Executive Summary

The December 2025 announcement of

Netflix's $82.7 billion acquisition of Warner Bros. Discovery represents the most significant restructuring of Hollywood's power dynamics in decades. This transformative deal—combining Netflix's 300 million subscribers with HBO Max's 128 million—creates an unprecedented streaming monopoly controlling 56% of global streaming mobile app users. For independent filmmakers, mid-sized distributors, and content creators worldwide, the implications for financing, distribution, and content acquisition are profound and far-reaching.

Deal Structure and Industry Impact Data

| Metric | Pre-Deal | Post-Deal | Impact |

|---|

| Netflix Subscribers | 300M | 428M combined | +43% market reach |

| Content Library | Netflix originals | +100 years WB catalog | Massive IP advantage |

| Studio Infrastructure | Leased facilities | WB lot ownership | Vertical integration |

| Theatrical Distribution | Limited releases | Full WB network | Exhibition control |

| Indie Acquisition Budget | $2B annually | Projected decline | Fewer buyers |

| Market Concentration | Fragmented | 56% streaming share | Reduced competition |

Indie Film Financing: A Shrinking Landscape

The consolidation dramatically reduces the number of major buyers for independent productions. Where filmmakers previously pitched to

Netflix,

HBO Max,

Warner Bros. Pictures, and

New Line Cinema as separate entities, they now face a single consolidated buyer with unified acquisition strategies.

Variety reports that independent producers are already experiencing chilling effects on development financing. Pre-sales to streaming platforms—once a reliable mechanism for securing production budgets—become more difficult when fewer platforms compete for content. The

Directors Guild of America has formally opposed the merger, citing threats to creative diversity and theatrical release patterns.

Financing alternatives including

A24,

Neon, and

international co-productions gain strategic importance as independent filmmakers seek buyers outside the Netflix-WB ecosystem. European broadcasters and Asian streaming platforms may emerge as critical partners for projects requiring theatrical-first windows.

Film Distribution: Theatrical Exhibition Under Pressure

Warner Bros.' theatrical distribution network—relationships with exhibitors built over a century—now falls under Netflix's control. The streaming giant has historically prioritized direct-to-platform releases, creating tension with theater chains dependent on exclusive theatrical windows.

The Hollywood Reporter notes exhibition groups have raised antitrust concerns, arguing the combined entity could marginalize theatrical releases entirely. Independent theaters face particular vulnerability, as they rely heavily on Warner Bros. content for programming diversity beyond Disney and Universal offerings.

The deal's structure separates

Discovery Global's cable networks (CNN, TNT, HGTV) into a standalone company, but entertainment content—including theatrical—consolidates under Netflix. This creates a vertically integrated operation controlling production, distribution, and exhibition relationships.

Content Acquisition: The New Power Dynamics

For content sellers, the math becomes challenging. With one fewer major buyer, sellers lose negotiating leverage. Netflix's acquisition patterns may shift from aggressive competition for content to strategic patience, knowing fewer alternatives exist for premium productions.

CNBC analysis indicates mid-budget productions ($20-60 million) face the greatest uncertainty. These films—too expensive for minimal marketing releases, too modest for tentpole treatment—historically found homes at WB's New Line or HBO's film division. Under consolidated ownership, internal greenlight competition intensifies.

International content creators face mixed implications. Netflix's global infrastructure offers unprecedented distribution reach, but acquisition prices may decline as competition decreases. Korean, Japanese, and European productions that previously commanded premium licensing fees may encounter revised market rates.

Regulatory Uncertainty and Market Timing

The deal requires

Department of Justice approval and faces significant scrutiny.

Reports indicate the Trump administration views the acquisition with "heavy skepticism," though Netflix executives maintain confidence in regulatory approval. The $5.8 billion reverse breakup fee acknowledges substantial regulatory risk.

For indie filmmakers and content creators, the 12-18 month regulatory review period creates planning uncertainty. Projects in development must consider both approval and rejection scenarios, complicating financing structures dependent on specific distribution outcomes.

Strategic Recommendations for Independent Creators

Industry advisors recommend diversification strategies: building relationships with

international distributors, exploring

direct-to-consumer models, and developing content suitable for platforms outside the Netflix-WB ecosystem including

Apple TV+,

Amazon Prime Video, and emerging global platforms.

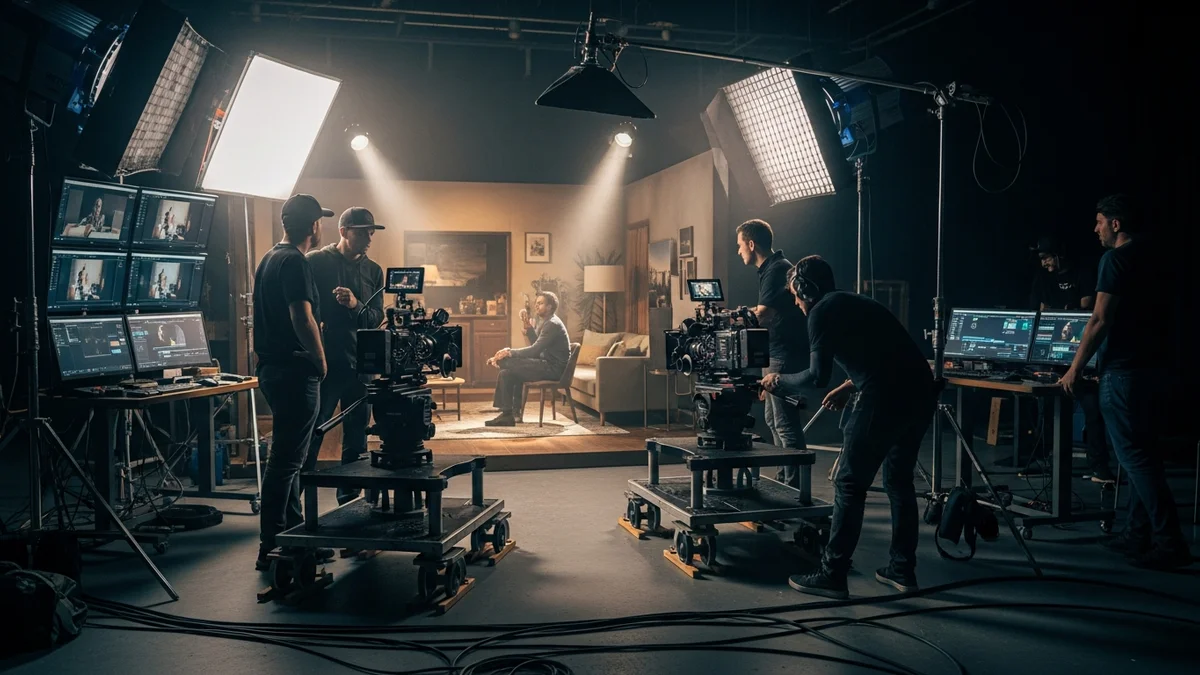

The theatrical experience retains cultural significance despite streaming dominance. Films designed for theatrical—immersive visuals, communal viewing experiences—may find receptive audiences at independent theaters and film festivals seeking differentiation from streaming content.

For related industry analysis, explore our

AI Film Making coverage examining how artificial intelligence tools are democratizing production capabilities for independent creators navigating this transformed landscape.

Frequently Asked Questions

What is the Netflix Warner Bros deal value?

Netflix announced the acquisition of Warner Bros. Discovery for $82.7 billion enterprise value ($72 billion equity value) on December 5, 2025. The deal includes $27.75 per WBD share, consisting of $23.25 cash and $4.50 in Netflix stock.

How does the Netflix Warner Bros deal affect independent filmmakers?

The deal consolidates major content buyers, reducing competition for independent productions. Where filmmakers previously pitched to Netflix, HBO Max, Warner Bros. Pictures, and New Line Cinema separately, they now face a single buyer with unified acquisition strategies, potentially lowering acquisition prices and reducing financing options.

Will theatrical distribution change after the Netflix Warner Bros merger?

Warner Bros.' century-old theatrical distribution network now falls under Netflix control. Exhibition groups have raised antitrust concerns that the streaming giant could marginalize theatrical releases. Independent theaters face particular vulnerability as they relied on Warner Bros. content for programming diversity.

What content does Netflix acquire from Warner Bros?

Netflix acquires Warner Bros. film studio, Warner Bros. Television, HBO, HBO Max streaming service, DC Studios (Batman, Superman), gaming business, and iconic franchises including Harry Potter, Game of Thrones, The Sopranos, Friends, The Big Bang Theory, and classic films like The Wizard of Oz and Casablanca.

When will the Netflix Warner Bros deal close?

The deal is expected to close in 12-18 months, targeting Q3 2026 or later. It requires DOJ/FTC approval, WBD shareholder vote, and completion of the Discovery Global cable networks spinoff before the acquisition can finalize.