest Edition) - DHL, December 2025

- McKinsey Operations Insights: Supply Chain & Logistics - McKinsey & Company, December 2025–January 2026

| Region | Est. 2025 Market Size (USD) | Projected 2030 (USD) | CAGR 2026–2030 | Key Growth Driver |

|---|---|---|---|---|

| North America | $1.7–1.9 trillion | $2.2–2.5 trillion | 4–5% | E-commerce, automation |

| Europe | $1.3–1.5 trillion | $1.6–1.9 trillion | 3–5% | Green logistics, digitization |

| Asia-Pacific | $2.8–3.2 trillion | $4.0–4.5 trillion | 6–8% | Manufacturing, infrastructure |

| Middle East & Africa | $250–300 billion | $350–450 billion | 5–7% | Trade corridors, ports |

| Latin America | $350–400 billion | $450–550 billion | 4–6% | Nearshoring, e-commerce |

| Rank | Company | HQ Country | Est. 2025 Revenue (USD) | Primary Segments |

|---|---|---|---|---|

| 1 | UPS | United States | $90–95 billion | Parcel, Supply Chain Solutions |

| 2 | DHL (Deutsche Post) | Germany | $85–90 billion | Express, Freight, Supply Chain |

| 3 | FedEx | United States | $87–92 billion | Express, Ground, Freight |

| 4 | Maersk | Denmark | $50–55 billion | Ocean, Terminals, Logistics |

| 5 | Amazon Logistics | United States | $45–50 billion | Last-Mile, Fulfillment |

| 6 | CMA CGM | France | $42–48 billion | Shipping, Logistics |

| 7 | C.H. Robinson | United States | $18–20 billion | Freight Brokerage, 3PL |

| 8 | XPO Logistics | United States | $15–17 billion | LTL, Brokerage |

- Freightos Baltic Index (FBX) – Ocean freight rate benchmarks and container shipping indices

- Xeneta – Air and ocean freight rate intelligence and market analytics

- Gartner Supply Chain Research – Supply chain strategy and logistics technology insights

- McKinsey Operations Insights – Global logistics and operations analysis

- S&P Global Market Intelligence – Economic indicators and PMI data

- DHL Global Connectedness Index – International trade and logistics connectivity

- IATA Pressroom – Air cargo industry statistics and forecasts

- FedEx Investor Relations – Corporate guidance and financial updates

- UPS Newsroom – Company announcements and operational updates

- Maersk News – Shipping advisories and market outlook

- CMA CGM News – Container shipping updates and service announcements

- Amazon About – Logistics and fulfillment technology insights

About the Author

David Kim

AI & Quantum Computing Editor

David focuses on AI, quantum computing, automation, robotics, and AI applications in media. Expert in next-generation computing technologies.

Frequently Asked Questions

What is the global logistics growth outlook from 2026 to 2030?

Recent platform indicators and analyst notes suggest mid-single-digit annual growth through 2030, balancing early-2026 ocean rate volatility with steady air cargo yields. Freightos FBX and Xeneta provide weekly snapshots that shippers use to benchmark spot rates and contract discussions. Gartner and McKinsey highlight AI routing, visibility, and automation as productivity drivers. The base outlook assumes normalized trade flows and continued technology adoption across major markets.

Which regions are positioned to drive logistics growth in 2026?

The United States shows stable demand and improved planning based on late-December PMI readings. Europe is mixed, with resilient corridors offset by manufacturing softness, per DHL’s connectivity analysis. India is accelerating multimodal investments to reduce logistics costs and improve throughput. China’s export rhythms remain a swing factor, with carriers adjusting capacity and routings accordingly. These dynamics inform Q1 tenders and 2026 contract terms.

How are carriers and 3PLs adjusting networks entering 2026?

Carriers like Maersk and CMA CGM are issuing January service advisories that refine schedules and transit planning. Integrators and 3PLs, including FedEx, UPS, and DHL, are emphasizing cost discipline, network optimization, and automation to boost reliability and yield. Amazon Logistics continues to scale robotics and machine vision to lift fulfillment productivity. These moves shape Q1 volumes, pricing power, and customer service levels as companies finalize 2026 agreements.

What risks could derail logistics forecasts for 2026–2030?

Persistent lane-specific rate volatility, macro uncertainty affecting industrial output, and schedule reliability challenges are top risks. Shippers face tender risk and inventory planning complexity, while carriers must maintain capacity discipline. Analysts model base, upside, and downside scenarios using PMI signals, platform telemetry, and carrier advisories. Technology adoption—AI planning, visibility platforms, and automation—helps mitigate disruptions and sustain service levels.

Which technologies will most impact logistics productivity by 2030?

AI-assisted routing and dynamic pricing engines are improving asset utilization and on-time performance. End-to-end visibility platforms with predictive ETAs and exception management are increasingly embedded in tenders. Fulfillment robotics and computer vision, notably at Amazon and DHL, are scaling to reduce cost-to-serve. These capabilities, highlighted in late-2025 research and early-2026 updates, underpin productivity gains expected across ocean, air, and ground networks over the next five years.