Robotics Market Size Accelerates as AI-Powered Automation Hits the Mainstream

The global robotics market is expanding rapidly as industrial automation converges with AI-driven service robots. New data and corporate moves suggest a breakout phase across factories, logistics, and commercial applications through the decade.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Market Snapshot: Size, Growth, and What’s Driving It

The robotics market is entering a scale-up phase, with industrial and service segments growing in tandem. Global industrial robot installations reached a new high in 2022 and remain elevated, reflecting pent-up demand and reshoring tailwinds, according to the International Federation of Robotics’ World Robotics report according to recent research. On the value side, the overall robotics market was estimated at tens of billions of dollars earlier this decade and is tracking to surpass mid–$100 billions by the middle of the decade, industry reports show.

The service robotics category—spanning logistics, retail, healthcare, agriculture, and hospitality—has emerged as a growth engine. The segment was valued in the tens of billions in 2023 and is projected to expand at a 20%+ CAGR through 2030, driven by labor constraints, e-commerce growth, and maturation of AI perception and manipulation, data from analysts indicates. Together, these dynamics signal that robotics is shifting from pilot projects to scaled deployments across multiple industries.

Hardware gains are increasingly complemented by software and simulation platforms that shorten development cycles and boost ROI. Foundational toolchains and digital twins are reducing integration risk and enabling faster iteration in the field, aligning robotics adoption with broader enterprise digitization agendas. This convergence is attracting strategic investment from technology leaders and industrial automation stalwarts alike.

Segment Breakdown: Industrial, Service, and Mobile Robots

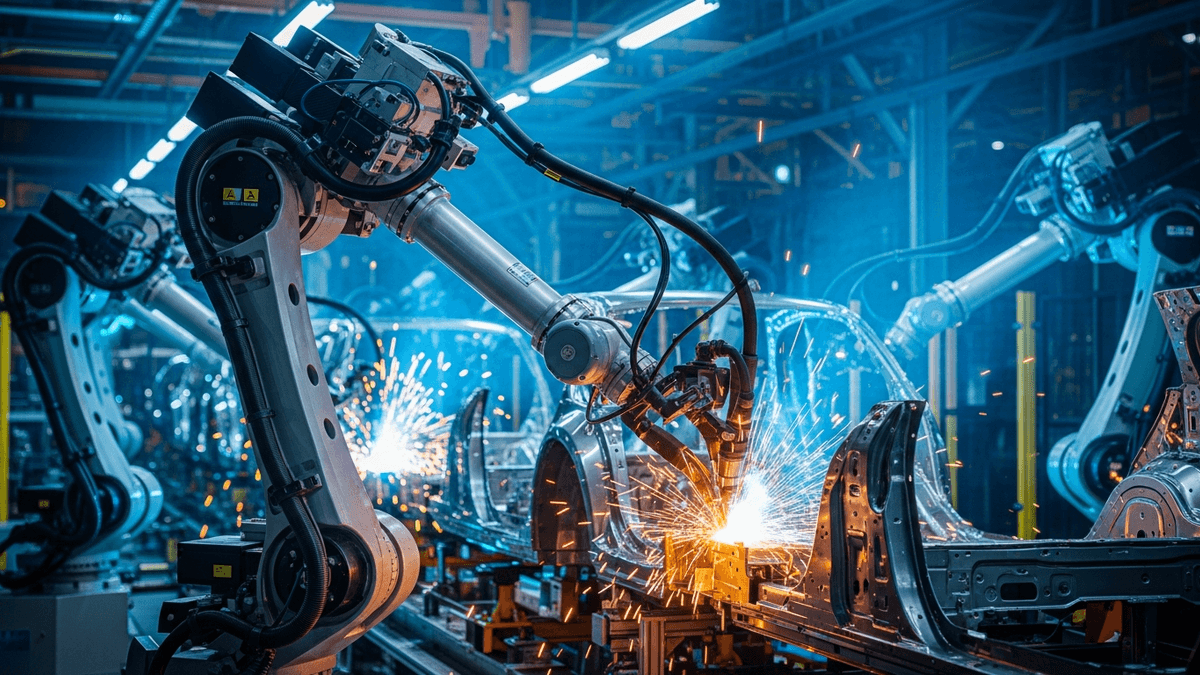

Industrial robotics remains the backbone of the market, with automotive, electronics, and metals leading adoption. Established leaders such as ABB, Fanuc, Yaskawa Electric, and KUKA are expanding portfolios into higher-payload arms, vision-guided systems, and turnkey cells to address demand for flexibility. Collaborative robots (cobots) continue to penetrate small and midsize manufacturing thanks to easier deployment and lower total cost of ownership, with Universal Robots (a Teradyne business) anchoring the category.

Service and mobile robots are scaling fastest in logistics and fulfillment. Autonomous mobile robots (AMRs) and item-handling systems from operators like Amazon are reshaping warehouse workflows, while AI-enhanced perception is expanding use cases from depalletizing to piece-picking. On the software side, platforms such as NVIDIA’s Isaac simulation and robotics stack are accelerating development and validation, enabling faster time to value for integrators and end users.

Healthcare, construction, and retail are increasingly in focus as labor market imbalances persist and safety standards strengthen. Surgical platforms and hospital logistics bots are moving from pilots to repeatable deployments, while inspection and maintenance robots gain traction in energy and infrastructure. This builds on broader Robotics trends, where robust sensing, edge AI, and standardized APIs are lowering integration barriers and unlocking new, non-industrial segments.

Competitive Landscape and Capital Flows

Incumbent automation leaders are doubling down on end-to-end solutions, while a new wave of humanoid and manipulation-focused entrants targets general-purpose tasks. Strategic moves underscore the momentum: Boston Dynamics, now majority-owned by Hyundai Motor Group, advanced its Spot and Stretch platforms following the transaction’s close (company announcement). Systems integrators and controls providers such as Rockwell Automation are broadening robotics capabilities via acquisitions to meet turnkey demand.

Venture-backed startups are targeting high-variance manipulation and general-purpose mobile manipulation. Agility in humanoid logistics is rising with Agility Robotics, while AI-native manipulation and humanoid programs at Figure AI continue to raise substantial capital for commercial pilots. Automotive and technology stakeholders, including Tesla, are exploring human-scale platforms to address repetitive tasks in manufacturing and services.

Partnerships between industrial leaders and compute providers are tightening as GPU-accelerated training and simulation become standard. Robotics stacks built on accelerated computing and photorealistic simulation are enabling faster iteration cycles and safer deployments. These insights align with latest Robotics innovations, where software-defined capabilities—not just hardware performance—are becoming decisive in competitive positioning.

Outlook: AI-Native Robotics and the Next Wave of Productivity

The medium-term outlook hinges on AI-native capabilities—foundation models for perception and control, real-time simulation-in-the-loop, and standardized interoperability across fleets. Productivity gains from automation could be substantial across sectors as tasks move from partially to fully automated, with meaningful macroeconomic impact according to recent research. As the market scales, subscription software, RaaS (Robotics-as-a-Service), and outcome-based contracts are likely to represent a larger share of revenue.

Execution risks remain: integration complexity, safety certification timelines, and supply-chain constraints for sensors and actuators can slow rollouts. Yet the direction of travel is clear. With industrial leaders like ABB and KUKA expanding modular portfolios, platform players such as NVIDIA pushing standardized stacks, and operators like Amazon proving value at scale in logistics, the market’s size and scope are set to expand through the decade. For investors and operators, the most durable value will accrue to solutions that combine reliable hardware with scalable, data-driven software lifecycles.

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

How large is the global robotics market today and how fast is it growing?

The robotics market spans industrial and service segments that together are growing at double-digit rates. Industrial installations set fresh records recently, while analysts project the broader market to reach the mid–$100 billions by the middle of the decade, supported by AI-enabled automation and reshoring.

Which segments are driving the most growth in robotics deployments?

Logistics, e-commerce fulfillment, and healthcare are leading service-robot growth, while automotive and electronics remain the core of industrial deployments. Autonomous mobile robots, cobots, and vision-driven manipulation systems are expanding the addressable market beyond traditional fixed automation.

Who are the key players shaping the robotics landscape?

Industrial leaders such as ABB, Fanuc, Yaskawa Electric, and KUKA anchor factory automation, while Universal Robots (Teradyne) leads in cobots. Platform and operator influence is rising as NVIDIA’s Isaac ecosystem, Amazon’s robotics operations, and innovators like Boston Dynamics, Agility Robotics, and Figure AI push new capabilities.

What are the biggest challenges to scaling robotics across industries?

Integration complexity, safety certification, and supply-chain constraints for sensors and actuators can slow deployments. Enterprises also face change-management and workforce upskilling needs to extract full value from AI-native, software-defined robotics systems.

What is the outlook for robotics through 2030?

Expect continued double-digit growth as AI perception, simulation, and standardized software stacks reduce deployment friction. The market should broaden from manufacturing into logistics, healthcare, and services, with Robotics-as-a-Service and outcome-based models driving recurring revenue and higher ROI.