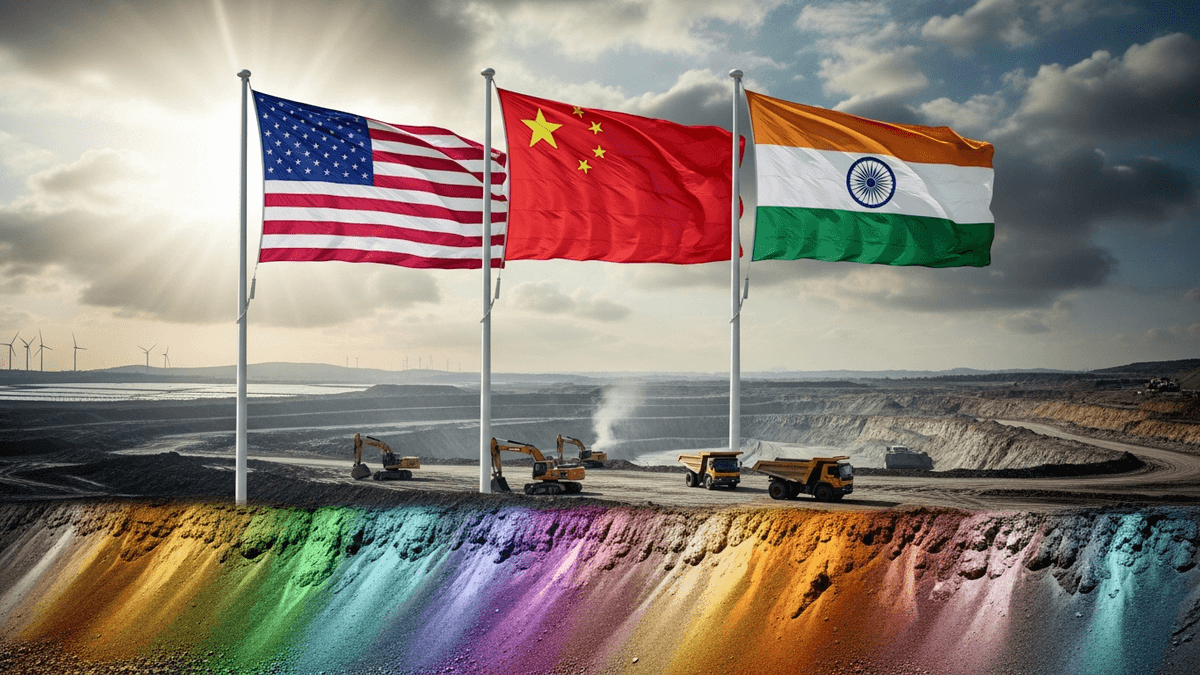

How Rare Earth Elements (REE) will Impact Global Economy, Trade and Supply Chains in 2026

Rare earth elements emerge as critical strategic resources reshaping global power dynamics in 2026. China controls 60% of global REE production while the United States and India accelerate domestic mining and processing capabilities to reduce dependency.

Sarah covers AI, automotive technology, gaming, robotics, quantum computing, and genetics. Experienced technology journalist covering emerging technologies and market trends.

| Economic Sector | REE Dependency | 2026 Market Value | Growth Impact |

|---|---|---|---|

| Electric Vehicles | Critical (Nd, Pr, Dy magnets) | $823B | +28% YoY |

| Wind Energy | High (Nd permanent magnets) | $142B | +18% YoY |

| Semiconductors | High (Ce, La polishing) | $680B | +12% YoY |

| Defense Systems | Critical (Sm, Nd, Tb) | $2.4T | +6% YoY |

| Consumer Electronics | Moderate (Nd, Eu, Tb) | $1.1T | +8% YoY |

| AI/Data Centers | High (Nd magnets, Y phosphors) | $420B | +35% YoY |

| Medical Equipment | Moderate (Gd for MRI) | $95B | +7% YoY |

| Country | REE Production Share | Processing Capacity | 2026 Trade Strategy |

|---|---|---|---|

| China | 60% | 90% | Export controls on processing technology, strategic stockpiling |

| United States | 14% | 8% | $2.8B domestic mining investment, allied supply partnerships |

| India | 6% | 3% | $1.2B processing capacity expansion, monazite sand development |

| Australia | 8% | 4% | Lynas expansion, new processing facilities, Japan partnership |

| Myanmar | 5% | 0% | Raw ore exports to China, political instability concerns |

| Brazil | 2% | 1% | Emerging producer, Serra Verde project development |

| Supply Chain Stage | Current Challenge | 2026 Solution | Investment Required |

|---|---|---|---|

| Mining | Limited non-China capacity | New mines in US, Australia, Brazil, Africa | $8.5B globally |

| Separation/Processing | 90% China concentration | Distributed processing in allied nations | $12.3B globally |

| Magnet Manufacturing | 85% China production | Regional magnet plants in US, EU, Japan | $6.8B globally |

| Recycling | Less than 1% recovery rate | Urban mining, EV battery recycling programs | $3.2B globally |

| Strategic Stockpiling | Insufficient reserves | 90-day supply buffers for critical elements | $4.5B globally |

| R&D Alternatives | No viable substitutes | Reduced REE motor designs, alternative materials | $2.1B globally |

About the Author

Sarah Chen

AI & Automotive Technology Editor

Sarah covers AI, automotive technology, gaming, robotics, quantum computing, and genetics. Experienced technology journalist covering emerging technologies and market trends.

Frequently Asked Questions

What are rare earth elements and why are they important?

Rare earth elements (REE) are 17 metallic elements essential for manufacturing electric vehicles, wind turbines, smartphones, military equipment, and AI hardware. They underpin technologies representing over $12 trillion in annual global economic activity and are critical for clean energy transitions.

Which country dominates rare earth production?

China dominates the rare earth landscape, controlling approximately 60% of global mining production and 90% of processing capacity. The United States produces 14% of global output but only has 8% processing capacity, while India produces 6% with 3% processing capacity.

How are the US and India responding to China REE dominance?

The United States has invested $2.8 billion in domestic mining and processing facilities, while India has committed $1.2 billion to processing capacity expansion. Both countries are forming strategic partnerships with Australia and Japan to develop independent supply chains.

What industries are most dependent on rare earth elements?

Electric vehicles ($823B market), defense systems ($2.4T market), semiconductors ($680B market), and AI/data centers ($420B market) are most dependent on rare earths. EV production requires critical neodymium, praseodymium, and dysprosium for permanent magnet motors.

What is being done to address REE supply chain vulnerabilities?

Global investments of $37.4 billion are targeting mining expansion ($8.5B), processing diversification ($12.3B), magnet manufacturing ($6.8B), recycling programs ($3.2B), strategic stockpiling ($4.5B), and alternative materials R&D ($2.1B) to reduce dependency on Chinese supply chains.