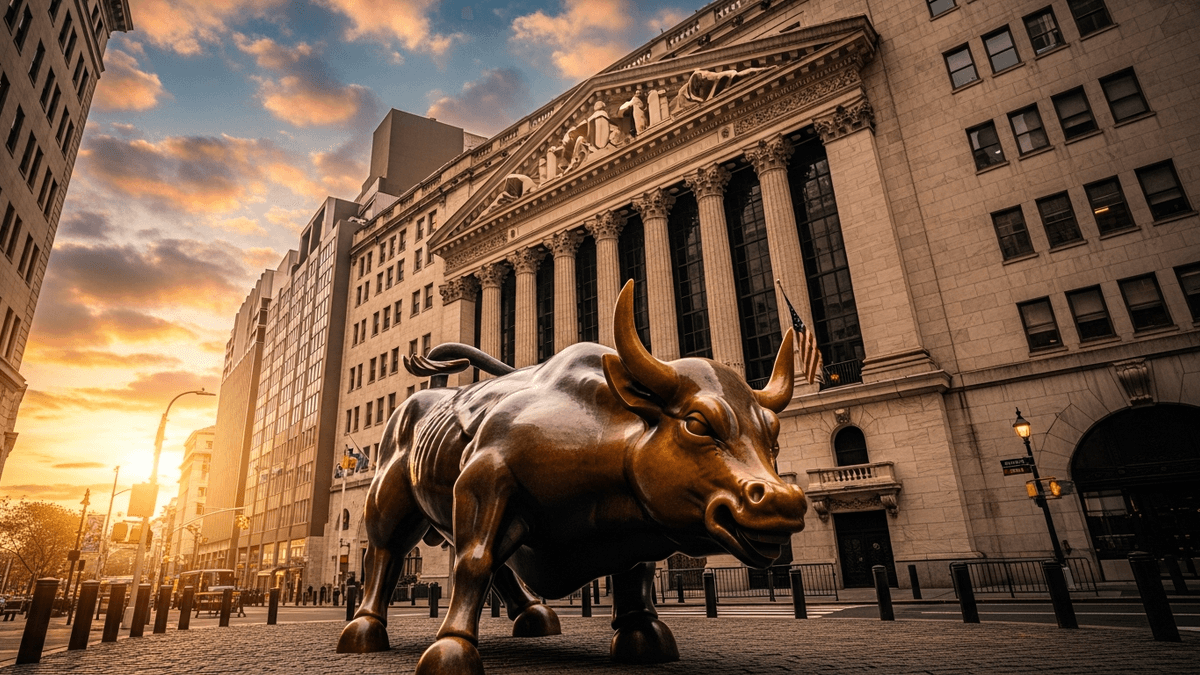

S&P 500 Index Fund UK Forecast in 2026: Growth Projections, Investment Strategies, and Market Outlook

UK investors eye strong S&P 500 performance in 2026 as major fund houses including Vanguard, iShares, and Fidelity project continued growth. Expert analysis covers currency hedging strategies, accumulation versus distribution funds, and optimal entry points for British investors seeking US market exposure.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

- S&P 500 index funds projected to deliver 8-12% returns in 2026 based on analyst consensus

- UK investors benefit from strengthened USD/GBP dynamics and diversified US market exposure

- Vanguard S&P 500 UCITS ETF and iShares Core S&P 500 ETF remain top choices for British investors

- Currency-hedged options protect against GBP volatility while capturing US equity growth

- ISA and SIPP wrappers offer tax-efficient routes for UK-based S&P 500 investing

| Institution | 2026 Target | Implied Return | Key Driver |

|---|---|---|---|

| Goldman Sachs | 6,500 | +11.2% | AI productivity gains |

| JP Morgan | 6,300 | +8.0% | Earnings growth normalization |

| Morgan Stanley | 6,400 | +9.5% | Consumer resilience |

| Bank of America | 6,600 | +12.9% | Tech sector momentum |

| UBS | 6,200 | +6.2% | Rate stabilization |

| Deutsche Bank | 6,450 | +10.4% | Corporate buybacks |

| Sector | Index Weight | 2026 Growth Outlook |

|---|---|---|

| Information Technology | 29.5% | Strong - AI infrastructure spending |

| Healthcare | 12.8% | Moderate - Drug pricing pressures |

| Financials | 12.5% | Strong - Higher rate environment |

| Consumer Discretionary | 10.2% | Moderate - Consumer spending normalization |

| Communication Services | 8.9% | Strong - Digital advertising growth |

| Platform | Annual Fee | Trading Cost |

|---|---|---|

| Vanguard Investor | 0.15% | Free for Vanguard funds |

| Hargreaves Lansdown | 0.45% | 11.95 pounds |

| interactive investor | 4.99-11.99 pounds/month | 3.99 pounds |

| AJ Bell | 0.25% | 5 pounds |

Featured Event

Impact Investing World Forum 2026

Join global investors and sustainability leaders in London for the premier impact investing conference. April 27-28, 2026.

Register Now- Vanguard UK - S&P 500 UCITS ETF Information

- iShares UK - Core S&P 500 ETF Details

- Goldman Sachs Research - 2026 Market Outlook

- HM Revenue and Customs - ISA Guidelines

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Frequently Asked Questions

What is the best S&P 500 index fund for UK investors in 2026?

The Vanguard S&P 500 UCITS ETF (VUSA/VUAG) and iShares Core S&P 500 UCITS ETF (CSP1) are top choices for UK investors, both offering low ongoing charges of 0.07% and trading on the London Stock Exchange in GBP.

Should UK investors hedge currency when buying S&P 500 funds?

Currency hedging depends on investment horizon and risk tolerance. Long-term investors often benefit from unhedged exposure as currency movements tend to even out over time.

What returns are analysts predicting for the S&P 500 in 2026?

Major investment banks forecast S&P 500 returns between 6-13% for 2026, with Goldman Sachs targeting 6,500 and Bank of America at 6,600.

Can I hold S&P 500 funds in an ISA?

Yes, UK-domiciled S&P 500 ETFs and UCITS funds are eligible for Stocks and Shares ISAs, allowing UK investors to shelter gains and dividends from tax.

What are the main risks of investing in S&P 500 from the UK?

Key risks include US market volatility, currency fluctuations between GBP and USD, concentration risk in technology stocks, and Federal Reserve policy changes.