PropTech Investment Stabilizes as VCs and Strategics Bet on Building Operations

After a sharp reset, investment into real estate technology is regaining momentum with a focus on operational efficiency, data, and decarbonization. Venture funds and strategics are prioritizing AI, digital twins, and energy management while dealmaking shifts toward disciplined growth.

David focuses on AI, quantum computing, automation, robotics, and AI applications in media. Expert in next-generation computing technologies.

PropTech Investment Finds Its Footing After a Volatile Cycle

After two years of recalibration, PropTech investment is showing signs of stabilization heading into 2025. Funding volumes remain below the 2021 highs, but the mix of capital has diversified from pure growth equity toward strategic M&A and structured rounds, according to recent research. The reset has narrowed focus to business models with clear unit economics and payback periods under 24 months.

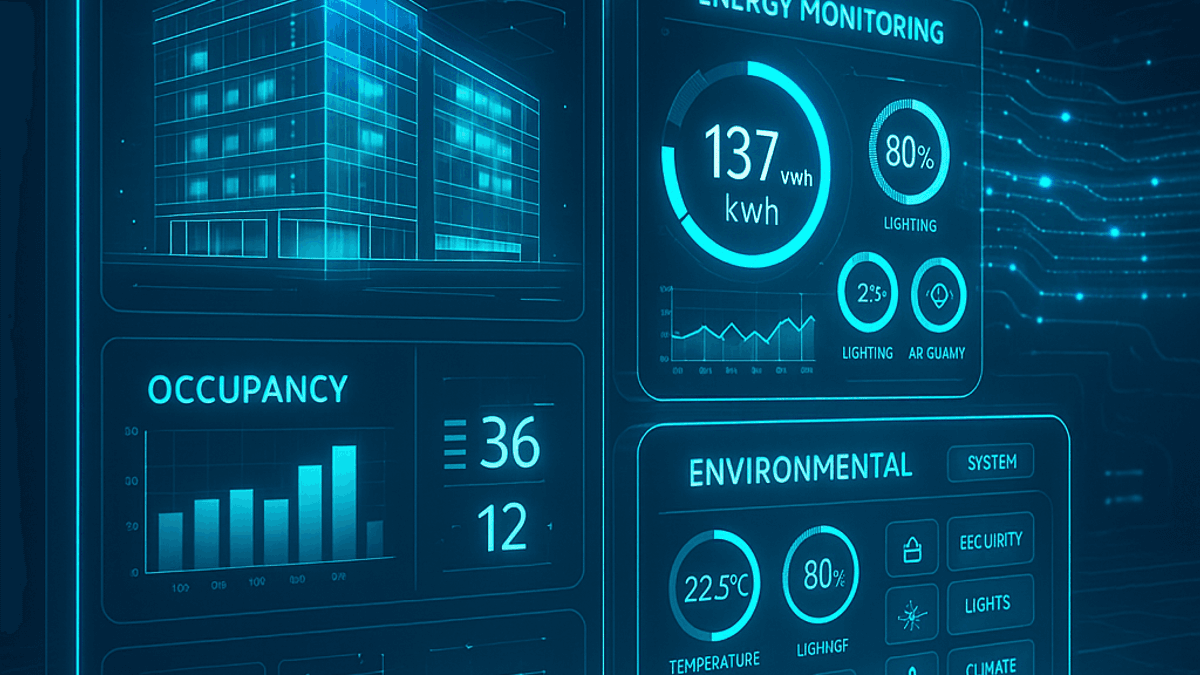

Enterprise buyers are leaning into tools that reduce operating costs, improve compliance, and enhance tenant experience. Budget priorities in commercial real estate reflect this shift, with spending tilting to building operations, data, and automation, Deloitte’s latest outlook shows. As capital costs remain elevated, investors favor platforms with recurring revenue, lower churn, and proven cross-sell paths.

The structural case for PropTech remains intact: real estate is enormous and under-digitized. Long-term modernization is underscored in the industry’s sentiment and capital plans, as highlighted in PwC/ULI’s Emerging Trends in Real Estate. Against that backdrop, operators with strong data moats and integrations are attracting renewed attention.

Where Capital Is Flowing: M&A, Growth Rounds, and Strategic Bets

Venture investors are concentrating on infrastructure, workflow software, and energy management. Specialist backers such as Fifth Wall, JLL Spark, and Camber Creek are prioritizing category leaders that can scale across asset types and geographies. This builds on broader PropTech trends, with funding increasingly tied to enterprise-grade product readiness and go-to-market discipline.

On the strategic side, platforms like CoStar have pursued acquisitions and heavy product investment in residential search and multifamily advertising, while Zillow is leaning into AI-driven home discovery and agent productivity. Marketplace operators such as Airbnb continue to expand tools that serve professional hosts and longer-stay demand, and transaction-focused innovators like Opendoor have refined pricing and listing partnerships to manage risk.

Growth rounds are most visible in property operations and resident experience. Providers including SmartRent and RealPage are adding analytics, access control, and energy features that tie directly to NOI. Sector spending priorities align with insights from JLL’s technology arm, which points to sustained investment in building automation and data platforms, industry reports show. Single-family rental infrastructure also remains active, with trading and portfolio tools from operators like Roofstock supporting institutional and retail flows.

Technology Priorities: AI Leasing, Digital Twins, and Energy Management

AI continues to move from pilot to production in leasing, pricing, and marketing. Consumer-facing platforms such as Zillow are pushing conversational search and recommendations, while enterprise tools from RealPage apply machine learning to revenue management and fraud detection. The value proposition is straightforward: reduce vacancy, compress lead-to-lease cycles, and give asset managers real-time visibility.

Digital twins and spatial data are also maturing. Matterport has expanded 3D capture and digital twin workflows from residential listings into commercial operations, insurance, and facilities management, and construction software like Procore is increasingly integrated across the build-to-operate lifecycle. As buildings account for a significant share of global energy use, the push for automation and analytics is reinforced by policy and cost pressures, data from analysts indicates. These insights align with latest PropTech innovations.

Regulation is acting as both catalyst and filter. In Europe, the Energy Performance of Buildings Directive (EPBD) sets aggressive standards for monitoring and efficiency upgrades, creating tailwinds for retrofit platforms and connected device ecosystems, according to EU guidance. As compliance requirements tighten, asset owners are prioritizing interoperable systems and verified data pipelines to avoid fragmented tooling.

Outlook: Profit Discipline Meets Scale Ambition

With interest rates still above pre-pandemic levels, investors are favoring durable, cash-efficient growth. Analysts expect mid-single to low-double-digit expansion in PropTech revenue pools as modernization continues across residential, office, industrial, and hospitality, according to industry analysts. The most resilient themes pair immediate ROI—like access control, leak detection, and automated leasing—with longer-horizon bets in decarbonization and advanced analytics.

The playbook is pragmatic: monetize across multiple stakeholders, bundle workflows, and anchor on data advantages. Platforms with deep integrations, transparent pricing, and proven cross-asset deployment will remain best positioned to outgrow peers. Investors are rewarding go-to-market efficiency, measured by lower CAC, higher net dollar retention, and embedded upsell paths.

What to watch in the next 12 months: the pace of M&A as strategics seek distribution and category leadership; adoption curves for AI copilots in leasing and maintenance; and the impact of regional regulation on retrofit demand. Expect continued activity from operators such as CoStar, Zillow, and infrastructure-focused backers including Fifth Wall and JLL Spark, as capital targets platforms that turn data into measurable building outcomes.

About the Author

David Kim

AI & Quantum Computing Editor

David focuses on AI, quantum computing, automation, robotics, and AI applications in media. Expert in next-generation computing technologies.

Frequently Asked Questions

How has PropTech funding changed since the 2021 peak?

Funding cooled in 2022–2023 as rates rose, then stabilized in 2024 with a more disciplined mix of growth equity, structured rounds, and strategic M&A. Volumes are below the pandemic-era highs, but investors are selectively backing platforms with clear ROI and strong unit economics, as noted in multiple industry outlooks.

Which segments are attracting the most capital right now?

Operational technologies—access control, energy management, analytics, and AI-enabled leasing—are top priorities for enterprise buyers. Spatial data and digital twins are also seeing uptake, particularly where they streamline maintenance, insurance, and compliance.

Who are some notable investors and operators in PropTech today?

Specialist VCs such as Fifth Wall, JLL Spark, and Camber Creek remain active, while operators like CoStar and Zillow are investing in product expansion and selective acquisitions. Marketplace and transaction platforms including Airbnb and Opendoor are refining models to balance growth and risk.

What challenges are PropTech platforms facing in the current environment?

Elevated interest rates and cautious enterprise budgeting require clear, near-term ROI and efficient go-to-market execution. Fragmented systems, regulatory complexity, and the need for verified data pipelines also push platforms to prioritize interoperability and credible measurement.

What is the outlook for PropTech investment over the next year?

Analysts expect moderate growth as adoption spreads across asset types and decarbonization pressures intensify. M&A should remain active as strategics seek distribution and category leadership, while AI copilots and building automation tools move from pilot to standard practice.