Smart Farming Adoption Patterns Reshape Enterprise Strategy and Supply Chain Execution

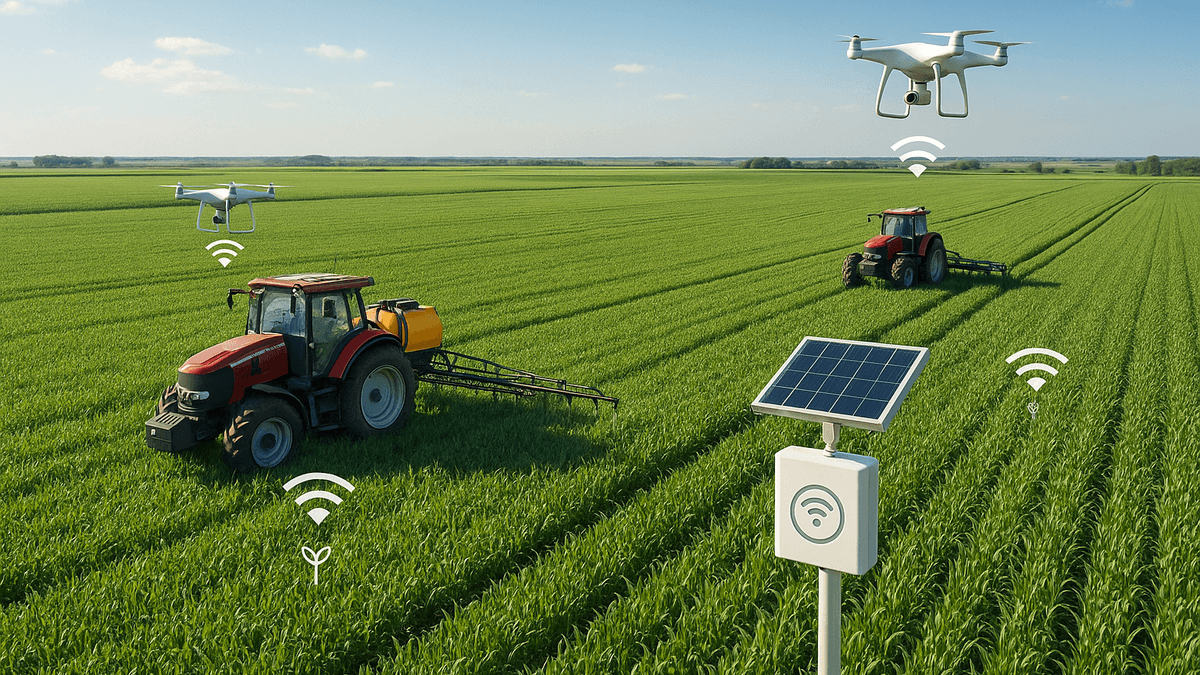

Enterprises are standardizing smart farming along layered adoption curves, blending sensors, connectivity, cloud analytics, and automation. This analysis maps the competitive ecosystem, core technologies, and operating model changes that drive durable ROI while detailing best practices for scale.

Dr. Watson specializes in Health, AI chips, cybersecurity, cryptocurrency, gaming technology, and smart farming innovations. Technical expert in emerging tech sectors.

- Enterprises follow staged adoption curves, progressing from precision guidance to data platforms and autonomy, seeking multi-season ROI and resilience across operations according to McKinsey.

- Global precision farming is projected to reach roughly $12–13 billion in the mid-to-late 2020s, driven by GNSS, variable-rate technologies, and cloud analytics MarketsandMarkets reports.

- Connectivity remains foundational; 4G, 5G, and LPWAN expand coverage for edge devices and telematics, enabling continuous data capture and control GSMA IoT agritech insights.

- Interoperability via ISOBUS and data standards accelerates scale across mixed fleets and platforms, reducing integration friction AEF ISOBUS standard overview.

- Digital farming supports yield and input optimization to meet long-run food demand pressures projected for 2050 FAO analysis.

| Enterprise Segment | Typical Starting Use Case | Representative Platforms | Sources |

|---|---|---|---|

| Row Crops | Autosteering and yield monitoring | Deere, CNH Industrial, Trimble | McKinsey; AEF ISOBUS |

| Specialty Crops | Remote sensing and variable-rate irrigation | DJI, Climate FieldView, IBM watsonx | GSMA agritech; MarketsandMarkets |

| Livestock | Telematics and environmental monitoring | AWS IoT, Microsoft Azure, AGCO | Microsoft agriculture; AWS IoT |

| Indoor Farming | Sensors and closed-loop climate control | IBM, AWS, Azure | GSMA agritech |

| Supply and Sustainability | Data harmonization and reporting | Azure Data Manager, IBM watsonx | McKinsey |

- Agriculture's connected future: How technology can yield new growth - McKinsey & Company, 2020

- Precision Farming Market Report - MarketsandMarkets, Various Editions

- Agritech IoT Insights - GSMA, Ongoing

- ISOBUS Standard Overview - Agricultural Industry Electronics Foundation, Ongoing

- Azure Data Manager for Agriculture Documentation - Microsoft, Ongoing

- AWS IoT Overview - Amazon Web Services, Ongoing

- IBM watsonx Overview - IBM, Ongoing

- How to Feed the World in 2050 - FAO, 2009

About the Author

Dr. Emily Watson

AI Platforms, Hardware & Security Analyst

Dr. Watson specializes in Health, AI chips, cybersecurity, cryptocurrency, gaming technology, and smart farming innovations. Technical expert in emerging tech sectors.

Frequently Asked Questions

How do enterprises typically stage smart farming adoption across operations?

Enterprises often progress through layers: precision guidance and yield monitoring, variable-rate applications, remote sensing and telemetry, and then platform-centric analytics integrated with ERP and sustainability reporting. OEM telematics from Deere, AGCO, and CNH Industrial establish reliable field data, while platforms like Trimble and Climate FieldView add analytics and agronomy workflows. This staged approach reduces integration risk and builds a durable data foundation for autonomy and AI-driven decisions, as discussed by industry analyses from McKinsey and GSMA.

What market forces are accelerating enterprise investment in smart farming?

Food demand pressures and input cost volatility push enterprises toward data-led optimization. Analysts project precision farming growth into the low double-digit billions, reflecting momentum in GNSS, variable-rate technology, and cloud analytics. Connectivity improvements via 4G, 5G, and LPWAN widen telemetry coverage for continuous monitoring and control. Reports from MarketsandMarkets and GSMA detail how maturing device ecosystems and cloud services from Microsoft Azure, AWS, and IBM catalyze durable enterprise adoption.

Which technologies form the core stack for enterprise deployments?

The core stack spans edge instrumentation (GNSS, ISOBUS implements, soil and climate sensors), connectivity (4G, 5G, LPWAN), and cloud data models for normalization and analytics. Digital twins and decision support enable variable-rate applications, machine vision for weed detection, and adaptive irrigation. Enterprises increasingly adopt agriculture-specific data services from Microsoft and analytics on AWS and IBM watsonx to harmonize field data with sustainability and supply reporting. AEF’s ISOBUS standards support mixed-fleet interoperability.

What are the principal risks enterprises face when scaling smart farming?

Key risks include data security, vendor lock-in, and integrating legacy fleets with modern platforms. Enterprises mitigate these by prioritizing open standards, robust APIs, and clear service-level agreements. They also invest in data governance—lineage, role-based access, and stewardship—and training to embed new workflows. Industry groups like AEF and AgGateway help reduce friction, while cloud security baselines from providers such as Microsoft and AWS underpin multi-tenant data protection and compliance across regions.

How will smart farming adoption evolve over the next decade for enterprises?

Adoption is expected to deepen from precision workflows to higher autonomy and integrated sustainability metrics. More granular variable-rate decisions will be powered by AI models trained on harmonized field data. Enterprises will standardize data platforms across business units, linking agronomy, supply, and finance for traceability and reporting. Analyst research points to continued ecosystem consolidation around interoperable standards and cloud-edge architectures that support resilience and regulatory requirements across global operations.