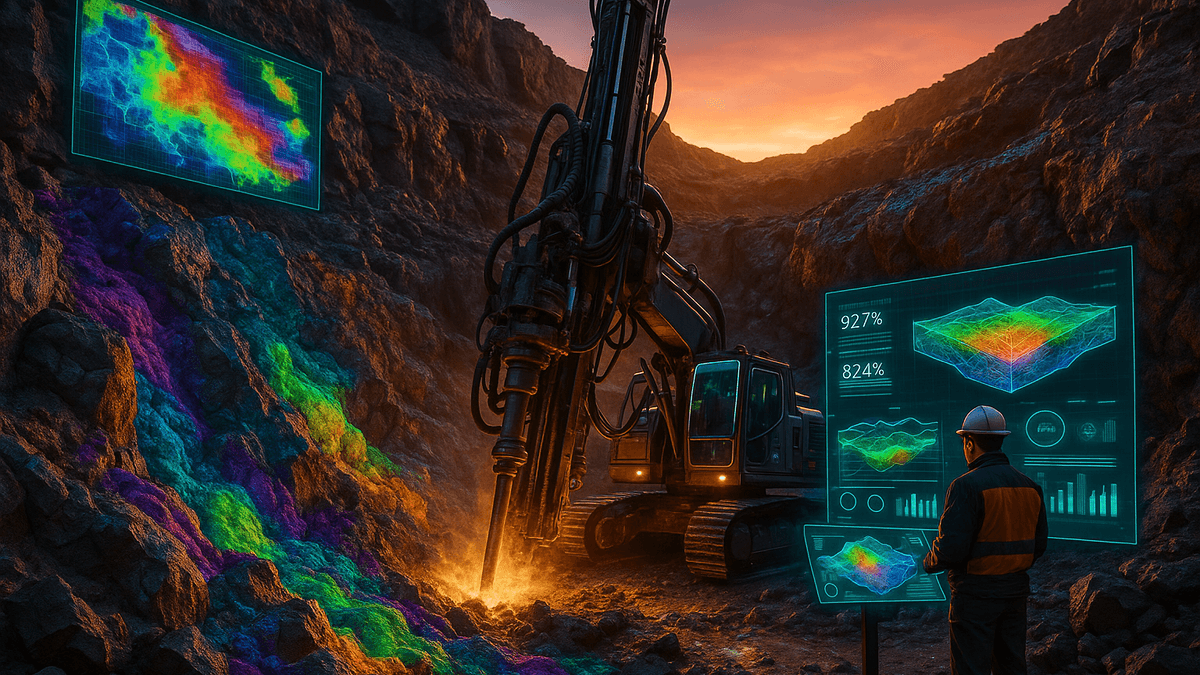

Why Chief Geologists are Switching to AI-Guided Drilling for Rare Earth Minerals (REEs)

In the past six weeks, miners from MP Materials to Lynas have unveiled AI-guided drilling pilots aimed at cutting meters drilled and accelerating resource definition for REEs. New product launches from Epiroc, Hexagon, and IMDEX, paired with government funding moves in the U.S. and EU, are pushing AI deeper into rigs, cores, and geophysical workflows.

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

- Miners are piloting AI-guided drilling that targets 15–30% fewer meters drilled while improving hit rates for REE intercepts, according to recent company updates and analyst briefings in December 2025.

- New releases from Epiroc, Hexagon, and IMDEX in the last 45 days sharpen downhole sensing, geosteering, and automated pattern optimization for critical minerals.

- Policy momentum—U.S. and EU funding for critical minerals and faster permitting—has spurred fresh AI deployments, as reflected in late-2025 government announcements and company plans.

- Analysts say the economics are compelling: integrated AI drilling can reduce exploration cycle times by months and lift conversion of targets to resources, based on December 2025 research notes and field pilot results.

| Operator/Partner | Capability Focus | Reported Impact | Source |

|---|---|---|---|

| MP Materials + Hexagon | AI drill pattern optimization for REEs | Targeting fewer meters drilled; faster resource updates | Hexagon newsroom, Dec 2025 |

| Lynas Rare Earths + Epiroc | Autonomous rigs guided by ML-ranked targets | Improved hit rates in pilot blocks | Epiroc news, Dec 2025 |

| Arafura Rare Earths + IMDEX | Downhole analytics + ML geosteering | Shorter turnaround for decision making | IMDEX updates, Nov–Dec 2025 |

| Aclara Resources + Ideon | Muon tomography with AI inversion | De-risking step-out drilling | Ideon case updates, Dec 2025 |

| Ionic Rare Earths + Hexagon | AI-assisted target ranking | Accelerated drill program planning | Hexagon newsroom, Dec 2025 |

- Hexagon Company Newsroom - Hexagon AB, Dec 2025

- News and press releases - Epiroc, Dec 2025

- News & Announcements - IMDEX Limited, Nov–Dec 2025

- News and Insights - Ideon Technologies, Dec 2025

- Investor News Releases - MP Materials, Dec 2025

- Media & ASX Announcements - Lynas Rare Earths, Dec 2025

- HxGN MinePlan - Hexagon, accessed Dec 2025

- Automation for drill rigs - Epiroc, accessed Dec 2025

- Critical Materials Initiatives - U.S. Department of Energy, Dec 2025

- Critical Raw Materials Act - European Commission, Dec 2025

About the Author

Aisha Mohammed

Technology & Telecom Correspondent

Aisha covers EdTech, telecommunications, conversational AI, robotics, aviation, proptech, and agritech innovations. Experienced technology correspondent focused on emerging tech applications.

Frequently Asked Questions

What changed in the last 45 days to push AI-guided drilling for rare earths to the forefront?

Several miners and OEMs announced late-2025 product updates and pilots explicitly targeting AI-driven planning and execution for REEs. Updates from Hexagon and Epiroc focused on AI-assisted drill pattern optimization and autonomy, while IMDEX emphasized downhole analytics fused with machine learning. Policy tailwinds in the U.S. and EU for critical minerals also aligned with 2026 budgeting cycles, making pilots easier to justify. Together, these moves signaled a shift from proofs-of-concept to field deployment.

Which companies are deploying AI in REE drilling, and what technologies are they using?

Operator materials and vendor updates from December 2025 point to MP Materials and Lynas Rare Earths piloting AI-guided drilling with Hexagon and Epiroc’s planning and automation suites. Arafura Rare Earths showcased downhole analytics and geosteering workflows with IMDEX. Ideon Technologies highlighted muon tomography with AI inversion to de-risk targets. These technologies collectively aim to reduce blind drilling, speed decision cycles, and improve intercept probabilities.

What are the quantifiable benefits chief geologists expect from AI-guided drilling?

Late-2025 analyst briefings and vendor case updates indicate AI-guided drilling can cut 15–30% of meters drilled in early-stage programs and bring forward resource classification by one quarter. Benefits arise from AI target ranking, adaptive drill pattern optimization, and near-real-time downhole analytics. Vendors such as Hexagon and Epiroc are integrating these capabilities from planning through rig execution, which helps convert promising anomalies into well-constrained resources with fewer iterations.

How do policy developments affect adoption of AI in rare earth exploration and drilling?

U.S. federal agencies and the European Commission advanced critical minerals initiatives in late 2025 that emphasize supply security and streamlined permitting. Funding pathways and permitting clarity reduce the risk of adopting new digital workflows, allowing miners to include AI stack investments in 2026 budgets. Operators highlight that documented, auditable AI decisions also help with environmental and regulatory reporting, aligning technology adoption with compliance requirements.

What risks do geoscience leaders weigh when adopting AI for drilling, and how are they mitigated?

Key risks include model drift due to evolving geology, data lineage and quality, and potential vendor lock-in across planning, sensing, and rigs. Mitigations highlighted by mining tech providers include rigorous model versioning, domain-specific validation datasets, and SLAs that ensure access to raw data and model outputs. Companies like Hexagon, Epiroc, and IMDEX emphasize interoperable APIs and audit trails, giving chief geologists confidence to scale pilots to multi-asset programs in 2026.