Physical AI Market Size and Forecast: Robots, IoT, and Drones Drive $2.8 Trillion Growth Through 2030

Analysts say 'physical AI'—the fusion of robotics, edge IoT, and autonomous drones—is entering a high-velocity investment cycle. New November launches from NVIDIA, Amazon, ABB, and DJI, alongside fresh institutional forecasts, point to a market that could add $2.8 trillion in value by 2030.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

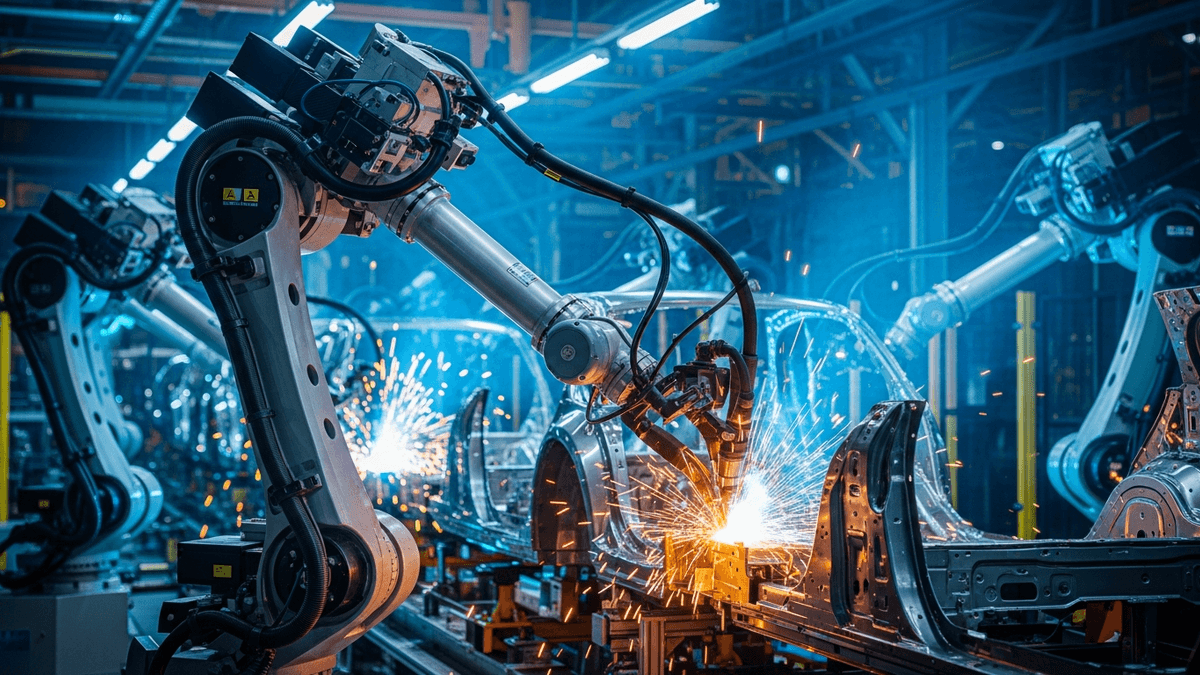

Physical AI Takes Center Stage in Late-2025

A wave of November announcements across robotics, connected devices, and autonomous systems is pushing 'physical AI' into the spotlight, with a new forecast projecting $2.8 trillion in cumulative value creation by 2030. The term covers the convergence of embodied AI in robots, machine vision at the edge, and autonomous aerial systems—all now intertwined with generative models and foundation-model tooling. That $2.8 trillion figure reflects increased capital expenditures and productivity gains, according to industry notes released in late November by major research houses and technology analysts.

On November 18, 2025, NVIDIA detailed new Isaac platform updates for embodied AI, including expanded ROS 2 support and generative simulation features aimed at warehouse, service, and mobile robotics. For more on related ai security developments. During the week of November 27, 2025, Amazon previewed broader robotics rollouts tied to its fulfillment operations, spotlighting edge inference for autonomous mobile robots and ongoing pilots with bipedal systems from Agility Robotics. Industrial players such as ABB also highlighted late-November cobot enhancements designed for mid-market manufacturers seeking faster deployment and safer human-robot collaboration.

Robots, Edge IoT, and Autonomous Systems: New Products and Pilots

Several product updates landed within the last 45 days that reinforce the momentum behind physical AI. November releases from DJI focused on enterprise firmware and payload improvements to bolster inspection workflows and AI vision accuracy. Meanwhile, Microsoft used its November Ignite window to showcase Azure IoT Edge enhancements, including vision-based anomaly detection and tighter integration with robotics toolchains. Across industrial sites, late-October and November rollouts from ABB and Siemens emphasize plug-and-play AI modules for predictive maintenance and autonomous material handling.

In the research community, embodied AI and manipulation benchmarks are moving fast, with fresh papers posted in November—covering dexterous handling, navigation, and multimodal policy learning—according to recent research. Analysts say these advances are rapidly transferring into commercial pilots, cutting iteration cycles for mobile robots and autonomous inspection platforms. For more on related Robotics developments.

Drones and Logistics: Toward BVLOS Scale and Edge Autonomy

Logistics-focused drone operators expanded their footprints this month, underscoring the push toward beyond-visual-line-of-sight operations. For more on related ai in defence developments. Enterprise-focused offerings from DJI and U.S. autonomy leader Skydio emphasized higher-confidence obstacle avoidance, improved thermal payloads, and AI-driven flight safety in late-November updates. Medical and retail delivery providers such as Zipline highlighted new corridor pilots and integration with edge IoT services to optimize routing and handoffs.

Regulatory guidance remains pivotal. November notices from authorities signaled incremental progress on frameworks that enable scaled operations for heavy-lift and long-range flights—particularly around safety cases and remote ID compliance—industry reports show. Drone autonomy is increasingly tied to edge compute, with operators adopting onboard AI and 5G connectivity to cut latency and handle dynamic environments. This builds on broader Robotics trends.

Earnings, Capital Allocation, and Policy Signals

Hardware-aligned earnings over the past month have referenced growing demand for AI-enabled devices and automation. On November 18, 2025, NVIDIA reported strong data-center performance while spotlighting embodied AI tooling for developers and OEMs. Industrial automation customers discussed elevated spend on AI vision and cobots during late-November calls, with companies such as Siemens and ABB pointing to pipeline strength and services revenue tied to software-driven automation. Agricultural and construction OEMs, including John Deere, reiterated autonomous roadmaps that merge high-precision sensors with AI guidance.

Capital is tracking the shift to physical AI at the edge. For more on related robotics developments. Venture and strategic investors have noted increased activity in humanoids, last-mile robotics, and inspection drones through November, with syndicates emphasizing foundation models adapted to real-world constraints—data from analysts suggest. On policy, late-October and November briefings in the U.S. and EU focused on safety, cybersecurity for IoT devices, and harmonization of standards to accelerate compliant deployments, particularly in critical infrastructure and healthcare.

What the $2.8 Trillion Forecast Implies for Operators

The late-November $2.8 trillion projection bundles productivity gains, capex cycles, and service-layer revenues across robots, IoT endpoints, and autonomous drones. It assumes mid-teens to low-30s annualized growth depending on segment maturity, driven by software-defined capabilities and generative simulation accelerating deployment. The forecast also factors in AI-native device design, with OEMs like NVIDIA, Amazon, ABB, and DJI pushing integrated stacks that reduce setup time and expand addressable workflows.

For operators, the near-term focus is standardizing data pipelines, edge inference, and safety guarantees. November platform updates from hyperscalers and industrial vendors signal interoperable tooling that lowers the integration burden across factories, fulfillment centers, and field operations. With embodied AI benchmarks tightening the loop between research and deployment, the physical AI stack is rapidly maturing—positioning robots, IoT, and drones as core assets in next year’s automation programs.

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

What does the $2.8 trillion physical AI forecast cover, and who is driving it?

The forecast captures cumulative value creation through 2030 across embodied robotics, edge IoT, and autonomous drones. It encompasses capex in hardware, software subscriptions, services, and productivity gains from AI-native automation. Momentum this month is led by platform updates from [NVIDIA](https://developer.nvidia.com/isaac), hyperscaler edge integrations from [Microsoft](https://azure.microsoft.com), and logistics expansions from drone operators like [DJI](https://www.dji.com) and [Zipline](https://www.flyzipline.com). Analysts highlight rising demand in manufacturing, warehousing, healthcare, and infrastructure inspection.

Which recent product launches and updates signal acceleration in physical AI?

In November 2025, [NVIDIA](https://developer.nvidia.com/isaac) rolled out Isaac enhancements for embodied AI and ROS 2 interoperability, while [Amazon](https://www.aboutamazon.com/news/operations/amazon-robotics) showcased expanded robotics pilots in fulfillment. Enterprise drone platforms from [DJI](https://www.dji.com/newsroom) and autonomy tools from [Skydio](https://www.skydio.com/news) added AI-driven safety and inspection features. On the IoT side, [Microsoft](https://azure.microsoft.com/en-us/products/azure-iot) highlighted analytics and edge inference gains at Ignite, underscoring tighter coupling between device sensors, vision, and automated decision-making.

How are enterprises implementing physical AI in operations right now?

Enterprises are standardizing data pipelines to feed AI models, deploying edge inference on cameras and robots, and adopting simulation tools to de-risk rollouts. Manufacturers leverage cobots from [ABB](https://new.abb.com/news) and digital twins to optimize cycle times. Logistics operators integrate autonomous mobile robots with warehouse management systems, while inspection teams use [DJI](https://www.dji.com/newsroom) and [Skydio](https://www.skydio.com) drones for asset monitoring. November updates from hyperscalers provide reference architectures that reduce integration friction and accelerate pilot-to-production timelines.

What are the main challenges to scaling robots, IoT, and drones in regulated industries?

Key hurdles include safety certification, cybersecurity for connected devices, and regulatory approvals for autonomous operations—especially BVLOS for drones. Operators must align with evolving standards and implement robust remote ID, encryption, and fail-safe mechanisms. Vendors such as [Siemens](https://press.siemens.com) and [ABB](https://new.abb.com/news) are emphasizing compliance-ready architectures. Industry guidance released through November highlights data governance, auditability, and continuous validation to meet policy expectations while maintaining operational efficiency.

What near-term trends should executives watch in physical AI going into 2026?

Expect generative simulation and foundation models for embodiment to compress development cycles, with growing support across [NVIDIA](https://developer.nvidia.com/isaac) and ROS 2 ecosystems. Look for wider edge IoT deployments that merge vision, 5G, and secure device management, plus scaled drone logistics in designated corridors. Earnings commentary in November pointed to rising service revenues tied to software-defined automation. Executives should prioritize interoperable stacks, safety certifications, and data strategies that enable rapid iteration without sacrificing compliance or reliability.