Quantum AI Market Trends: Statistics, Benchmarks, and Enterprise Momentum in 2025

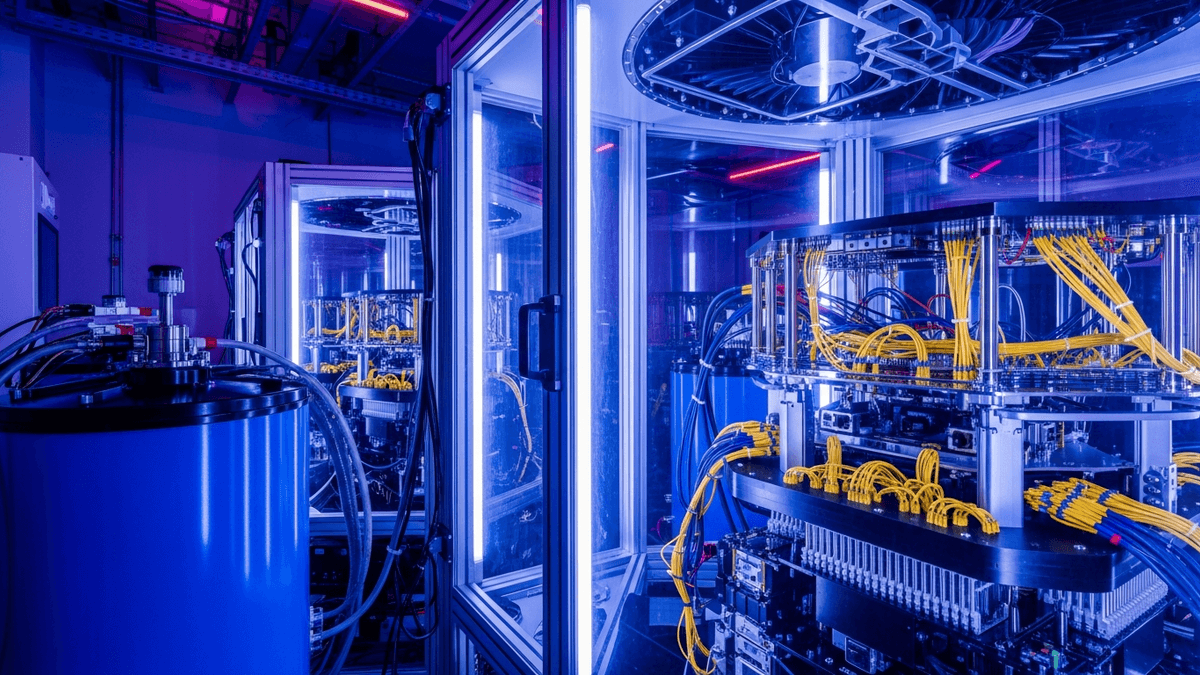

Quantum AI is moving from lab demos to enterprise pilots, with measurable gains in hardware performance, software maturity, and spending. Fresh statistics point to accelerating adoption across cloud ecosystems and targeted use cases in optimization, chemistry, and model training.

Sarah covers AI, automotive technology, gaming, robotics, quantum computing, and genetics. Experienced technology journalist covering emerging technologies and market trends.

Quantum AI Market Trends: The Data Behind Adoption

The statistics around Quantum AI point to steady, measurable progress rather than overnight transformation. The global quantum computing market is projected to reach roughly $6.5 billion by 2030, according to industry sizing estimates that track vendor revenues, services, and ecosystem growth according to Statista. While Quantum AI remains a subsegment, its traction is visible in optimization, generative modeling, and materials simulation—domains where probabilistic sampling and combinatorial speedups matter.

Companies including IBM, Google, Microsoft, and Amazon Web Services are bundling quantum access with classical AI toolchains, making it easier to run hybrid workflows that combine GPU training with quantum sampling or optimization primitives. Industry sentiment has shifted from speculative hype to quantifiable milestones; enterprise pilots and benchmarks are increasingly reported in financial updates and technical blogs, and analysts have begun to track cross-team KPIs spanning qubit counts, error rates, cost per shot, and end-to-end time-to-value.

Recent ecosystem surveys show that national programs and public-private partnerships continue to expand, helping derisk R&D and seed commercial scaling as highlighted by the OECD. In parallel, cloud-native integrations are compressing adoption cycles: prebuilt SDKs and managed services let teams experiment without purchasing hardware or building custom control stacks.

Investment, Talent, and Enterprise Pilots

Capital flows and talent pipelines are reliable signals for Quantum AI readiness. Venture-backed startups including IonQ, Rigetti Computing, Zapata AI, and QC Ware are reporting rising customer interest in hybrid algorithms—particularly variational optimization, quantum kernel methods, and quantum-enhanced sampling. These pilots often pair quantum routines with classical ML to test whether speed or accuracy gains justify production rollout.

On the enterprise side, partnerships with cloud ecosystems are moving fast. Amazon Web Services Braket, Microsoft Azure Quantum, and accelerator programs run by IBM and Google increasingly emphasize concrete KPIs (e.g., error-mitigated fidelity thresholds, circuit depth limits, and workload fit). This builds on broader Quantum AI trends, where success is measured by business outcomes—like reduced Monte Carlo variance for risk models or shorter lead times in materials discovery.

Workforce statistics also tell a pragmatic story. Analyst trackers note steady demand for quantum algorithm engineers and applied ML researchers with strong linear algebra and numerical optimization backgrounds as summarized in McKinsey’s Quantum Technology Monitor. Upskilling programs across enterprise IT and data science teams are focusing on benchmarking, hybrid pipeline design, and model governance frameworks that encompass quantum components.

Hardware and Algorithm Benchmarks Shaping Quantum AI

Hardware performance is a central statistic for Quantum AI timelines. In 2023, researchers at IBM presented evidence that error mitigation can extend the computational reach of noisy devices, enabling meaningful results on certain physics problems according to a study in Nature. Meanwhile, Google reported advances in error characterization and scaling strategies that improve circuit reliability, helping algorithm designers better match workloads to hardware constraints.

Trapped-ion progress from Quantinuum and superconducting efforts from Rigetti Computing continue to push native gate fidelities and connectivity, both critical for Quantum AI tasks that require coherent depth. Annealing systems from D-Wave remain useful for certain optimization problems, providing an applied bridge between quantum sampling and classical heuristics.

On the classical side of the stack, GPU-based simulators such as NVIDIA’s cuQuantum toolkit underscore the hybrid reality of early-stage Quantum AI, letting teams stress-test circuits and estimate performance before paying per-shot costs on real devices data from analysts. These insights align with latest Quantum AI innovations, where practical benchmarks—algorithmic qubits, circuit depth, and end-to-end latency—guide workload selection.

Outlook, Risks, and What to Watch Next

Near-term Quantum AI statistics will likely emphasize application-centric metrics over headline qubit counts. Expect reporting around: accuracy improvements versus classical baselines for risk modeling, wall-clock speedups in generative sampling, and cost-per-insight KPIs that factor in cloud fees and orchestration overhead. Market growth estimates suggest continued double-digit expansion through the decade according to Statista, with hybrid pipelines serving as a practical on-ramp.

Key risks remain: noise, decoherence, and scaling challenges can blunt theoretical gains, and talent scarcity may slow productionization according to recent research. To mitigate, providers like Microsoft and Amazon Web Services are leaning into managed services, prebuilt workflows, and automated benchmarking dashboards, while hardware leaders such as IBM, Google, and Quantinuum iterate on error suppression and modular architectures.

The most telling statistics over the next 12–24 months will be pilot-to-production conversion rates, sustained accuracy gains in domain-specific tasks, and the breadth of Fortune 100 adoption across finance, pharma, and advanced manufacturing. If those numbers move steadily upward, Quantum AI’s role will shift from exploratory R&D to a targeted accelerator embedded in mainstream AI stacks.

About the Author

Sarah Chen

AI & Automotive Technology Editor

Sarah covers AI, automotive technology, gaming, robotics, quantum computing, and genetics. Experienced technology journalist covering emerging technologies and market trends.

Frequently Asked Questions

What is the current market outlook for Quantum AI through 2030?

Sizing varies by source, but third‑party estimates suggest the broader quantum computing market could reach roughly $6.5 billion by 2030, with Quantum AI representing a growing subset focused on optimization, sampling, and model acceleration. Growth is expected to be driven by hybrid workflows that integrate quantum circuits with classical AI pipelines.

Which players are leading in Quantum AI infrastructure and services?

Cloud and hardware leaders such as IBM, Google, Microsoft, and Amazon Web Services are shaping the ecosystem through managed services and SDKs. Specialized providers like Quantinuum, D-Wave, IonQ, and Rigetti Computing contribute hardware diversity that enables different algorithmic approaches.

Where are enterprises seeing early value from Quantum AI?

Early pilots show promise in combinatorial optimization, risk modeling, materials simulation, and generative sampling, where quantum routines can complement classical ML. Teams often report improvements in accuracy or variance reduction, even when wall‑clock performance remains constrained by hardware noise and circuit depth.

What are the biggest implementation challenges for Quantum AI?

Noise management, limited circuit depth, and algorithm-to-hardware fit are persistent hurdles. Talent availability and benchmarking discipline are equally important, requiring robust KPIs—accuracy versus classical baselines, cost per shot, and end‑to‑end latency—to determine when production deployment makes sense.

What milestones should businesses track in the next 12–24 months?

Watch for improved error mitigation, rising pilot-to-production conversion rates, and consistent gains in domain-specific tasks such as finance and materials. Hybrid cloud integrations, standardized benchmarking, and sustained Fortune 100 adoption will be key signals of Quantum AI moving beyond R&D into measurable business impact.