Health Tech Industry Forecast for 2026: AI, Interoperability, and Virtual Care Realign Growth

Health Tech enters 2026 with AI accelerating clinical productivity, TEFCA-powered data liquidity, and virtual care cementing double‑digit shares of outpatient visits. Expect platform consolidation around EHR and cloud giants, disciplined funding, and payer-aligned reimbursement reshaping adoption.

Dr. Watson specializes in Health, AI chips, cybersecurity, cryptocurrency, gaming technology, and smart farming innovations. Technical expert in emerging tech sectors.

2026 Outlook: Revenue Mix Shifts Toward Virtual, Data, and Automation

Health Tech in 2026 is poised to grow on three fronts: AI-driven software, interoperable data layers, and virtual care embedded in routine delivery. U.S. virtual care alone could account for as much as a quarter‑trillion dollars in addressable spending, according to a widely cited McKinsey analysis of the post‑pandemic care mix telehealth could support up to $250 billion of U.S. spending. That ceiling won’t be uniformly realized, but a 13–17% share of outpatient visits conducted virtually is increasingly durable as health systems tie video visits to remote diagnostics and at‑home testing.

Platform leaders are steering this shift. Virtual care specialists such as Teladoc Health and Amwell are bundling telehealth with remote monitoring and behavioral health, while consumer platforms like Amazon Clinic aim to compress the time from symptom to script. On the enterprise side, cloud offerings from Microsoft and Google Cloud are being embedded into electronic health record (EHR) workflows, giving providers scalable AI services, voice automation, and data governance in one stack.

AI in the Workflow: From Pilots to Productivity by 2026

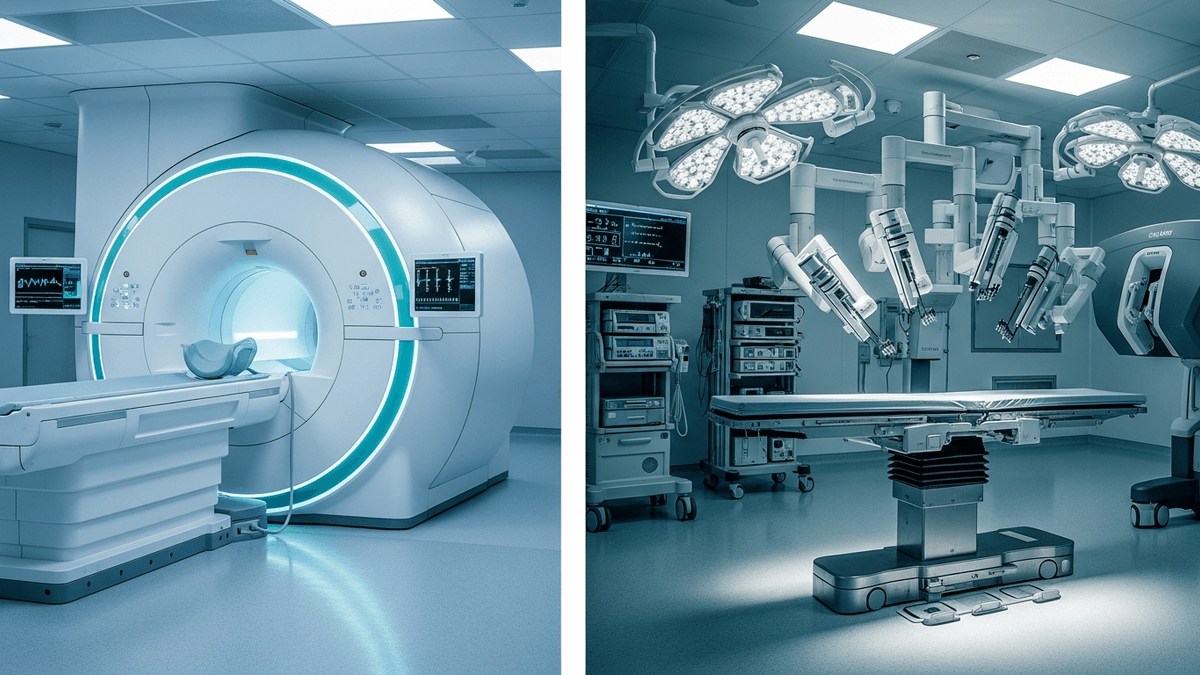

AI in healthcare is moving from departmental pilots to system‑wide deployment. The U.S. Food and Drug Administration has already cleared hundreds of AI/ML‑enabled devices—largely in imaging and cardiology—providing a regulatory foundation for scaled use FDA’s running list of AI/ML-enabled medical devices. By 2026, the center of gravity shifts toward ambient clinical documentation, triage, and decision support, with EHR-embedded copilots reducing administrative load and improving throughput.

EHR and cloud ecosystems are converging to make that real. Epic and Oracle Health are integrating voice, summarization, and prior‑auth automation with AI services from Microsoft and Google Cloud. On the device front, hospital and home‑based diagnostics from Philips and Siemens Healthineers are feeding continuous data streams into analytics pipelines, while consumer‑grade platforms like Apple extend longitudinal health records with wearable metrics. These insights align with latest Health Tech innovations and point to a 2026 environment where AI improves clinician productivity and elevates patient experience simultaneously.

Interoperability and the 2026 Data Liquidity Moment

Data liquidity is set to expand as TEFCA—the U.S. framework for nationwide health information exchange—matures. The Office of the National Coordinator (ONC) designated the first Qualified Health Information Networks (QHINs), including major exchange backbones in late 2023, establishing the rails for cross‑network sharing the first QHINs are designated. As onboarding accelerates through 2025, 2026 becomes the year when payer, pharmacy, and provider data routinely traverse the same backbone, cutting duplicate testing and bolstering prior‑auth automation.

Interoperability tailwinds will benefit platform‑centric players. EHR incumbents such as Epic and Oracle Health can expose standardized APIs for third‑party innovation, while diversified health platforms like CVS Health and payer‑services leaders like Optum translate data liquidity into care navigation and risk adjustment at scale. Expect tighter alignment between virtual care from Teladoc Health or Amwell and retail‑clinic footprints, as well as cloud‑native analytics from Microsoft and Google Cloud to standardize quality reporting. This builds on broader Health Tech trends that reward platforms with deep integration rather than standalone point solutions.

Capital, Reimbursement, and Dealmaking: The Setup for 2026

Funding discipline persists into 2026 after the reset in 2023–2024, when venture rounds became smaller and later‑stage deals consolidated Rock Health’s funding analysis. Strategics with distribution—retail, EHR, and payer-platform incumbents—are positioned for roll‑ups and partnerships that fill feature gaps. Private equity dry powder remains available, but deal theses emphasize proven unit economics and reimbursement clarity, consistent with the playbooks seen in recent Bain analyses healthcare private equity report.

Medicare’s evolving rules for remote physiological monitoring (RPM) and remote therapeutic monitoring (RTM) underpin the business case for 2026, as coding refinements clarify when and how services are billable CMS Physician Fee Schedule. Virtual‑first models scale when payers reimburse integrated pathways—behavioral health plus primary care, chronic care plus at‑home diagnostics—delivered through platforms operated by Amazon Clinic, CVS Health, and care‑enablement vendors allied with Microsoft and Google Cloud. In 2026, expect M&A to concentrate in three areas: ambient documentation, prior authorization automation, and at‑home diagnostics connecting devices from Philips and Siemens Healthineers into payer‑accepted care plans.

What to Watch: Execution Risks and Milestones

Three execution risks loom over the 2026 arc. First, AI governance must keep pace with deployment: bias mitigation, audit trails, and change management for models touching clinical decisions will be scrutinized by regulators and hospital boards; developers will look to FDA precedents and emerging guidance for adaptive algorithms FDA’s AI/ML devices list. Second, TEFCA’s promise depends on robust onboarding and consent flows; watch how QHINs translate technical readiness into day‑to‑day clinical utility ONC’s QHIN designations. Third, cost pressures may slow procurement cycles unless vendors demonstrate hard ROI: minutes saved per note, reduced denials, and avoided readmissions are the metrics that will clear capital review committees.

Despite those risks, the throughline is constructive. Enterprise buyers are consolidating around fewer, larger platforms—the EHR, the cloud, and the retail‑payer front door—while innovators that plug cleanly into those surfaces can scale faster. Advisory houses expect health spending growth to stay elevated relative to pre‑pandemic baselines, reinforcing the need for productivity‑enhancing tech in 2026 Deloitte’s global outlook. The winners will be those with credible clinical outcomes, regulatory maturity, and distribution leverage across EHR, cloud, and retail care channels.

About the Author

Dr. Emily Watson

AI Platforms, Hardware & Security Analyst

Dr. Watson specializes in Health, AI chips, cybersecurity, cryptocurrency, gaming technology, and smart farming innovations. Technical expert in emerging tech sectors.

Frequently Asked Questions

How big could virtual care be in 2026?

Analysts expect virtual care to stabilize in the mid‑teens as a share of outpatient visits, with significant revenue supported by chronic care, behavioral health, and at‑home diagnostics. A McKinsey analysis suggests the U.S. virtual care opportunity could support up to $250 billion in annual spending, indicating continued upside if payers maintain reimbursement.

Which vendors are positioned to lead Health Tech in 2026?

EHR and cloud platforms such as [Epic](https://www.epic.com), [Oracle Health](https://www.oracle.com/industries/healthcare/), [Microsoft](https://www.microsoft.com/en-us/industry/health), and [Google Cloud](https://cloud.google.com/solutions/healthcare-life-sciences) are central to enterprise adoption. On the front door of care, virtual and retail players like [Teladoc Health](https://www.teladochealth.com), [Amwell](https://business.amwell.com), and [Amazon Clinic](https://clinic.amazon.com) are integrating services that tie telehealth to diagnostics and pharmacy.

What role will AI play in clinical workflows by 2026?

AI will move from pilots to embedded utilities across ambient documentation, triage, imaging, and prior authorization. With hundreds of FDA‑cleared AI/ML devices already in market, health systems will increasingly deploy EHR‑integrated copilots and device‑driven analytics to improve throughput and reduce administrative burden.

How will interoperability change by 2026?

As TEFCA QHINs mature and onboard more participants, cross‑network data exchange should become far more routine for providers, payers, and pharmacies. This will reduce duplicative testing, enable real‑time eligibility and prior authorization, and allow analytics vendors to standardize quality and risk reporting across populations.

What’s the investment and M&A outlook for Health Tech in 2026?

Following a reset in 2023–2024, capital remains selective, favoring platforms with proven unit economics, clear reimbursement, and scalable distribution. Expect deal activity around ambient documentation, prior‑auth automation, and at‑home diagnostics, with strategics like [CVS Health](https://www.cvshealth.com) and payer‑aligned platforms such as [Optum](https://www.optum.com) active in partnerships and tuck‑ins.