Smart Farming by the Numbers: Adoption, ROI, and Market Momentum

From field sensors to AI-driven tractors, smart farming is shifting from pilot projects to scaled deployment. New market data shows double-digit growth, tangible efficiency gains, and intensifying competition among incumbents and agtech startups. Here’s what the latest statistics reveal—and what business leaders should watch next.

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

Market momentum and demand drivers

In the Smart Farming sector, The smart farming market continues to expand at a clip. The global precision agriculture segment was valued at roughly $10 billion in 2022 and is forecast to grow at a 13–14% compound annual rate through 2030, according to industry analysts, reflecting steady adoption of GNSS guidance, variable-rate technologies, remote sensing, and farm-management software according to industry reports. Demand is being pulled not only by productivity ambitions but also by regulatory pressure to document sustainability and traceability across supply chains.

Longer-term food security dynamics remain a structural tailwind. Global demand for food is expected to rise significantly by mid-century, a challenge that has pushed public and private stakeholders to consider digital tools that lift yields while lowering inputs and emissions according to FAO projections. Smart farming’s appeal lies in its ability to convert agronomic data into prescriptive decisions—placing seeds, nutrients, and water with higher precision, while automating repetitive tasks.

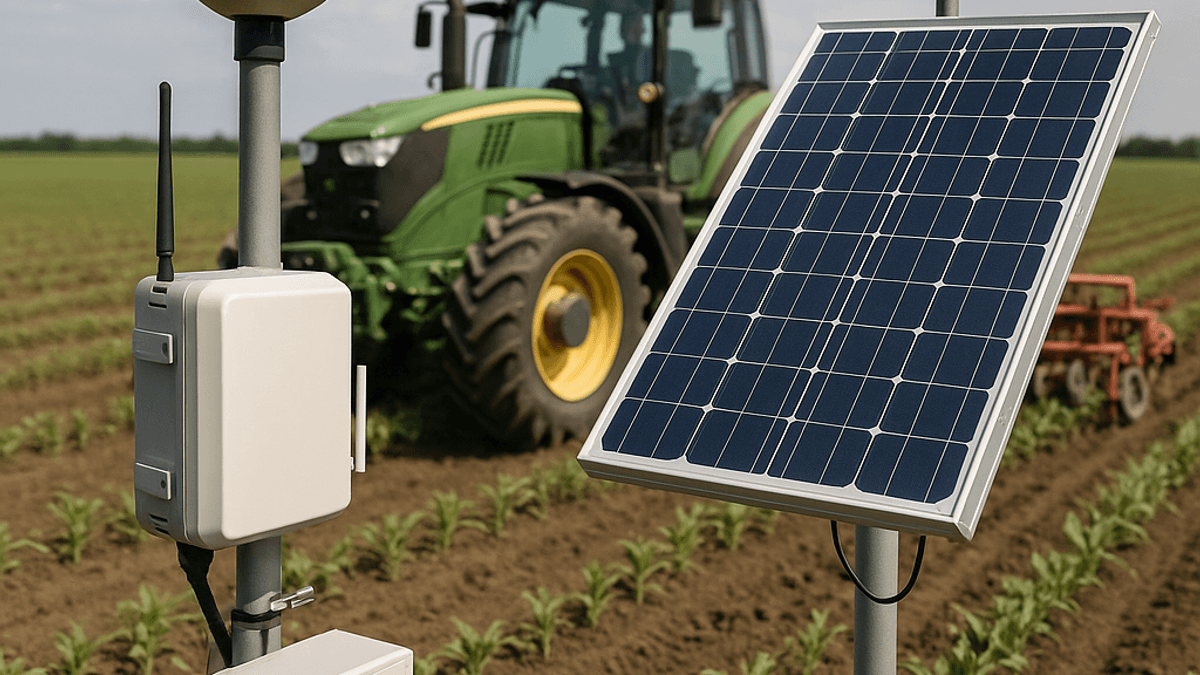

The technology stack is maturing. Edge devices (soil probes, weather stations, cameras), connected machinery, satellite and drone imagery, and cloud analytics are increasingly integrated. Suppliers like Deere & Company, CNH Industrial, AGCO, Trimble, and Bayer’s Climate FieldView are pairing hardware with subscription software, turning equipment into data platforms with recurring revenue streams. As connectivity improves, these systems can capture a growing share of on-farm workflows.

Deployment and adoption on the ground

Connectivity is a prerequisite, and it’s trending in the right direction. Farm internet access has been rising, improving the feasibility of IoT deployments and real-time operations management, with recent national surveys showing a substantial majority of farms now online based on USDA data. That expansion in broadband and cellular coverage is enabling remote diagnostics, over-the-air software updates, and cloud-based agronomy.

On the field side, adoption patterns vary by crop type, region, and farm size, but guidance and autosteer systems are now commonplace among large row-crop operations in North America and increasingly in Europe and Latin America. Variable-rate application for seed and fertilizer continues to expand as input prices and sustainability targets push managers toward more granular prescriptions. Imagery from satellites and drones is moving from scouting to integrated decision support, feeding AI models that flag compaction, disease pressure, and irrigation issues.

Farm management systems are consolidating fragmented datasets—from machine telemetry to weather and soil models—into dashboards that quantify cost per acre and margin impact. As the data gets cleaner and more interoperable, the productivity of agronomists and operators rises, and the case for multi-farm or cooperative analytics becomes stronger, particularly in markets with labor shortages and intense cost pressure.

The economics of smart farming

The business case for precision tools hinges on measurable savings and yield stability. Across crops, reported ranges typically include 10–20% reductions in fertilizer and chemical use, 2–10% yield improvements, and meaningful cuts in fuel and labor hours—results that compound when guidance, variable-rate, and imagery analytics are deployed together according to recent research. While outcomes vary by field conditions and operator skill, the direction is consistent: more data, better timing, tighter placement, fewer passes.

At the machinery level, predictive maintenance and remote support help avoid costly downtime during narrow planting and harvest windows. In irrigated systems, sensor-led scheduling can trim water use by double-digit percentages, lowering energy costs and preserving aquifer drawdown. Sustainability metrics—nitrogen-use efficiency, carbon intensity per ton, and biodiversity indicators—are increasingly baked into the ROI, aligning agronomic gains with ESG targets required by buyers and lenders.

Scale matters. Larger operations spread the fixed cost of hardware and software over more acres and can more easily standardize workflows, while smaller farms benefit from service models—contract agronomy, aerial imagery-as-a-service, and cooperative equipment sharing—that deliver smart capabilities without heavy capital outlays. As vendors refine subscription tiers and interoperability, payback periods are shortening, particularly where input volatility is high.

Capital flows and competitive landscape

Investment in agrifood tech cooled alongside broader venture markets in 2023, but upstream agtech—enabling tools on the farm—remained comparatively resilient. Global funding pulled back from 2021 peaks, with notable shifts toward companies demonstrating clear unit economics and proven adoption as industry reports show. Strategic buyers stayed active: AGCO announced plans to acquire a majority stake in Trimble’s agriculture business via a joint venture, CNH Industrial integrated Raven’s autonomy and precision tools, and Deere continued building out its software and autonomy roadmap.

Competition is intensifying across layers of the stack. Equipment OEMs are embedding native guidance, perception, and control systems; imagery providers are moving up the value chain with analytics; input companies are offering decision-support tied to seed and chemistry portfolios; and independent platforms are pushing for openness. The battleground is not only feature sets but data ownership, interoperability, and the ability to prove ROI at the field level.

Consolidation is likely to continue, especially in software niches where scale boosts model performance. Meanwhile, regional startups are leveraging local agronomy and crop specialization to carve defensible positions. Expect more partnerships between telecoms, satellite operators, and ag platforms to address connectivity and data latency challenges across remote geographies.

Outlook and risks

Near term, the statistics point to steady double-digit market growth, expanding sensor density per acre, and broader integration of AI for perception (weed/disease detection), planning (prescription generation), and control (autonomous implements). As regulations tighten on nutrient runoff and carbon reporting, the value of accurate, auditable field data will rise, making smart tools a compliance asset as much as an agronomic one.

Risks remain. Data fragmentation, uneven connectivity, and operator training gaps can blunt returns. Economic cycles and input price swings affect payback calculus, and privacy concerns shape data-sharing norms. Vendors that solve for interoperability and farmer-friendly UX—and tie outcomes to contracts with buyers, insurers, and lenders—are best positioned to avoid churn.

For business and tech leaders, the opportunity is clear: smart farming is moving from discrete interventions to system-level optimization. The firms that quantify and guarantee outcomes—cost per acre, yield stability, carbon intensity—will lead the next phase. As the numbers accumulate, boardrooms will face a simple question: can you afford not to be precise?

About the Author

James Park

AI & Emerging Tech Reporter

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.