Artificial intelligence revolutionises pharmaceutical research in 2026, accelerating drug discovery timelines from decades to years while dramatically reducing development costs. From target identification to clinical trial optimisation, AI technologies reshape how the world's leading pharmaceutical companies and biotech startups bring life-saving treatments to patients. This analysis examines the ten most significant AI drug discovery trends across the UK, Europe, United States, India, and China.

## Executive Summary

The global AI in drug discovery market reaches $4.9 billion in 2026, growing at 45% annually as pharmaceutical companies integrate machine learning across their research pipelines. Major players including Pfizer, AstraZeneca, Roche, and emerging biotech firms deploy AI platforms to identify novel drug targets, design molecular compounds, predict clinical outcomes, and optimise manufacturing processes. Regional innovation hubs in Cambridge, Basel, Boston, Hyderabad, and Shanghai drive breakthrough applications.

## 1. Generative AI for Molecular Design

Generative AI models transform how researchers design drug candidates by creating novel molecular structures optimised for specific therapeutic targets. Companies including

Insilico Medicine and

Recursion Pharmaceuticals deploy diffusion models and transformer architectures to generate compounds with desired pharmacological properties. These systems explore chemical spaces far beyond human intuition, proposing molecules that would never emerge from traditional medicinal chemistry approaches. Insilico's AI-designed drug ISM001-055 advances through clinical trials for idiopathic pulmonary fibrosis, validating the generative approach.

## 2. AlphaFold and Protein Structure Prediction

DeepMind's AlphaFold continues transforming structural biology in 2026, with the AlphaFold Protein Structure Database now containing over 200 million predicted structures. Pharmaceutical researchers leverage these predictions to understand disease mechanisms, identify druggable binding sites, and design molecules that interact precisely with target proteins. The technology proves particularly valuable for previously "undruggable" targets where experimental structure determination remained challenging. European and UK researchers lead applications in rare disease drug development.

## 3. AI-Powered Target Identification

Machine learning platforms analyse vast biomedical datasets to identify novel therapeutic targets with higher probability of clinical success. Companies including

BenevolentAI in the UK and

Exscientia integrate genomics, proteomics, and clinical data to discover disease-relevant targets overlooked by traditional approaches. These platforms reduce target validation timelines from years to months while improving the probability of clinical success. BenevolentAI's baricitinib repurposing for COVID-19 demonstrated the power of AI-driven target discovery during the pandemic.

## 4. Clinical Trial Optimisation

AI transforms clinical trial design, patient recruitment, and outcome prediction across the pharmaceutical industry. Platforms analyse electronic health records and genomic data to identify optimal patient populations for specific therapies. Predictive models estimate trial success probability before expensive Phase III investments.

Unlearn.AI generates digital twins enabling smaller control arms and faster trials. US and European regulators increasingly accept AI-enhanced trial designs, accelerating approval pathways for innovative therapies.

## 5. Multimodal Foundation Models

Large multimodal models trained on diverse biomedical data types emerge as powerful tools for drug discovery in 2026. These foundation models integrate molecular structures, protein sequences, gene expression data, clinical records, and scientific literature to generate insights across the research pipeline.

Google DeepMind and pharmaceutical partners deploy models that predict drug-target interactions, anticipate side effects, and suggest combination therapies. The trend toward foundation models promises more generalisable AI capabilities across therapeutic areas.

## 6. AI in Antibody and Biologics Design

Machine learning accelerates the design of therapeutic antibodies, peptides, and other biologics. AI platforms optimise antibody sequences for binding affinity, stability, and manufacturability while reducing immunogenicity risks.

Absci and

LabGenius in the UK combine AI with high-throughput experimentation to discover antibody therapeutics in months rather than years. Chinese biotech firms including WuXi Biologics integrate AI platforms to serve global pharmaceutical clients with accelerated biologics development.

## 7. Synthetic Data and Privacy-Preserving AI

Pharmaceutical companies adopt synthetic data generation and federated learning to enable AI development while protecting patient privacy. These approaches allow training on diverse datasets without sharing sensitive health information across institutional boundaries. European GDPR requirements drive innovation in privacy-preserving AI, with UK companies leading development of synthetic clinical trial data platforms. The technology enables collaboration between competing pharmaceutical firms on pre-competitive AI research initiatives.

## 8. AI-Driven Drug Repurposing

Machine learning platforms systematically identify new therapeutic applications for existing approved drugs, dramatically reducing development timelines and costs. AI analyses molecular, genetic, and clinical data to predict which approved compounds might treat diseases beyond their original indications. Indian pharmaceutical companies leverage drug repurposing AI to develop affordable treatments for diseases prevalent in emerging markets. The approach proves particularly valuable for rare diseases and neglected tropical diseases where traditional drug development economics remain challenging.

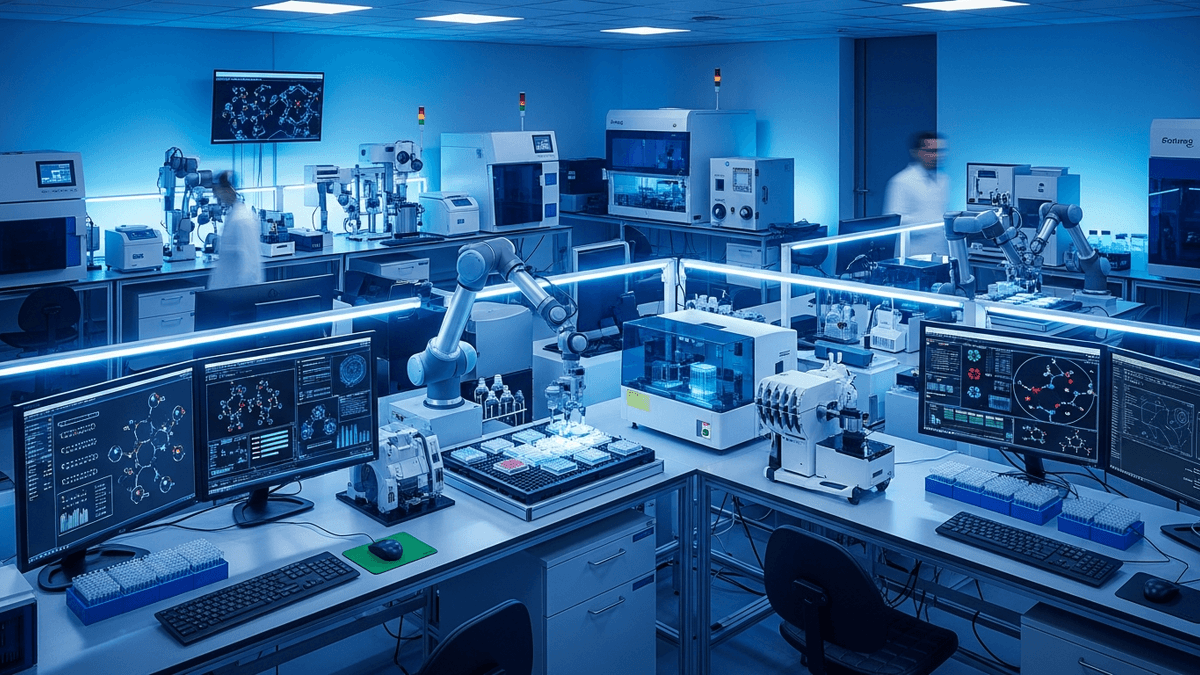

## 9. Automated Laboratory Integration

AI-driven robotic laboratories enable closed-loop drug discovery where algorithms design experiments, robots execute them, and machine learning models analyse results to guide subsequent iterations.

Arctoris and Recursion operate automated facilities that conduct thousands of experiments daily with minimal human intervention. This integration accelerates the design-make-test-analyse cycle from months to days, fundamentally changing drug discovery economics. Chinese investments in automated laboratory infrastructure position the country as a leader in high-throughput drug discovery.

## 10. Regulatory AI and Submission Automation

AI streamlines regulatory submissions and interactions with health authorities including the FDA, EMA, and MHRA. Natural language processing automates document preparation, consistency checking, and response generation. Predictive models analyse historical approval data to optimise submission strategies. The FDA's ongoing modernisation initiatives increasingly incorporate AI-ready data standards, creating opportunities for automated regulatory intelligence. Companies that master regulatory AI gain competitive advantages through faster approval timelines and reduced compliance costs.

## Regional Innovation Landscape

United Kingdom: The UK maintains leadership in AI drug discovery through the Cambridge-London-Oxford triangle. Companies including BenevolentAI, Exscientia, and LabGenius benefit from deep life sciences expertise, supportive regulatory environment, and access to NHS data assets.

European Union: Switzerland and Germany anchor European AI pharma innovation, with Basel-based Roche and Novartis deploying extensive AI capabilities. EU regulatory harmonisation and research funding through Horizon Europe support cross-border collaboration.

United States: Boston and San Francisco remain global AI drug discovery hubs, with major pharmaceutical companies and well-funded startups driving innovation. FDA engagement with AI developers creates pathways for regulatory acceptance.

India: Indian pharmaceutical companies leverage AI for drug repurposing and generic drug development. Growing AI talent pools in Hyderabad and Bangalore attract global pharmaceutical R&D investments.

China: Massive government investment in AI and biotechnology positions Chinese companies as emerging competitors in drug discovery. Shanghai and Suzhou biotech clusters deploy AI across therapeutic development programmes.

## Investment and Partnership Trends

Pharmaceutical companies increasingly acquire AI drug discovery startups or establish strategic partnerships to access capabilities. Major deals in 2025-2026 exceed $50 billion in total value as traditional pharma races to integrate AI. Venture capital flows to AI biotech companies remain strong despite broader market corrections, reflecting confidence in the technology's transformative potential.