Wearables innovation: health-grade sensors, smart rings, and new revenue

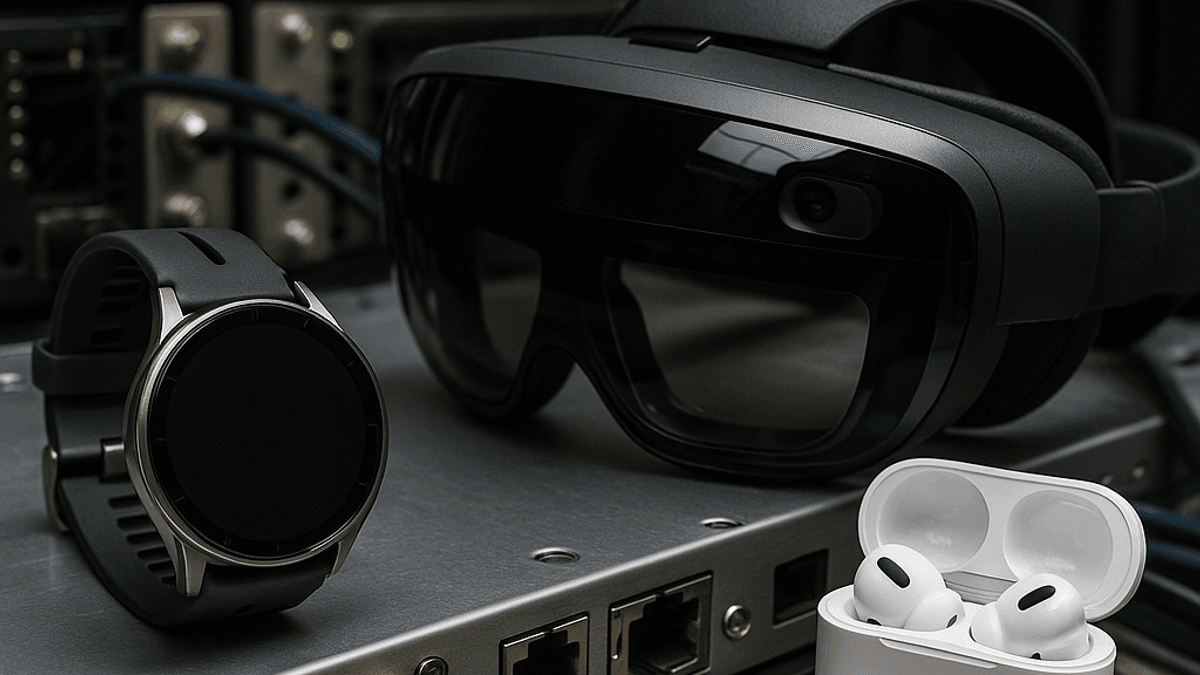

Wearables are rebounding as health-grade sensors and new form factors push the category beyond step counting. With smart rings joining smartwatches and hearables, companies are racing to blend clinical validation, ecosystems, and subscription services—reshaping the business of connected wellness.

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.

Market reacceleration and shifting mix

In the Wearables sector, After a period of consolidation, wearables are back in growth mode as consumers upgrade aging devices and new form factors expand the addressable market. Shipment volumes returned to the hundreds of millions, with smartwatches, hearables, and now rings forming the core of demand, according to industry data. Apple, Samsung, Huawei, Xiaomi, Garmin, Fitbit (Google), and rising specialists like Oura and Whoop are competing across price tiers and use cases, from performance tracking to passive health monitoring and safety.

The mix is tilting toward devices that deliver more actionable insights—sleep staging, recovery scores, continuous HRV, and ambient stress—with even entry-level products gaining features that previously sat at the high end. Hearables remain the volume engine, but smartwatches and rings are pulling higher engagement thanks to long wear time and seamless coaching prompts. As ecosystem lock-in grows, vendors are leveraging cross-device continuity (phones, earbuds, watches) to reduce churn and raise lifetime value.

Hardware improvements are also enabling a fresher upgrade cycle. New sensor stacks, low-power silicon, and tighter firmware–cloud loops are producing more accurate insights with less battery penalty. That matters in form factors like rings, where industrial design constraints are extreme and “forget-you’re-wearing-it” experiences drive adherence.

From steps to biomarkers: clinical validation and regulation

The category’s most consequential shift is toward health-grade capabilities. Wearables are increasingly bridging wellness and regulated care, with over-the-counter hearing aids accelerating mainstream adoption since the U.S. finalized the OTC pathway in 2022, per the FDA. Remote detection of arrhythmias, fall risk alerts, and ambient activity/sleep signals are being integrated into care plans and employer wellness programs.

Large-scale studies have bolstered confidence. In the Apple Heart Study published in the New England Journal of Medicine, researchers analyzed data from over 400,000 participants to evaluate smartwatch notifications for atrial fibrillation, helping validate the potential of wrist-based screening and follow-up pathways, according to peer-reviewed research. While algorithms for blood pressure and sleep apnea are still maturing—and regulatory pathways vary—clinically oriented features are steadily moving from pilot to scaled deployment.

For payers and providers, the economics hinge on risk stratification and adherence. Continuous streams of cardiorespiratory metrics, when paired with contextual data and telehealth, can reduce avoidable events and improve patient engagement. The strategic prize for vendors is to translate sensor novelty into longitudinal outcomes—and reimbursement—without compromising usability or battery life.

New form factors and ecosystem plays

A surge of innovation is unfolding in wearables beyond the wrist. Smart rings promise 24/7 comfort, discreet form factors, and multi-day batteries—appealing to consumers who want recovery insights without a screen. Sports-focused straps and patches serve athletes and industrial workers who need specialized metrics, while camera-equipped smart glasses are inching toward hands-free productivity and lightweight capture.

As use cases diversify, ecosystems matter more than any single spec. Deep integration with smartphones, health records, and coaching apps underpins stickiness, as does data portability for cross-device journeys. Consumer interest in connected wellness remains resilient, with personalized insights and preventive care consistently ranking high in demand, industry reports show. That’s pushing incumbents to open developer hooks, standardize data schemas, and court third-party services.

The competitive landscape is bifurcating: platform players prioritize breadth—hardware families, cloud services, and content—while specialists focus on depth, owning a metric or cohort (sleep quality, endurance training, women’s health). Expect continued M&A as companies assemble sensor portfolios, regional distribution, and clinical partnerships.

The business calculus: subscriptions, margins, and data risk

Financially, the sector is pivoting from one-time hardware sales to recurring services. Subscription tiers that bundle advanced analytics, coaching, and content are lifting average revenue per user and smoothing cyclicality. For manufacturers, margin structure depends on sensor bill of materials, battery chemistry, and yield; for brands, it hinges on differentiating insights and minimizing churn.

Employer and insurer channels are expanding, particularly for preventive care and chronic condition management. That brings stringent requirements for data governance, auditability, and interoperability. Companies must navigate privacy and consent frameworks—especially in Europe—where rules like the GDPR dictate how health-adjacent data can be processed and shared, according to regulatory guidance.

The winners will be those who convert continuous data into trusted outcomes. In practical terms: clinically credible algorithms, transparent data practices, battery-first industrial design, and ecosystems that feel effortless. As wearables become invisible yet indispensable, the line between consumer electronics and digital health will blur—and the value will accrue to companies that deliver both insight and trust at scale.

About the Author

James Park

AI & Emerging Tech Reporter

James covers AI, agentic AI systems, gaming innovation, smart farming, telecommunications, and AI in film production. Technology analyst focused on startup ecosystems.