Space Market Size: What’s Driving the Next Trillion-Dollar Economy

After years of hype, the space economy is delivering real revenue growth—and a clearer path to scale. From satellite broadband to Earth observation and launch, the market’s expansion is reshaping telecom, logistics, and national security.

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation

Space economy at a glance

In the Space sector, The global space economy has shifted from promise to performance. The Space Foundation’s latest benchmarks show the sector reached roughly $546 billion in 2022, expanding about 8% year over year as commercial activity accelerated and government programs stayed resilient, according to The Space Report. Commercial revenues now account for the lion’s share of space activity, while civil and defense budgets continue to underwrite infrastructure and scientific missions that anchor demand.

Momentum carried into 2023–2024 on the back of record launch cadence, growing satellite services, and surging demand for broadband and Earth observation data. While the sector remains cyclical and capital intensive, the mix of recurring service revenues (from communications and data) with infrastructure build-outs is gradually lowering volatility and improving visibility for operators and investors.

Where the revenue is coming from

Satellite communications still dominate market share, with ground equipment—from user terminals to gateways—representing a major slice of spend. The rapid buildout of low-Earth-orbit (LEO) constellations is expanding addressable markets: SpaceX’s Starlink is scaling global fixed broadband, Amazon’s Project Kuiper is moving from pilot to deployment, and Eutelsat OneWeb is targeting enterprise and government connectivity. Earth observation providers such as Planet, Maxar, ICEYE, and Capella Space are pushing into higher-value analytics, turning imagery into decision-ready intelligence for insurance, agriculture, energy, and defense.

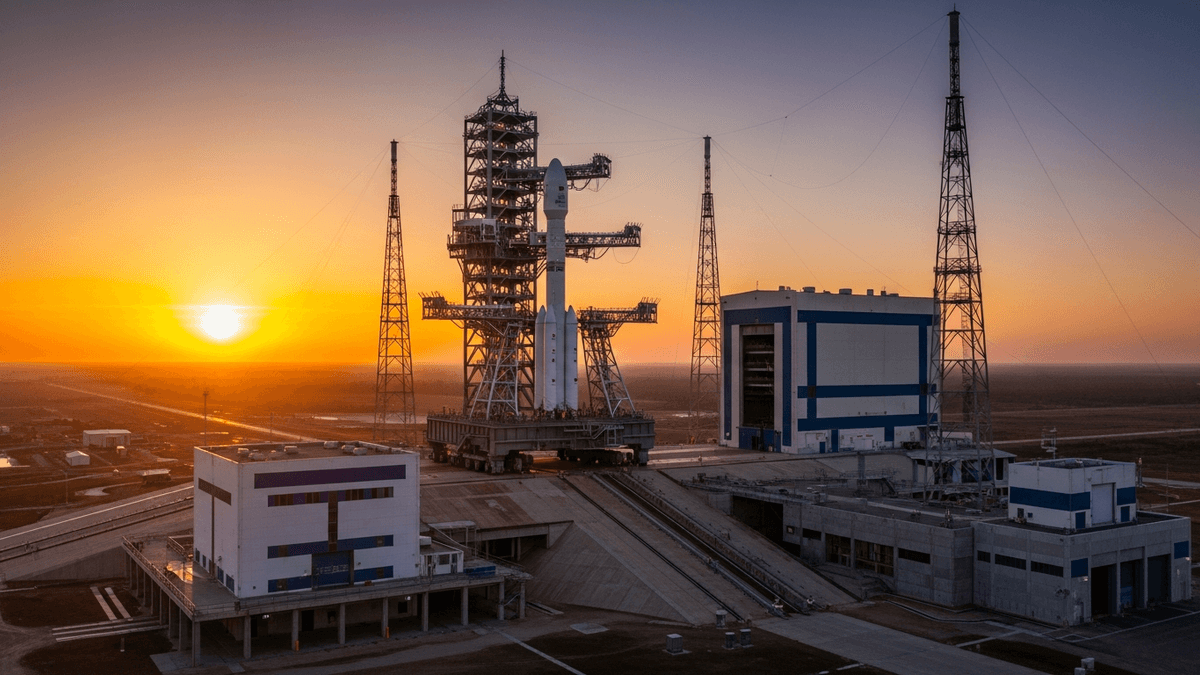

Launch remains a smaller piece of the pie but a critical enabler. Reusability, rideshare models, and a more robust supply chain have cut per‑kilogram costs and unlocked new business cases. 2023 marked another record year for orbital attempts and mass to orbit, with SpaceX’s cadence setting the pace and a deeper bench emerging across Rocket Lab, ULA’s Vulcan, and Blue Origin’s heavy-lift ambitions—trends underscored by data from analysts at BryceTech. As launch prices normalize, downstream services—connectivity, observation, in‑space data processing—capture a growing share of value.

Capital, customers, and consolidation

Despite tighter credit and a reset in speculative listings, the industry’s revenue growth and rising utilization rates are drawing more disciplined capital. Corporate partnerships and government anchor tenancy are replacing easy venture money, with dual‑use demand from defense and civil agencies providing durable baselines. The strategic rationale is clear: space infrastructure underpins terrestrial networks, logistics, climate monitoring, and precision agriculture—an adjacency map that widens the customer funnel, as McKinsey analysis explains.

Consolidation is reshaping market structure. Operators are integrating vertically to control terminals and distribution, while manufacturers are moving closer to service models through managed payloads and hosted platforms. On the supplier side, avionics, sensors, and propulsion vendors are benefiting from multi‑constellation demand, though supply‑chain constraints and insurance costs remain pressure points. The net result: fewer, stronger platforms with clearer unit economics.

The outlook: scale, regulation, and the trillion‑dollar debate

The long‑term thesis remains intact: as launch costs fall and satellite networks densify, recurring services should outgrow hardware cycles. Connectivity (including direct‑to‑device), Earth observation analytics, precision PNT, and in‑space computing are poised to compound, while national security needs provide counter‑cyclical support. On current trajectories, the space economy could top $1 trillion by 2040, Morgan Stanley projects, with upside tied to mass‑market mobility and IoT.

Execution risks are real. Spectrum policy, orbital debris mitigation, export controls, and insurance capacity will shape deployment velocity and capital costs. Price competition in LEO broadband, supply‑chain bottlenecks, and the challenge of scaling manufacturing without eroding quality all demand careful navigation. Still, for business leaders evaluating exposure—whether as suppliers, customers, or investors—the signal is clearer than ever: space is no longer a niche; it’s a cross‑sector platform with defensible cash flows and room to run, as reflected in aggregate growth documented by The Space Report and launch trends tracked by industry reports.

About the Author

Marcus Rodriguez

Robotics & AI Systems Editor

Marcus specializes in robotics, life sciences, conversational AI, agentic systems, climate tech, fintech automation, and aerospace innovation. Expert in AI systems and automation