Quantum AI Startups Market Trends: Funding, Tech Maturity, and Early Wins

Quantum AI is shifting from hype to delivery as specialized startups secure capital, ship hybrid tools, and land enterprise pilots. Investors are backing practical workloads in optimization, materials, and cybersecurity, while cloud providers and hardware leaders tighten integrations.

Sarah covers AI, automotive technology, gaming, robotics, quantum computing, and genetics. Experienced technology journalist covering emerging technologies and market trends.

Quantum AI Startups Enter a Pragmatic Phase

Quantum AI—the fusion of quantum computing techniques with machine learning—has entered a more pragmatic phase, with startups prioritizing near-term, hybrid approaches over moonshot claims. Venture-backed players such as SandboxAQ, Zapata AI, QC Ware, and Pasqal are focusing on optimization, simulation, and security use cases where quantum-inspired algorithms can deliver gains today.

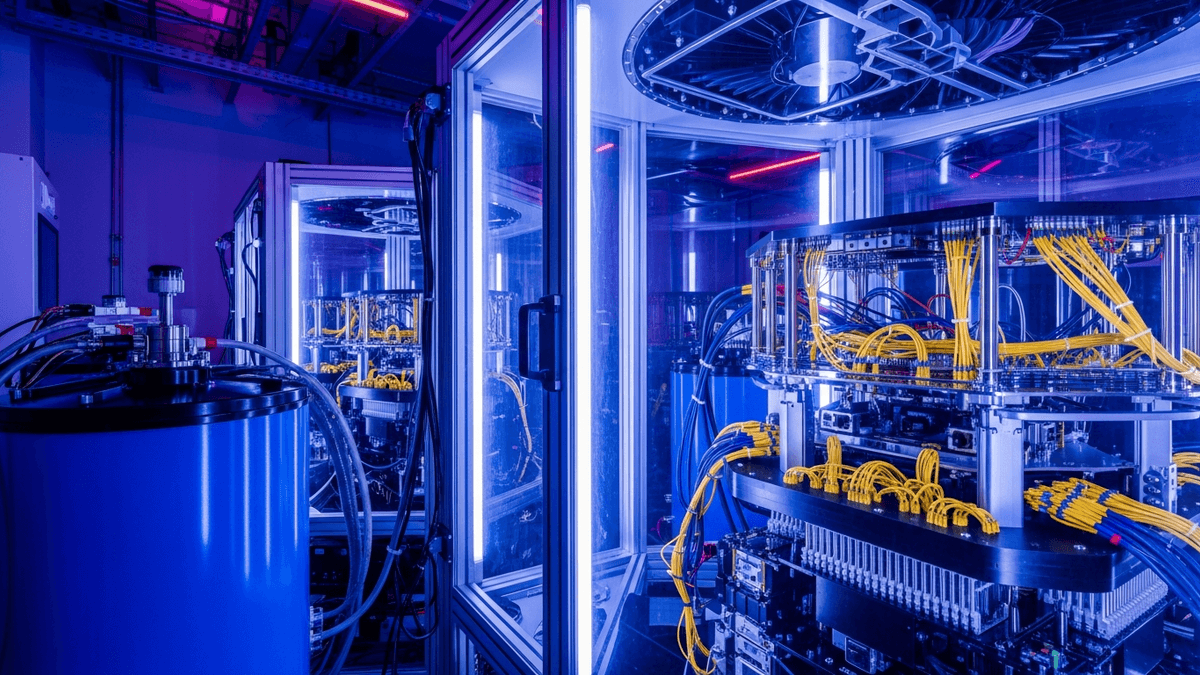

Hardware-linked companies including IonQ and Quantinuum are advancing performance while collaborating with software-focused peers to test quantum machine learning (QML) workflows. The resulting ecosystem blends error-mitigated quantum circuits with classical AI, targeting problems that are compute-bound under traditional methods but amenable to quantum speedups or improved scaling.

As buyers ask for measurable impact, many startups are reframing roadmaps around hybrid pipelines, cost-performance benchmarks, and domain-specific tooling. This shift is narrowing the gap between research and production, setting a more realistic cadence for rolling out QML to early adopters.

Market Trends: Funding, IPOs, and Strategic Deals

Capital formation has accelerated where commercial traction looks tangible. Alphabet spinoff SandboxAQ disclosed more than $500 million in funding commitments to scale AI-enabled quantum security and simulation. France’s Pasqal raised €100 million to expand neutral-atom quantum systems, with a growing roster of enterprise pilots.

Public-market signals have also improved. Quantum hardware and services provider IonQ has repeatedly guided for higher revenues as demand grows, while Zapata AI listed via a SPAC to fund its industrial-grade optimization and analytics suite. The broader market for quantum computing could reach $1–5 billion in the mid-2020s, according to industry analysts, with value pools concentrated in chemicals, finance, and logistics.

Strategic partnerships are becoming a key growth lever. Companies like Quantinuum and QC Ware are forming consortia with finance and pharma leaders to co-develop use cases and benchmark performance, de-risking adoption through shared R&D and multi-year service agreements.

Technology Maturity: Hybrid Algorithms and Toolchains

On the technology side, startups and established players are converging on hybrid, error-mitigated workflows. Q-CTRL specializes in control software and error suppression, helping customers stabilize circuits and improve signal-to-noise for QML tasks. Canada’s Xanadu is expanding PennyLane, a popular open-source library for differentiable programming across quantum and classical backends.

Ecosystem integrations are deepening. IBM Quantum is publishing device roadmaps and software improvements that impact QML reliability, while NVIDIA’s cuQuantum enables high-performance classical simulation of quantum circuits to prototype models and validate workflows before running on real hardware. This builds on broader Quantum AI trends as enterprises standardize stacks around cloud APIs and domain-specific datasets.

Cloud access is critical to adoption. Providers like Microsoft Azure Quantum and AWS Braket are streamlining access to multiple quantum hardware types and simulators, allowing startups to ship managed services and reference architectures that fit enterprise compliance and procurement norms. For more on related Quantum AI developments.

Early Commercial Impact in Finance, Pharma, and Materials

Early pilots signal how Quantum AI will be productized. In capital markets, QC Ware collaborated with Goldman Sachs on quantum-enhanced analytics, exploring portfolio optimization and derivative pricing methods where hybrid approaches can compress compute times. In healthcare, Zapata AI has worked with Roche on quantum-inspired machine learning for drug discovery workflows.

Industrial scheduling and materials discovery are rising priorities. Pasqal has partnered with BMW Group to study production optimization problems that are computationally intensive under classical heuristics. Meanwhile, hardware and software companies such as Quantinuum are showcasing chemistry-oriented QML proofs of concept, aiming to shorten cycles for simulation-driven R&D.

These efforts benefit from cloud-native delivery. With standardized interfaces and managed services through AWS Braket and Microsoft Azure Quantum, startups are packaging Quantum AI capabilities for specific verticals—providing clear SLAs, usage-based pricing, and integration support for enterprise data pipelines. These insights align with latest Quantum AI innovations.

Outlook: Timelines, Risks, and What to Watch

Over the next three to five years, the most credible gains will likely arrive in optimization, simulation, and generative design for materials—delivered via hybrid stacks that blend classical ML with quantum subroutines. Analysts caution that error rates, scaling limits, and data scarcity will constrain pure QML performance in the near term, yet hybrid approaches can still move the needle in specific workloads, industry reports show.

Execution risk remains: talent is scarce, benchmarking is complex, and ROI proofs require careful problem selection. Startups including SandboxAQ, Zapata AI, IonQ, and Xanadu are responding with domain-specific toolkits, stronger customer success motions, and transparent performance metrics.

Watch for more verticalized offerings, standardized KPIs for QML pilots, and deeper integrations with accelerator hardware from NVIDIA and cloud platforms from IBM Quantum, AWS Braket, and Microsoft Azure Quantum. As the market matures, expect consolidation around startups that can prove repeatable value on production datasets and deliver measurable cost/performance advantages.

About the Author

Sarah Chen

AI & Automotive Technology Editor

Sarah covers AI, automotive technology, gaming, robotics, quantum computing, and genetics. Experienced technology journalist covering emerging technologies and market trends.

Frequently Asked Questions

What are Quantum AI startups focusing on in the near term?

Most are prioritizing hybrid workflows that combine classical machine learning with small quantum circuits for optimization, simulation, and security. Companies like SandboxAQ, Zapata AI, QC Ware, and Pasqal are packaging domain-specific solutions for finance, pharma, and industrial operations.

How much funding is flowing into the Quantum AI sector?

Funding is increasing where commercial traction is visible. SandboxAQ disclosed more than $500 million in commitments, while Pasqal raised €100 million to scale neutral-atom systems, and public players like IonQ are reporting improved revenue outlooks, according to recent analyst and company updates.

Which toolchains are enabling practical Quantum AI development?

Hybrid stacks are anchored by platforms such as IBM Quantum, NVIDIA’s cuQuantum for high-performance simulation, and cloud access via Microsoft Azure Quantum and AWS Braket. Software specialists like Q-CTRL and Xanadu’s PennyLane help stabilize circuits and simplify differentiable programming across backends.

Where are early Quantum AI pilots showing impact?

Finance pilots with Goldman Sachs and QC Ware explore portfolio optimization and pricing models; pharma collaborations like Roche with Zapata AI target drug discovery workflows; and industrial efforts such as BMW Group with Pasqal address complex production scheduling. These pilots aim to demonstrate measurable improvements over classical-only approaches.

What is the outlook for Quantum AI over the next 3–5 years?

Expect incremental gains in optimization and materials simulation via hybrid algorithms, with broader advantages contingent on error mitigation and hardware scaling. Analysts forecast a multi-billion-dollar market in the mid-2020s, with consolidation favoring startups that prove repeatable, domain-specific ROI.